+++ Amongst the festivities that BMW planned for The Amelia Concours d’Elegance this year, the company’s relatively new North American CEO, Sebastian Mackensen announced rough reveal dates for when we’ll see the next-generation M2 and a lightweight M4 variant. Of greatest importance is the next geneation BMW M2. Mackensen announced that this version of the new 2 Series will be revealed at some point in 2022. He didn’t go so far as to nail down a specific month or day, but it’ll be here before the year is out. That essentially confirms that the M2 will be available to buy as a 2023 model. Mackensen didn’t reveal much about the car, but he alluded to it being the soul of what truly makes BMW M what it is. Just like the previous M2, I expect it to be a total hoot to drive. As for the lightweight M4 CSL, Mackensen says this M4 variant will be revealed in 2022. He didn’t provide an exact date, but a recent report suggests that an official reveal will take place in May this year. The CSL should simply take performance even higher than the M4 Competition. Expect more power (it could be somewhere around the 550 hp mark), more aggressive aero, a lower curb weight (a lighter bodywork and deletion of rear seats should account for more than 100 kilograms) and a much higher price. The M4 CSL will be coming exclusively with RWD and an automatic gearbox. Like BMW’s recent CS models, the CSL could also end up being a limited-availability model that is only produced for a certain amount of time at low volume. Both of these models, the M2 and M4 CSL, are fitting cars to reveal in the year that BMW is celebrating 50 years of its M division. They’re both coupes, and they’re both heavily slanted toward BMW’s hardcore enthusiast fanbase. A lesser BMW M4 CS is expected to follow next year, while the first-ever M3 Touring will arrive towards the end of 2022. +++

+++ EUROPE noted a slight decrease in new passenger car registrations in January, by 2 % year-over-year. According to EV Volumes’ data shared by Jose Pontes, for the European car market, it was the worst January in 30 years. Nonetheless, plug-in electric car sales increased. Last month, some 156.236 new passenger plug-in electric cars were registered (up 39 % year-over-year), while the market share improved to 19 %. See more sales reports for Europe here. Most of the plug-in car sales happen to be battery-electric cars (BEVs), which represent 53% of the total. BEVs are also growing very quickly (up by 78 % year-over-year to 83.000 units and 10 % share), compared to plug-in hybrids (PHEVs), which increased by 11 % year-over-year (73.000 units and 9 % share). For reference, in 2021, about 2.272.666 new passenger plug-in electric cars were registered in Europe. That’s a big 66 % increase compared to 1.37 million units in 2020 (reported by the same data source at the time). Thanks to the strong second half of the year, the average plug-in electric car market share in 2021 improved to 19 %, including 10 % for all-electric cars and 9 % for plug-in hybrids. The most popular plug-in models January brings some surprising results, including first place for the Kia e-Niro. Because it’s the first month of the year, we would not draw any conclusions yet. We need to see 1-2 more months to see whether some of the models are really becoming more popular than others. After the Kia Niro e-Niro with 4.035 sales, next in popularity were the Peugeot 3008 HYbrid (3.615), the Audi Q4 e-Tron (3.585), the Renault Zoé (3.432), the Volvo XC40 Recharge Electric (3.425), the Hyundai Ioniq 5 (3.407), the Hyundai Kona Electric (3.371), the Fiat 500e (3.339), the Dacia Spring (3.275) and the Volkswagen ID.4 (3.247). The top automotive groups by plug-in electric car sales volume in Europe: Volkswagen Group: 20.3 % share (Audi 6.8 %, Volkswagen brand 6.2 %), Stellantis: 16.4 % share (Peugeot brand at 6.9 %), the Hyundai Motor Group: 13.2 % share (Kia brand at 7.2 %, Hyundai at 6 %), BMW Group 12.4 % (BMW brand at 9.7%), Mercedes Group 10.7 % share (Mercedes-Benz brand at 9.5 %), Renault-Nissan-Mitsubishi alliance (8.7 %), Geely-Volvo at 8.3 % share (Volvo brand at 6.7 %). The results are also quite unusual. We can see premium brands on top (BMW and Mercedes-Benz), Audi ahead of Volkswagen, and the very strong position of Hyundai Motor Group. Tesla is not mentioned as its results in January were relatively low. In the past, Tesla usually delivered a high volume of cars in the later part of a quarter. +++

+++ During the Investor Day virtual event, KIA announced a plan to expand the GT high-performance lineup to all of its battery-electric vehicle models. The first will be the upcoming EV6 GT, shown in March 2021. It’s the top-of-the-line version of the EV6, ready to race with some of the most expensive sports cars. “Kia will also focus on providing differentiated design for its products and expanding high performance model offerings. Beginning with the launch of the EV6 GT high performance model, Kia plans to expand the GT line-up to all BEV models”. At the time, the company announced that the EV6 GT will be able to accelerate from 0 to 100 km/h in 3.5 seconds, thanks to a dual-motor, all-wheel-drive system rated at up to 586 hp and 740 Nm of torque. For reference, the regular EV6 with a 77.4 kWh battery and an all-wheel-drive system has up to 326 hp of power and 605 Nm of torque. It’s good enough to accelerate 0-100 kph in 5.1 seconds or so. While the Kia EV6 GT is just around the corner, next year Kia will introduce a new flagship EV9 model; a large SUV. If all new BEVs are expected to get the GT version, the EV9 GT potentially will follow shortly. +++

+++ MERCEDES-BENZ is recalling a small number of EQS models due to a pair of electrical connections that may not have been properly secured during assembly. These issues can result in non-functioning equipment, or in rare instances, create a potential fire hazard. Fortunately, the potential issue has been isolated to fewer than 25 examples of the new all-electric flagship. “Due to a deviation in the production process, the bolting of the ground connection at the front-left longitudinal carrier as well as the potential equalization for the electric auxiliary heater in the motor compartment might not meet current production specifications”, Mercedes-Benz said in its defect report. “An incorrectly bolted ground connection could result in an increased electrical resistance at the connection”, Mercedes said. “The combination of potentially high electrical currents flowing through this connection and an increased electrical resistance could increase the risk of fire. In the event of an interruption with this ground connection, the left headlamp might not function, among other potential components”. Apart from what may appear to be random malfunctions (such as the aforementioned headlight issue), there would be no other outward indicators of a problem, Mercedes-Benz says. Dealers are in the process of being notified of the issue; owners will receive notices before the end of April. +++

+++ Back in 2019, Daimler and Geely formed a 50:50 joint venture to reinvent the SMART brand for the new era of electric mobility. The first result from the new cooperation is the #1 (yes, this is its official name) electric crossover, which is currently under development. We haven’t seen an official debut date from the company yet, though a new report claims the model will be unveiled in early April. The reborn automaker is currently putting the finishing touches on the zero-emissions crossover. More importantly, we are about a month away from the full and official debut of the #1. A second, slightly larger crossover will reportedly join it at a later date. The #1 is said to be powered by a rear-mounted asynchronous electric motor, delivering about 204 hp. The electric energy will be stored in 1 of 2 available battery options with the larger one reportedly having a capacity of 60 kWh. It should be enough for a range of up to 400 km between charges, measured by the WLTP. A fast-charging station could recharge the battery from 5 to 80 percent in about 30 minutes. Smart previewed the production model with a concept unveiled during the 2021 IAA in Munich last September. The Smart #1 Concept measures 4.29 metres long, which makes it comparable to the current Mini Countryman at 4.31 metres. The successor of the Countryman will also have an electric version and the 2 models can be seen as direct competitors, although the Countryman will grow in its dimensions. +++

+++ Saving up for a new ride? Better start putting more cash aside. Russia’s invasion of UKRAINE is ramping up the price of metals used in cars, from aluminum in the bodywork to palladium in catalytic converters to the high-grade nickel in electric vehicle batteries, and drivers are likely to foot the bill. While metals have not been the target of Western sanctions yet, some shippers and autoparts suppliers are already steering clear of Russian goods, putting more pressure on carmakers already reeling from a chip shortage and higher energy prices. “So what happens from here?” asked Carlos Tavares, chief executive of Stellantis, the world’s 4th biggest automaker, when speaking to reporters last week. “First, what happens is that we have an escalation of cost that comes from raw materials and energy that is going to put more pressure on the business model”, he said. Aluminum and palladium both hit record highs on Monday while nickel, which is also used to make stainless steel, crossed the $100.000-a-ton level for the first time ever on Tuesday. Andreas Weller, chief executive of Aludyne, which makes aluminum and magnesium die-cast parts for automakers, said his European business has seen a 60% rise in the cost of aluminum over the past four months, as well as soaring energy bills. With annual sales of $1.2 billion and a surge of costs in the “hundreds of millions of dollars”, Weller, whose company is based in Southfield, Michigan, said he has been forced to ask customers to pay more than the prices already agreed. “Some are more understanding and cooperative than others, but we cannot survive without that”, Weller, who has 4 foundries and 1 machining plant in Europe, told. Stellantis chief executive Tavares said an end to the chip shortage could help carmakers offset higher metal and energy prices, but he did not expect any resolution to the semiconductor issues this year. Consumers are already paying for the chip shortage as it has pushed car inventories down and prices up, even before higher metals prices feed through to the forecourt. According to consultancies LMC and J.D. Power, the average transaction price for a new vehicle in the United States was $44.460 in February; up 18.5 % from the same month in 2021. German carmakers such as Volkswagen and BMW have already been hit by Russia’s invasion of Ukraine as it has forced makers of wire harnesses in the west of the country to halt production. A wire harness is a vital set of parts which neatly bundle up to 5 km of cables in the average car, and Ukraine is a key supplier. And when it comes to metals, Russia companies are major suppliers to Germany. In 2020, they accounted for 44 % of Germany’s nickel imports, 41 % of its titanium, a third of its iron, and 18 % of its palladium. With production of 108 million tonnes last year, Russia is the world’s fifth-largest producer of iron ore, according to Credit Suisse, supplying European steelmakers who now face higher prices and possible difficulties procuring the metal. Austria’s Voestalpine and Sweden’s SSAB are both exposed to this risk, according to U.S. investment bank JPMorgan. Voestalpine said it had enough inventory for the coming months, but expected it would have to source raw materials from other suppliers thereafter. SSAB did not respond to a request for comment about supplies from Russia. Faced with the choice of buying Russian goods and indirectly funding Russia’s invasion, which Moscow calls a special military operation, Germany steel and aluminum supplier Voss Edelstahlhandel has decided to draw the line. “Even though aluminum is not on the sanctions list, it is used by Russia to get money into the country and therefore we quit”, chief Executive Thorsten Studemund told. Russia is a big manufacturer of aluminum, the most energy-intensive metal to produce, accounting for 6 % of global output. Battery minerals Studemund’s company has also been contending with high prices for nickel. Caspar Rawles, chief data officer at specialist consultancy Benchmark Mineral Intelligence (BMI), said that while Russia accounts for 5 % of global nickel production, it supplies about 20 % of the world’s high-grade nickel. The metal is used to make batteries for electric vehicles (EVs), posing a fresh challenge for carmakers already investing billions to move away for combustion engines just as demand for zero-emission models is starting to take off. Some of Russia’s high-grade nickel will probably end up in China, which is unlikely to impose sanctions on Russia, but this all comes at a time when carmakers are facing rising bills for other EV battery minerals as demand outstrips supply. “That’s the main concern for the battery supply chain in that you’ve got record high lithium prices, and very, very high cobalt and nickel prices”, Rawles said. “This is just adding to battery mineral woes”. Batteries are one the most expensive components in EVs and automakers have been hoping they will become cheaper so they can offer more affordable electric cars. BMW said it was focusing as much as possible on recycling battery nickel, with up to 50 % scrap nickel used in the high-voltage battery of its new iX model. When it comes to palladium, carmakers are also in a bind. The auto industry uses it in catalytic converters for gasoline models (or platinum for diesel models), both of which still make up the vast majority of car sales. Palladium prices have been rising for about 6 years and Russia accounts for about 40 % of the global market. “There is no other option beyond palladium and platinum for catalytic converters, and you can’t build a car without a catalytic converter”, said Chris Blasi, chief executive of precious metals dealer Neptune Global. He said he bought a lot of palladium in December at $1.940 an ounce. On Monday, it hit a record $3.440. Blasi estimated that the value of the palladium used in the average car is about $200, but that could easily double. “Either consumers will pay more for cars, or if automakers can’t pass it on they’ll have to find cost savings somewhere else”, he said. +++

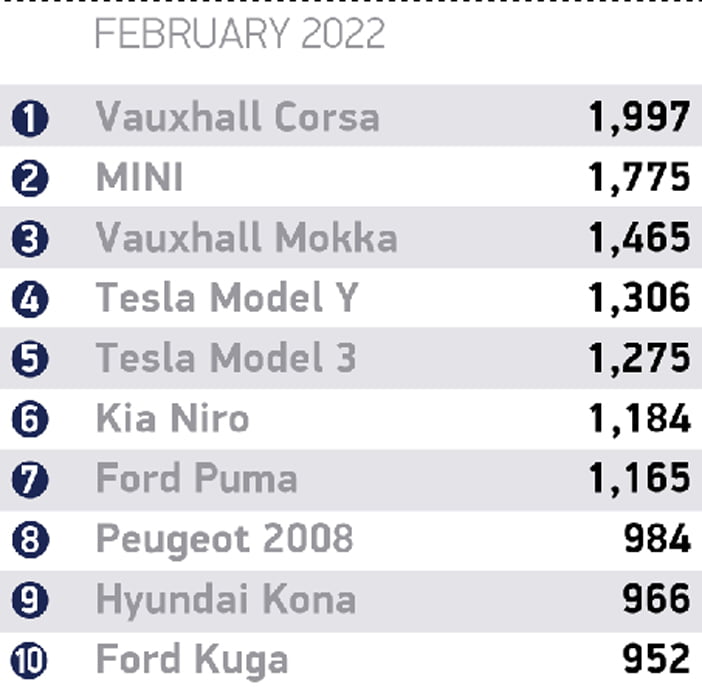

+++ In February, new passenger car registrations in the UNITED KINGDOM increased by 15 % year-over-year to 58.994. The growth is noted compared to the locked-down February 2021 but compared to February 2020, the market is down almost 26 %. The Society of Motor Manufacturers and Traders (SMMT) explains that the market is affected by economic uncertainty and supply challenges. SMMT notes also that February is typically the lowest volume month in the UK, as many buyers delay purchases until the ‘new plate’ month of March. According to the official data, passenger plug-in electric car registrations more than doubled last month to 15.094 (up 127 % year-over-year). That’s 25.6 % of the total market. Together with 6.883 non-rechargeable hybrids, the xEVs (BEVs, PHEVs, HEVs) stand for about a third of the market. Especially interesting is that all-electric car sales almost tripled year-over-year, which is almost enough to reach a market share of 18 %. Battery electric car registrations in the UK in February were 10.417 (up 196 % year-over-year) at a market share of 17.7 %. PHEVs did 4.677 sales (up 49 % year-over-year) at a market share of 7.9 % (Total: 15.094, up 127 % year-over-year, at market share of 25.6 %). So far this year, more than 38.000 new passenger plug-in cars were registered in the UK, reaching an average market share of almost 20 %. New plug-in car registrations, year-to-date in 2022: BEVs: 24.850 (up 154 % year-over-year, market share of 14.3 %) and PHEVs: 13.724 (up 48 % year-over-year, market share of 7.9 %); Total: 38.574 (up 102 % year-over-year; market share of 22.2 %). Tesla made a big splash in February, as two of its models managed to enter the top 5 most popular models in terms of the number of new registrations. The Model Y noted 1.306 units and became the 4th most popular model right after deliveries started, while the Tesla Model 3 was fifth with 1.275 units. Let’s recall that the Model 3 was the second most popular car in the country in 2021. Nonetheless, Tesla deliveries are not consistent on a monthly basis (more on a quarterly basis) so there are no Tesla cars in the top 10 year-to-date yet. +++