+++ BENTLEY has been steadily dripping details on its electrification plans through the rest of the decade. It’s going fully electric and carbon neutral by 2030, and its first all-electric car is coming in 2025. Today, the company provided a few more details on its electric product rollout and how it will start phasing out internal combustion cars. That first electric car is coming toward the end of 2025, so it’s probably a 2026 model year vehicle, and it’s reportedly going to be an SUV. It’s also just the start of a big electric push. The next 5 years after that car’s introduction will bring another new fully electric model each year. Those electric models will probably include new generations of existing nameplates such as the Continental GT and Bentayga, but at least one, possibly the first one, will be an as-yet-unnamed machine. Furthermore, Bentley will continue building these cars at the Crewe, England, facility where it’s investing 2.5 billion pounds, or nearly $3.4 billion. Until the first EV arrives, Bentley will be expanding its hybrid offerings, with a few new hybrid variants of existing models coming this year. By 2024, all Bentley models and variants will be available with a plug-in hybrid option. By 2026, all of Bentley’s cars with internal combustion engines will be plug-in hybrids. +++

+++ There are more than 8.000 new technical job openings at GENERAL MOTORS and the automaker plans to fill them during a hiring spree this year. The Detroit automaker is looking for software, computer, mechanical and electrical engineers, as well as battery engineers, cyber security experts and others. GM said in a statement Wednesday that it’s expanding teams that develop vehicle software, engineer hydrogen fuel cells for non-automotive uses, and develop new battery designs. The company has been moving to expand its revenue sources with ventures outside of selling automobiles. It’s working with partners to develop hydrogen fuel cell locomotives, aircraft and generators. It’s also partnering with Honda on battery technology and vehicle platforms. The announcement comes the day after GM announced a $7 billion investment in Detroit-area facilities, with a focus on developing electric vehicles. New hires don’t necessarily have to work at the company’s technical center in the Detroit suburb of Warren, Michigan. The company has a “work appropriately” policy that gives employees flexibility to work where they want, when the work permits. Last year GM hired over 10.000 people worldwide, with one third of them in software engineering jobs. Since late 2020, it has added about 21,000 technical positions. The company said it’s committed to recruiting a diverse workforce. Last year, nearly one-third of its new hires were women and 42 % were from under-represented minority groups, it said. The hiring spree contrasts with February of 2019, when GM cut about 8.000 white-collar workers worldwide as part of a restructuring that added $2.5 billion to the company’s bottom line. GM sought the cuts to raise profit margins and invest more in autonomous and electric vehicles. Most of the layoffs happened at GM’s technical center, and most of those people worked on components for internal-combustion engines and discontinued car models. Iwao Fusillo, GM’s chief data and analytics officer, said the company is developing electric and autonomous vehicles, safety features and subscription services, all driven by software. “In order to execute against that, we need to bring in thousands and thousands of tech talent”, he said. The hires don’t hurt the bottom line and they help to achieve the GM’s targets, said Jessika Lora, General Motors’ director of global innovation. “Yesterday’s strategy cannot be used to win tomorrow”, she said. +++

+++ Taking last year’s momentum of GENESIS expanding its global presence, Hyundai’s standalone luxury brand expects to increase its sales by 10 percent this year with its new lineups and electrified versions of high-end vehicles, its chief executive said. “We are expected to sell between 215.000 to 220.000 Genesis vehicles”, CEO Chang Jae-hoon told reporters at the G90 launching event, adding that the global sales of the luxury brand surpassed 200.000 last year 6 years after its launch. In 2020, it sold a total of 130.000 cars. “We attribute (the success of breaking the 200.000-mark for annual sales) to the strengthened lineup by adding a variety with SUV models and electrified versions, as well as increased sales volume after successfully expanding to the US market. We also find it meaningful to become the top 10 luxury sedans, surpassing Honda’s Acura”, Chang added. The launch of the latest 4th generation G90 last month will spur the brand’s upgraded reputation globally, he said, noting that the carmaker targets for annual sales of 20.000 G90 cars in the global market. The luxury sedan segment has been long dominated by the German trio: Mercedes-Benz S-Class, BMW 7 Series and Audi A8. But challengers like Genesis releasing solid alternative to take over German rivals, Chang said stressing that its new full-size sedan will soon redefine the segment. “I’m confident that with G90, Genesis will top the top-notch luxury sedan market. What’s more important for us is to satisfy customer needs, not a competition with other carmakers (in the luxury sedan segment)”. The global demand of high-end full-size sedans is estimated at 230.000 a year. The market share of G90 is expected to take 8.6 percent next year from 3.1 percent last year. The 4th generation G90, Genesis’ fully-revamped flagship model following the facelift in 2018, could be the brand’s last gasoline-powered model in line with the automaker’s vision to electrify its entire lineup by 2025, considering the automaker’s 5 to 6-year gap in between model’s full changes. Chang hinted that the next electrified Genesis model will be from a different segment, not G90, considering the adopt the new E-GMP platform for EV making. “We don‘t have a plan to electrify the G90, but will set up a plan to electrify an high-end model from another segment”, he said. “Electrification of a fullsize sedan is not an easy task”. Market expectations vary on the next-generation EV model by Genesis, whether the largest F-segment GV90 will be launched to rival the European SUV makers, or the smallest single-piece hatchback G70 will be remade to replace the diesel sedans that have been discontinued. But unlike the carmaker’s announcement in the last year, G90 has dropped Highway Driving Pilot function which makes automatic lane changes and Level 3 autonomous driving which allows hands-off driving on highways. Such tech will be applied to G90 at the end of this year. Last year, Hyundai, Kia and Genesis sold a record-high 1.4 million cars in the US, an increase of 21.6 percent from a year ago, surpassing Japan’s Honda to take fifth slot in total sales in the US. +++

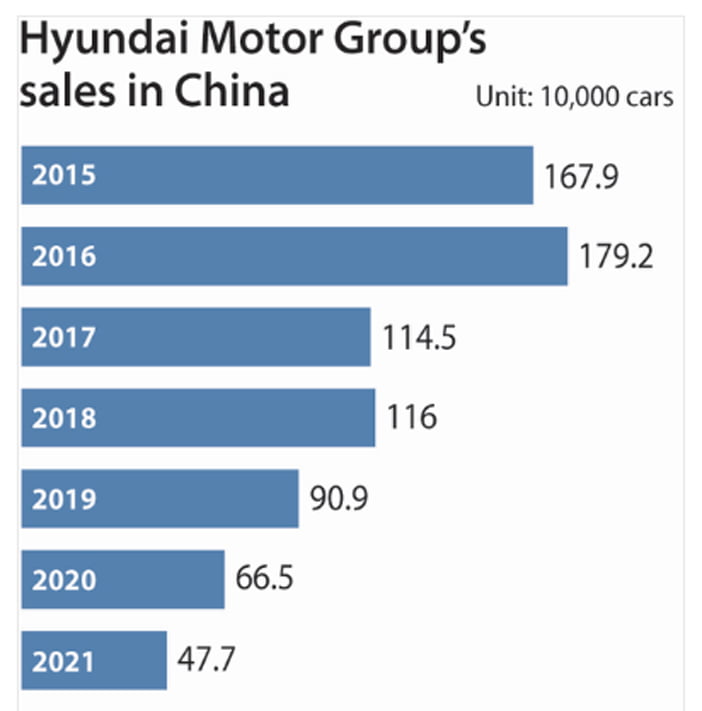

+++ The HYUNDAI MOTOR GROUP achieved record-breaking sales in the United States and Europe last year, while floundering in China. It sold 477.282 units in China in 2021, 28 percent fewer than in 2020, according to data compiled by the China Passenger Car Association (CPCA). Its average monthly sales were 39.700 units; less than a third of its average in 2016. Its market share in China is 2.7 percent, or 12th among carmakers. In 2011 it had 6 percent of the market and it was No. 3. What went wrong with Hyundai in China? The automaker’s decline started in 2017 when South Korea decided to deploy the U.S.-led Terminal High Altitude Area Defense (Thaad) antimissile system despite very clear and strong objections from Beijing. China reacted with unabashed economic retaliations against South Korea and its companies. It told tour agencies not to send group tours to South Korea. It yanked Korean pop stars from the Chinese airways. And it encouraged a boycott of Korean products, ranging from cosmetics to cars. Hyundai’s sales of 1.8 million units in 2016 fell by 36 percent the next year. Except for a slight rebound in 2018, sales never recovered. The Korean automaker has been looking for a strategy to win back Chinese customers. In April 2021, it said it would launch 21 electric models by 2030, launching at least 1 model every year. It said it would establish a local R&D center and start selling its first fuel-cell electric vehicle, Nexo, in 2022. Lee Kwang-guk, who headed Hyundai Motor Group’s Chinese operations since 2019, resigned last year and was replaced. It hoped to use Genesis, the Korean automaker’s luxury brand, as a way of reestablishing itself in the market. It world-premiered its first-ever electric Genesis, the Electrified G80, in China last April. That was a big departure from Hyundai’s long-standing tradition of premiering new models at home. The Electrified G80 was unveiled at the Shanghai International Automobile Industry Exhibition in April 2021 at an extraordinary evening event with thousands of drones and a light show. The company made a public pledge to bring the most inspiring Genesis experiences to its Chinese customers. Despite such efforts, sales have remained flat and some analysts say there was a mistake in the automaker’s marketing strategy from the very start in 2001. “When it first entered the market, Hyundai offered its vehicles to Chinese taxi drivers and its brand image was hurt”, said Kim Yong-jin, a former chair of the Korean Academy of Motor Industry and current professor of business administration at Sogang University, “leading directly to the automakers’ sales plunging. When the Chinese auto market went crazy about hightech systems in recent years, Hyundai did not respond to it properly as well”. Hyundai had originally intended to focus on sales of small and midsized sedans, but faced a lot of competition from local brands. Chinese auto brands accounted for 46.6 percent of the country’s auto market last year, a significant jump from the previous year’s 41.1 percent, according to CPCA data. The SUV market is dominated by Japanese brands such as Toyota and Nissan. Hyundai and sister company Kia made efforts in the electric vehicle (EV) market (the largest EV market in the world) with tepid results. Hyundai launched various eco-friendly models including the Mingtu EV, Lafesta EV and Encino EV, but their sales came to a mere 2.397 units last year. Tesla is reported to have sold 440.000 EVs in China last year. “The Chinese have a culture of not wanting to buy a vehicle that is used for taxi fleets”, said Lee Hang-ku, a senior researcher at the Korea Institute for Industrial Economics and Trade. “Hyundai Motor seems to have neglected that culture and offered its flagship model Sonata for local taxi fleets”. Pricing also was a problem. “Hyundai Motor cars don’t have as good reputations as Japanese cars in China but in terms of pricing, they seem to have made a mistake”, said Lee Ho-geun, professor of automotive engineering at Daeduk University. “Hyundai’s Tucson sells for between 34.8 million won and 42.3 million won while Honda’s CR-V sells for between 31.8 million won and 43.4 million won”. In sharp contrast, Hyundai and Kia are doing better than ever in the United States and Europe. The sister companies sold 1.48 million units in the United States last year, an all-time high and 21.6 percent higher than the year before. Its previous record was 2016’s 1.42 million units. It was the first time the Korean automakers outsold rival Honda since entering the U.S. market in 1986. Hyundai Motor Group ranked in fifth place in the U.S. auto market last year and Honda was 6th. In Europe, the sister companies sold 1 million units last year. Hyundai had a 4.4 percent market share and Kia 4.3 percent, European Automobile Manufacturers’ Association data said. Combined, Hyundai and Kia ranked 4th with 8.7 percent market share, outperforming BMW Group, which trailed in fifth spot with a market share of 7.3 percent. Among the top 5 players in Europe last year, the Hyundai Motor Group was the only one to post growth. Others suffered from pandemic problems and an auto chip shortage. No. 1 Volkswagen Group saw a 3.7 percent drop in sales last year. Stellantis and Renault Group, the No. 2 and No. 3 players, saw growth shrink 1.6 percent and 10.9 percent respectively. +++

+++ KIA , South Korea’s second-biggest carmaker, said Wednesday its fourth-quarter net profit rose 30 percent from a year earlier on a weak won and increased SUV sales. Net profit for the 3 months ended in December jumped to 1.248 trillion won ($1.04 billion) from 961.6 billion won during the same period of last year, the company said in a statement. “A combination of a weak won, improved product mix and reduced incentives helped offset the impact of chip supply chain problems and the coronavirus pandemic”, the statement said. Semiconductor issues will remain a major hurdle during the first half to achieving this year’s business targets, though chip supplies are expected to improve from the second quarter, Kia chief financial officer Joo Woo-jeong said in the company’s earnings conference call. To prop up sales, Kia plans to launch the all-electric EV6 sedan and the Niro gasoline hybrid models in the United States this year, while expanding sales of the Sportage. Operating profit fell 8.3 percent to 1.175 trillion won in the 4th quarter from 1.282 trillion won a year ago due to one-off costs, such as research & development costs and bonuses for employees. Sales were up 1.6 percent to 17.188 trillion won from 16.910 trillion won during the same period. For the whole of 2021, net income more than tripled to 4.760 trillion won from 1.488 trillion won a year earlier. Operating profit more than doubled to 5.065 trillion won from 2.066 trillion won during the cited period. Sales rose 18 percent to 69.862 trillion from 59.168 trillion won. In 2022, Kia aims to achieve an operating profit of 6.5 trillion won on sales of 83.1 trillion won by focusing on SUV models and environmentally-friendly vehicles. The maker of the Ceed and the Sorento targets to sell 3.15 million vehicles, 13 percent higher than the 2.77 million units sold last year. +++

+++ KIA said that its electric SUV model EV6 has been recognized as Car of the Year and Electric SUV of the Year by the UK automotive What Car?’s Car of the Year Awards. “The EV6 combines a huge real-world range with the ability to charge at speeds that no rival can keep up with, addressing two of the biggest concerns that people still have about electric cars. Kia has been able to take advantage of the compact size of electric motors and produce a car that’s hugely spacious and practical”, said What Car? magazine editor Steve Huntingford. Launched in 1978, the What Car? Awards pick the best model of the year based on segment. Kia has been recognized 5 times since 2018, in categories of City Car of the Year, Car of the Year, Value Car of the Year and more for its Niro, Sorento and Picanto. Kia also received Car of the Year in 2019. “It’s a great honor for Kia to win Car of the Year at this year’s What Car? Awards, and show the world once again how our strategic commitment to electrifying the Kia product range is truly paying off”, said Kia CEO Song Ho-sung. “Our plan to electrify our range is gaining momentum and includes 11 new BEV (battery electric vehicle) models by 2026 as part of our Plan S strategy, where, in time, electric vehicles will make up the majority of our global sales”. Kia’s EV6 includes 800 volt ultrafast charging from 10 to 80 percent in just 18 minutes. On a single charge, up to 528 kilometers of driving range is possible. +++

+++ LAND ROVER has revealed pricing and specification details for the plug-in hybrid (PHEV) variants of the new Range Rover, which the firm says offer “exceptional efficiency” and up to 70 miles of electric-only range. The P440e is driven by a 3.0-litre turbocharged straight-6 petrol engine mated to a 38.2 kWh battery and a 143 hp electric motor. Land Rover claims a total power output of 440 hp and 600 Nm. The P510e offers an uprated 3.0-litre petrol engine but makes use of the same 38.2 kWh battery and 143 hp electric motor, for 510 hp and 700 Nm of torque. Both variants are available in SE, HSE and Autobiography specification levels. P440e models can be selected in long- or short-wheelbase forms, while the more powerful P510e is short-wheelbase only. All models gain all-wheel steering, a panoramic sunroof and a host of tech upgrades as standard, including a new 13.1in infotainment system to control most primary vehicle functions, Amazon Alexa speech recognition and wireless smartphone mirroring. A First Edition model will also be up for purchase in the model’s first year of production. Equipment levels are based on the Autobiography, but the limited-run variant also gains a Sunset Gold satin paint finish or a choice of five other exterior paint colours. Both powertrains offer up to 110 km of all-electric range; higher than JLR’s estimated 100 km prediction and 8 miles more than the EV range offered by the new Mercedes-Benz C-Class PHEV. The new Range Rover PHEV also emits as little as 18 g/km of CO2, lower than an initial prediction of 30g/km. Land Rover estimates a real-world all-electric range of 85 km and suggests drivers will be able to complete 75 % of all journeys on electric power alone. The Range Rover also offers 50 kW rapid charging capabilities, meaning it can charge up from zero to 80 % in under an hour, or 5 hours using a home wallbox. “The new Range Rover is the most desirable, elegant and capable luxury SUV in the world”, said Nick Collins, JLR’s executive director of vehicle programmes. “Our efficient new extended-range plug-in hybrid electric vehicle powertrains elevate the driving experience with a fine balance of performance, refinement and efficiency, enabling owners to complete whisper quiet zero emissions journeys of up to 100 km”. The Range Rover will become the first car in the Land Rover line-up to offer an all-electric variant in 2024. The firm intends to offer an electric version for all of its models by the end of the decade, as part of its 2039 goal to reach net zero carbon emissions across the business. +++

+++ SSANGYONG , the Korean unit of Indian carmaker Mahindra, said it narrowed losses last year but remains in a complete capital erosion. Net losses narrowed to 292.9 billion won ($244 million) in 2021 from 504.34 billion won a year earlier on companywide dramatic cost-cutting efforts, the company said in a statement. Operating losses decreased to 296.2 billion won last year from 449.4 billion won in 2020. Sales fell 27 percent to 2.42 trillion won from 2.95 trillion won during the cited period. In self-help measures, SsangYong’s 4,700 employees began to take two-year unpaid leave in rotation on July 12 while accepting an extension of a cut in wages and suspended welfare benefits until June 2023. The company plans to sell its current Pyeongtaek plant in 3 to 5 years and build a new factory to focus on electric vehicles in the same city. On January 10, a Seoul court approved the acquisition of SsangYong by a local consortium led by electric carmaker Edison Motors. On the same day, the Edison-led consortium signed a final deal to take over the financially troubled carmaker. SsangYong was placed under court receivership in April last year for the second time after undergoing the same process a decade earlier. Its Indian parent Mahindra failed to attract an investor due to the Covid-19 pandemic and its worsening financial status. Edison is required to submit its rehabilitation plans for SsangYong to the court by March 1. For the whole of 2021, its vehicle sales fell 22 percent to 84.106 units from 107.324 a year earlier amid the pandemic and chip shortages. SsangYong’s lineup consists of the Tivoli, Korando, Rexton and Rexton Sports SUVs. SsangYong reduced on-year net and operating losses last year but remained in complete capital erosion, raising chances of being delisted from the Korea Exchange (KRX). KPMG Samjong Accounting, the auditor of SsangYong, declined to give its opinion on the carmaker’s annual financial statements for the year 2020. SsangYong could be delisted if its accounting firm again refuses to offer an opinion on the company’s annual performance for the following year after the one-year period. +++

+++ TESLA on Wednesday expected supply chain issues to continue through this year, after posting record quarterly revenue that beat Wall Street estimates. Revenue rose to $17.72 billion in the fourth quarter, from $10.74 billion a year earlier. Analysts had expected the electric-vehicle maker to report revenue of $16.57 billion. The world’s most valuable automaker last quarter handed over a record number of vehicles to customers despite supply chain headwinds. “Our own factories have been running below capacity for several quarters as supply chain became the main limiting factor, which is likely to continue through 2022”, Tesla said in a statement. Tesla said on Wednesday that its new factory in Austin started production of Model Y late last year, saying it plans to start deliveries to customers after final certification, without elaborating on the timeframe. It said it aims to maximize output from its California factory beyond 600,000 vehicles per year. Tesla has fared better than most automakers in managing supply chain issues by using less scarce chips and quickly re-writing software. Tesla faces challenges of scaling up production at 2 new factories this year with technology changes as well as battery and other supply chain constraints clouding the outlook. It faces rising competition from rivals who are set to launch an array of electric cars, from more affordable models to electric pickups. +++