+++ Michelin will continue testing its Uptis range of AIRLESS TIRES by fitting them to 40 vans owned by French postal service La Poste. The brand has already started testing the prototype tire (which can’t deflate or go flat) in real-world conditions in Asia and in North America. The pilot project began in June, when La Poste installed a set of Uptis airless tires on 3 of its delivery vehicles. It sounds like the yellow vans will then deliver letters and parcels like any other van fitted with regular tires. The data gathered during the first phase of the project will then be analyzed and used to make improvements if necessary, and up to 40 delivery vans will be fitted with Uptis tires by 2024. Michelin’s images show the Uptis tires fitted to a Citroën Jumpy, which is a medium-sized van that competes in the same segment as the now-gone Mercedes-Benz Metris and the Renault Trafic, among others. This is one of the bigger vans in La Poste’s fleet, the service also owns thousands of smaller Renault Kangoo-type vans, and Michelin hopes the tire will help La Poste reduce service-related downtime. Once the pilot program is in full swing, La Poste will send its Uptis-riding vans on routes around Lesquin, Valenciennes and Douai in the north of France, near the border with Belgium. Regardless of which route they end up on, they’re sure to turn heads: the Uptis tire is airless, so it relies on a series of flexible fins to support the weight of the vehicle. It’s see-through, and it’s certainly not a subtle modification. I expect that more details about Michelin’s pilot project will emerge in the coming months. As of writing, it’s too early to tell if or when the Uptis tire will reach production, though the French company notes that it’s developing the technology primarily for “light commercial fleets intended for professional use”, meaning you may need to be patient before you can buy a set for your BMW 3 Series daily driver. +++

+++ My Electric Vehicle revolution Bingo card did not include spaces for the return of wagons (aero crossovers by a more suitable name) and the doubling down on retro design cues, but that’s what we’re getting and I like it. ALFA ROMEO is clocking in on the retro side, design chief Alejandro Mesonero-Romanos telling: “Our next-generation cars will bring back the Coda Tronca into a current design language, as a means to boost aerodynamic efficiency and range, of course, but also to give the cars a distinctive, classically Alfa Romeo design character”. You might not know that “coda tronca” means “short tail” in Italian, but you know what it looks like. Effectively a Kammback or Kammtail, it’s when a vehicle roof descends toward the rear of the vehicle, ending in a vertical flank that looks like someone cut the car short with a large knife. It’s been on everything from the Shelby Daytona Coupe and Ferrari 250 GTO to the Honda Insight, Toyota Prius, and Audi A2 and A7. The short tail was also famously on the 1963 Alfa Romeo Turbolare Zagato, shortened to the TZ. This is the design Mesonaro-Romanos refers to, as well as the Sprint Zagato, or SZ, that preceded it. He said, “You will see it on several future models”, the first reportedly the compact crossover due on the market next year. This will be Alfa Romeo’s version of the recently introduced Jeep Avenger battery-electric crossover for Europe, once believed to be called the Brennero. The design boss crossed that name out, telling: “The model name is now decided. it will be Italian and it will be beautiful. But more than that, I cannot say for now”. I might have better luck predicting specs. Checking the Avenger’s details, I’d expect the Stellantis eCMP 2 platform crammed with battery modules under the seats that add up to 54 kWh. The Avenger’s e-motor turns the front wheels with 156 hp and 260 Nm of torque, an all-wheel-drive version is on the way. Range on the WLTP cycle is rated at an estimated 400 km. As with the Jeep, the Alfa Romeo is expected to get a gas-powered version, maybe with the same 1.2-liter motor going into the Jeep. I’m not sure how else the Alfa might distinguish itself from the Jeep, but the Kamm tail could make range for both powertrains a notable differentiator. +++

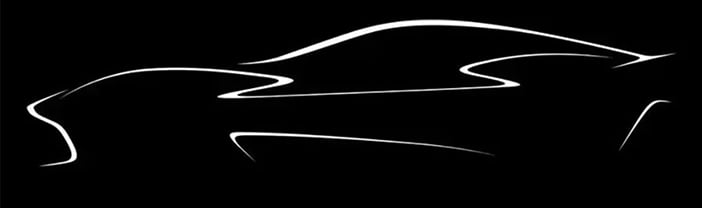

+++ ASTON MARTIN has teased the next step in its electrification journey with a line drawing of a new product due in 2025. Some expect this to be an SUV, the first of 4 battery-electric vehicles that will arrive between 2025 and 2029 and that won’t be electric versions of Aston’s current model range. The automaker didn’t state that this would be an SUV, and comparing the relative heights of the greenhouse, shoulder, and diffuser in the teaser drawing make me wonder. But hey, teases are meant to do just that. When brand and commercial chief Marco Mattiaci was asked which segment the teaser vehicle pointed at, he replied, “If you look at the EV market evolution between now and 2030, the growth is in GT and SUV. We’ve established a good foothold in SUVs with DBX and have been doing GTs for 110 years. We’ll look at those segments first”. Summarizing what’s ahead, a revamped Vantage is meant to debut before the end of this year. Next year, we’ll see the DBS successor and the Valhalla. The latter offering will be Aston Martin’s first electrified offering, a PHEV built around a 4.0-liter twin-turbo V8 with close to 1.000 horsepower and all-wheel drive. The Mercedes-sourced internal combustion engine powers the rear wheels, Aston Martin is developing its own electric motor units to power the front wheels. The recent deal with Lucid will show first fruit with the 2025 car. Aston Martin is developing its own modular EV platform able to serve every segment the brand plans to enter. The U.S. startup is providing its twin-motor electric drive units that contain motors, inverter, and transmission turning the rear axle while Aston’s own motors turn the front axle. Lucid will provide the cylindrical battery cells it buys from 1 of 3 South Korean companies, as well as battery modules placed into a pack of Aston’s design but built at Lucid’s Arizona plant. “Packs” might be a better term, since Aston Martin technical head Roberto Fedeli told: “We want to be able to create EV cars with a roof height of a little bit less than the Vantage”. Fedeli went on to point out that this will mean we see battery modules packaged differently than the current convention of sandwiching them in the floor, with multiple modules positioned around the car potentially possible”. The Lucid Wunderbox onboard charger is also part of the tech supply. Lucid chief Peter Rawlinson said everything is an offshoot of what’s in the Lucid Air, “The main difference is in thermal integration and battery layout. It will be a different-shape battery pack with a software difference”. Aston will continue to use electrical architectures from Mercedes-Benz as part of its ongoing deal with the German automaker, and will source behind-the-scenes components like seat frames HVAC units from recent investor Geely. If all goes well in England, Fedeli will have a drivetrain on the test bench this year and prototypes on roads next year. Prototypes will be heavily camouflaged, but might give away a “radical design” and novel solutions to creating the emotions and aero efficiency Fedeli said he insists on. “Aerodynamics is becoming the king. We have to manage the aerodynamics, and this could be done by using our partnership with the F1 team through simulation. We have some ideas about blowing the wake at the tailgate of the car in order to reduce the drag as much as possible. We are going to reduce the drag by 50 percent, and this is what we need in order to avoid making the car heavy because of the energy we need on board for range”. Other brand new bits highly important to an EV could include a Brembo brake-by-wire system and Pirelli P Zero tires that can account for individual tire load. +++

+++ In a small seaside town in northeast Japan, factory workers are disassembling old batteries from the world’s first mass-market electric cars and preparing them for a second life. Reusing batteries could help the auto industry live up to its promise to make a truly green transition. But it’s time-consuming and, for now, unprofitable. Early units of NISSAN ’s all-electric Leaf, which first went on sale almost 13 years ago, have started to reach the end of their life spans. In an effort to make the end of the cars’ lives as green as their operation was, their used batteries are collected at Nissan dealerships in the US and Japan and sent to the factory in Namie, Fukushima, a town devastated in 2011 by a tsunami and a nuclear disaster. Engineers at the plant, operated by 4R Energy (Nissan’s joint venture with trading house Sumitomo) spend hours on each battery pack before shipping them out, mostly to be used again in another electric vehicle but sometimes to be repurposed in other devices, such as backup generators. Collecting and reusing EV batteries keeps them from being discarded in landfills, where they might release toxins, or from being melted and pulled apart for their metals, which can be hazardous when done improperly. It also would reduce the industry’s reliance on the mining of costly rare-earth elements such as lithium and cobalt and cut down on the carbon emissions involved in making EV batteries; the dark side of the green car business. Moreover, creating a bigger market for used batteries could boost the secondhand market for electric cars as well, by extending their life span and bolstering their resale value, which would hasten their adoption, says Yutaka Horie, the president of 4R Energy. “For EVs to proliferate, it needs to get easier for customers to buy and sell”, Horie said as he gave a tour of the factory that opened in 2018 with local government support. Namie officials have been trying to attract industries to the area after it lost 90% of its population in the evacuations following the Fukushima disaster. With all the nuclear reactors in the area now decommissioned, officials are seeking to host businesses dealing with renewable energy and other new technologies. Because the project would help fulfill Nissan’s goal to make EVs more sustainable and popular, profitability was never an urgent priority. But 4R hopes that with time, it will become a profitable business on its own. At first glance, the factory doesn’t look very cutting-edge. Robots and other automation equipment, a common sight at most car factories these days, aren’t noticeable. Instead, most of the work is done manually by its 9, mostly local engineers. A reused EV battery can cost about half the price of a new one, according to Bloomberg Intelligence analyst Tatsuo Yoshida. He says what sets Nissan apart from other EV makers is that its 4R subsidiary is concentrating on reusing batteries as opposed to recycling them. Reusing entails swapping out deteriorated cells with healthy ones to extend the life of an aged but still-working battery. When recycling a battery, its rare-earth metals and other useful parts are extracted and used to produce something new. At 4R’s plant in Namie, the process starts by slicing open the battery packs to evaluate their condition. Each pack weighs 300 kilograms and contains 48 modules, each consisting of 2 batteries. Once the insides are exposed, they’re plugged into a computer for an initial assessment. Workers put the packs through a stress test in a sealed room they call the sauna, repeatedly exposing them to extremely high and low temperatures. This provides data on the extent of deterioration and the remaining range in each battery. “This data is everything”, Horie says, motioning toward the sauna. The data, together with background information on previous owners (which sometimes can include everything from their geographies to driving history) offer insights on how EV batteries degrade over time under different environments, laying the groundwork for future improvements in battery development, he says. This data-heavy, labor-intensive approach stands in sharp contrast to the recycling method being pursued by automakers such as Tesla and BYD, which break down end-of-life batteries and extract their raw minerals to reuse in completely new batteries. While both methods keep used batteries from ending up in the junkyard, 4R Energy’s extensive testing allows it to salvage more of what remains, meaning there’s less waste. But partly because of the data collection, the process is far more time-consuming. Battery recycling might be easier to scale up as volume grows, but both recycling and reuse will have a role to play in the future, says Bloomberg analyst Colin McKerracher. “Battery repurposing is often more time-consuming than recycling, but allows the company to reuse more of the battery materials”, he says. 4R won’t disclose financial details, except to say that it believes greater scale will eventually help it turn a profit. Horie says 4R’s intake has been doubling annually since 2018, and it now receives “thousands of batteries” every year. It also now has storage capacity for 2.000 batteries across 3 locations in Fukushima. But even with such growth, it’s unclear whether 4R will reach the scale required to turn a profit. Nissan’s Leaf never quite took off with drivers, selling only 646.000 cars since production began in 2010. Early adopters of environmentally conscious vehicles instead went for hybrids such as the Toyota Prius, and attention in recent years has shifted to Tesla’s sleeker all-electric models. 4R Energy currently only handles old Leaf batteries, but it’s planning to expand its scale by working with other Nissan models including the Sakura, a newer EV popular in Japan. It’s also trying to turn the old batteries into a greater variety of equipment, including power storage units for wind, solar and other renewable energy. Tooru Futami, who worked at 4R Energy following a career at Nissan developing the Leaf, says the batteries being made today have better range and longer life spans than old ones do, making it hard for used batteries to compete. But he believes this advantage will shrink over time, as long-range batteries join the recycling stream and improvements in battery performance plateau. “Over time, that gap will narrow”, says Futami, now a research fellow at the mobile gaming and e-commerce company DeNa in Tokyo. The Leaf was the front-runner, but batteries from the first Teslas and other early EVs are also nearing the end of their use, meaning battery recycling and refurbishing is just starting to take off. A recent surge in EV sales means more growth ahead. As many as 77 million EVs could be on the road by 2025, with 229 million by 2030, according to projections. Even in Japan, where EVs accounted for only 1.7% of passenger cars sold last year, the ground is shifting. In February, Nissan said, it will introduce 27 EV models. And Toyota, after years spent focusing on hybrids and gasoline cars, plans to rapidly expand EV production in the next few years. The Japanese carmakers are still trailing far behind Tesla and others in EVs, despite their early start in the environmentally friendly category. These days, Chinese manufacturers dominate the EV battery supply chain, from mining to assembly, and their recycling capacity is also growing. Analysts say 4R Energy will eventually feel more competitive pressure. “4R is the front-runner in Japan, but there are dozens like them in China”, says Hideki Kidohshi, a senior specialist in energy and transportation at the Japan Research Institute. He says it’s not realistic to expect financial viability for the company’s efforts right away, anyway. “It’s not about whether this business makes sense now”, he says. “It’s about lowering costs in preparation for future growth”. +++

+++ PORSCHE , with CEO Oliver Blume behind the wheel, has zipped by a number of milestones over the past several years. Its share price has gained more than 36% since its IPO in September 2022 and profit margins are at an enviable 18%. And yet, Blume isn’t satisfied. “We are driving the company like a sports team”, Blume said earlier on the sidelines of the company’s 75th anniversary celebration. “After a success, focusing on what we can do more, going for the next goal”. The next goal, Blume said, is 20% margins. The road to get there will be paved with investments in new segments and maybe even a 7-figure hypercar. The last 9 months haven’t been kind to other automakers that went public in the past few years, particularly companies like Canoo, Fisker, Lucid Motors and Polestar that merged with special purpose acquisition companies. Even Rivian, the 2021 IPO darling that debuted at $78 a share, has seen its price fall some 82%. Porsche has managed to avoid a similar fate; a result that Blume credited to years of preparation. “It was a process over years, where we developed the company”, Blume said. “5 years ago, Porsche would never have been able to go to the stock market, and now it was the right moment”. That preparation required a renewed focus on the fundamentals: margins, profits and cash flow. But, don’t think all that has made the company boring. At Porsche’s 75th birthday party in Stuttgart, Blume unveiled the Mission X, a hypercar designed to be the fastest production car ever made, not the most profitable. Though Porsche is certainly a premium manufacturer, its reputation has been built on performance, not poshness. A pivot to challenge brands like Mercedes-Benz or Rolls-Royce is not to be made lightly. “Before we decide to go to a new segment, we make a deep analysis of the markets, of the profit pools and different regions of the world, and we think the segment of luxurious SUVs is quite huge, and with a very strong development potential from the future, and strong profit margins. What’s missing is a very sporty one there”, Blume said. In other words: Buyers have many luxurious and stylish options in the premium SUV segment, but none of them has the character of a Porsche. It’s a similar story to what drove Porsche to introduce the Cayenne SUV 20 years ago. Though not particularly luxurious, the tall, big and wide Cayenne was a massive departure from the company’s pure sports offerings. Cayenne sparked controversy, with many brand purists saying that Porsche had lost its way. Far from the beginning of the end, Cayenne is now Porsche’s biggest seller, while the company’s portfolio of fast, desirable sports cars is broader than ever. By heading to green pastures, Porsche found huge success, and now Blume hopes to do so again. That next expansion is a new SUV that Blume referred to by its code name: K1. This new SUV, first mentioned in March and due by 2027, will be bigger than Cayenne. It’ll be quick, too, but the focus here is on luxury. Performance will come from a fully electric powertrain, Blume said, in keeping with Porsche’s goal of delivering 80% EVs by 2030. However, the look and layout of the car might be a little unfamiliar. “You will be surprised by the design”, Blume said. Blume also said that the K1’s systems and software, the car’s “technology profile”, will be unique. Porsche has more than 1.000 technical positions open, including many on the software side. Blume said that this is an increasingly core part of the company’s identity: “We think that the IP we are developing is very specific”, Blume said. “100% portion of this kind of costs are important for our brand identity and for our product identities. Therefore, that is our core business”. For Blume, this clarifies the build versus buy debate. “You can buy solutions in the market in areas, which are not your core business. And so for us it is very clear where to tap into that focus, where we will get the best talent from the market to develop our core competencies”, he said. “And in other areas, where it is not so important, we will work together with partners, but they are the best partners in the market”. When it comes to that core experience, Blume said: “All the touch and feel and coming up to the software experience into the car should be unique for Porsche”. Bringing a luxury all-electric SUV (catnip for American buyers) might make sound financial sense. However, for extremely low-volume hypercars (Porsche sold just 918 of the 918 Spyder), the value proposition is often a bit more nebulous. Blume cited the brand-building impact of a record-setting halo car like the Mission X: “All our hypercars are icons”, he said. But, there are some more tangible benefits, too. “In the hypercars, we show the best the company is able to develop, to produce, to show what our technologies are for the future. We will later bring them to other serial cars, and so, it’s not only a showcase, it’s real life, to bring innovations, to develop innovations,” he said. “The whole team is focused, motivated, pushed to develop a hypercar, and that is the best the company is able to deliver”. Blume declined repeatedly to indicate whether or not the Mission X would be produced, but we shouldn’t have to wait long to find out. He said the decision will be made “during the next month”. Should it get the green light, its first official duty will be recapturing the fastest production car lap record around the Nurburgring Nordschleife. For Blume, that iconic, 13-mile race track cut through the forests of western Germany is part of Porsche’s DNA: “When we design and build the concept of a car, the Nurburgring Nordschleife is the measure for Porsche”. Porsche’s last hypercar, 2013’s 918 Spyder, itself set the fastest lap time for a production car, with a time of 6:57. The current record, set by the $2.7 million Mercedes-AMG One, sits at 6:35. That will likely be the target for the Mission X, the existential goal for a car built by a nearly octogenarian company still intent on proving its mettle on the track. +++

+++ RIVIAN on Monday beat Wall Street expectations for quarterly deliveries on stable demand for its electric vehicles, sending the company’s shares up 10% in early trading. Amazon-backed Rivian has been struggling to lift output, pressured by supply-chain disruptions and a price war started by market leader Tesla. The Irvine, California-based startup, which makes R1T pickups and R1S SUVs, has been developing its own drive unit to lower costs and reduce dependency on suppliers. Rivian, which announced in February plans to lay off 6% of its workforce, reiterated its annual production target of 50.000 units. The company expects demand for its pickups and SUVs to remain stable through the year, finance chief Claire McDonough said last month. Rivian second-quarter vehicle deliveries jumped 59% to 12.640, compared with estimates of 11.000 vehicles, according to 15 analysts polled by Visible Alpha. It produced 13.992 vehicles at its manufacturing facility in Illinois during the same period, 4.597 more than in the first quarter. Rivian’s report comes on the heels of industry leader Tesla’s deliveries hitting a record in the second quarter on the back of its price-cut strategy. +++

+++ TESLA will likely face challenging business conditions this year given the EV maker hasn’t lined up any new models, and that could force the firm to slash car prices again to shore up demand, according to Bernstein’s senior research analyst. “Our perspective is that upcoming numbers won’t be great. I think there’s limited chance that Tesla will eclipse consensus expectations in terms of deliveries this quarter. I think margins will be down sequentially, because they took incremental price cuts in the quarter”. Toni Sacconaghi told in an interview. The analyst added that the lack of new car releases could lead to supply-side issues for Tesla, calling for more demand-spurring price cuts. “That’s the challenge over the next 4 to 6 quarters before we have some new, lower-priced models. That’s our concern, that Tesla will ultimately fall short on deliveries at some point over the next 4 to 6 quarters, or that we’re going to see continued price cuts to be able to drive that growth”, Saccotnaghi said. The automaker run by Elon Musk has triggered a price war with competitors including Ford and General Motors, after it slashed the prices of its EV models 6 times this year in a bid to spur demand. The price cuts mean Tesla’s Model Y cars are cheaper than ever, selling for $47.740. That’s less than the average car price in the US. While that’s helped boost demand with first-quarter deliveries surging 36%, the price cuts are also hurting Tesla’s profits. That’s caused investors to worry that the carmaker is sacrificing its margins for volume. Nevertheless, Tesla shares seen impressive gains this quarter after investors grew excited over the company’s charging deals with Ford and General Motors. +++

+++ VOLKSWAGEN execs would tell you some very unfunny things happened on the way to electrification: Design decisions wrought years of damage, vehicle platform and software catastrophes scotched launch timelines for not just 1 but at least 3 brands, and chaos piled high enough to unseat a CEO. Those execs might not be correct about that middle one, though, if Volkswagen Group CEO Oliver Blume is telling the truth. During a presentation laying out the conglomerate’s ten-year plan at the annual capital markets day, Blume said the Scalable Systems Platform (SSP) will launch on time, in 2026. This counters recent reporting as well as complaints from individual brands late last year and this year. Due to ongoing problems with the software needed to make the SSP work, Audi’s first vehicle with the new software had been delayed up to 3 years, to 2027. A few months later, Porsche updated its IPO prospectus with a warning that software holdups might delay the battery-electric 718 twins and Cayenne. I don’t know how the company got things back on track, but investors will be pleased and customers should be, too. Blume’s presentation made clear that VW expects to launch a platform even more potent than the one we were told about 2 years ago. Previous CEO Herbert Diess gave a similar presentation in 2021 explaining that the SSP would serve every group brand, and serve every kind of vehicle from city cars with as little as 115 hp to supercars with as much as 1.200 hp. Blume, however, said the SSP will be able to power drivetrains making as much as 1.800 hp; 60o hp more than the last projection. But wait, there’s more. SSP development will break down into 3 paths: Urban city cars for Volkswagen, Audi, Skoda and Cupra; compact and mid-size vehicles for VW, Audi, Porsche and Skoda; and large vehicles for Audi, Porsche, Bentley and Lamborghini. Note the absence of Bugatti. This one skateboard chassis will eventually replace the current MQB, MLB, MSB and MMB internal combustion platforms, the present MEB, PPE and J1 electric platforms, and the MEB+ arriving in 2025. It will be powered by new “unified” batteries of various chemistries developed in-house and running on an 800 volt electrical architecture. The charging time to take the batteries from 10% to 80% SOC will be 12 minutes, compared to the 35 minutes needed for the current MEB battery-electric platform; the interim MEB+ platform will lower that time to 21 minutes. The fleshed-out software dubbed 2.0 will enable Level 4 hands-free driving. To get a sense of scale and return on investment when this is all put together, the current MEB platform sits under about ten models total, from the ID.3 to the Audi e-Tron GT. The large SSP will support 14 models from Audi, Bentley, Lamborghini and Porsche by itself. According to Blume, those 14 SSP-based models are predicted to sell about 1.14 million units between debut and 2038, netting the group more than 150 billion in revenue, with profit margins above 20%. For comparison, Porsche’s 2022 operating profit was 18%. It’s not clear which vehicle will introduce the world to the SSP in 2026, but we do know the second-generation all-electric Audi Q8 e-Tron, Audi’s Project Artemis and Volkswagen’s Project Trinity have all been penciled in around that time. If Blume’s assertions still hold weight at that time, then a line from Herbert Diess’ 2021 presentation could still come true: That come 2030, VW will make more money in the EV business than the ICE business. +++