+++ DS plans to keep smaller models in its range, including a successor to the existing 3 Crossback, as the French brand eschews a trend among premium manufacturers to switch towards larger vehicles. With the likes of Mercedes looking beyond its A- and B-Class, and Audi dropping the A1 and unlikely to replace the Q2, the premium market appears to be shifting away from bigger-selling vehicles offering smaller margins. But DS brand director Beatrice Foucher says that she doesn’t want to lose customers who have been brought into the fold through the original 3 and, latterly, the 3 Crossback small SUV. “When you look at the market and the customer needs, obviously there is still demand for a car which is around 4.3 or 4.4 metres long, with a kind of premiumness”, Foucher said. “I think if you want to go below 4 metres, there are cars on the market doing the job of ‘premium’: Smart or the Fiat 500. So for me, this is not the territory I will expand into. I will stick more to the 4.4-metre mark. We will keep the customers we have; we had DS 3, some of them moved to the DS 3 Crossback, and now we have good momentum with that car. It had an odd time to create its market but month after month we are still growing with it. I want to keep the customers we have and we will offer something for them later on, in a premium”. Foucher said she thinks premium German brands are “right” to move away from supermini sized vehicles. “There’s a direct link between size and price”, she said. “I’m sure there’s a turning point around these dimensions. And keep in mind, too, that with electrification, the proportions, with the bonnet and cabin, will be different. We can play with roominess with less overall length”. When asked directly if this could be a suitable project to be based on the forthcoming STLA Small platform, being developed by DS parent group Stellantis, Foucher said it was “an example” of something that could work on the architecture. DS will launch only pure-electric vehicles from as soon as 2024. The initial wave of models is likely to be larger cars, using the STLA Medium platform, although the pure-electric version of the newly launched 4, which uses the same EMP2 underpinnings as the Peugeot 308 and Opel Astra, will be able to be sold well into the second half of the decade. The current CMP-based electric version of the 3 Crossback could have a similar long-term plan. +++

+++ News on the economy and inflation has been almost universally negative in recent months. Everything seems to be getting more expensive, and everything is taking longer to ship and receive, especially cars. Research firm AlixPartners recently released a report on price increases on ELECTRIC VEHICLES , and the numbers are surprising. Tesla has increased its prices several times in recent months, to the point that some Teslas now cost nearly 10% more than they did at the beginning of the year. Rivian, Ford, General Motors and others are on the same track. The new GMC Hummer EV got a $6,250 price bump last week due to rising materials costs, which are up 144 percent from March 2020. There are still plenty of reasonably priced EVs for sale, but there’s no way around the fact that prices are rising. In May, buyers paid an average of 22% more for a new EV than they did the year before, as the average sale amount climbed to $54,000. To be fair, prices for gas vehicles are on the way up as well, though to a lesser extent. Buyers paid an average of $44,400 in the same period, a 14 percent increase. Why are EVs becoming so much more expensive so quickly? Well, inflation is a significant part of that, but there are other factors, too. Automakers are pushing EV prices to compensate for the increases they’re seeing in raw materials costs. Some components have nearly doubled in cost since before the pandemic, wiping profits off the boards for even the most popular models. Ford CFO John Lawler told reporters that the shift had all but killed the automaker’s earnings on the Mustang Mach-E, so prices got a bump to offset the pain. The costs of research and development of new EVs also drive sales prices, as automakers have to recoup their upfront costs with each unit sold. AlixPartners told the Wall Street Journal that the shift to electrification will cost car companies a combined $526 billion by 2026, and we’re still not out of the woods regarding supply chain issues, so that total could grow as time goes on. Finally, it’s hard to expect automakers to loosen prices on a product category with the explosive growth in demand that electric vehicles have seen in recent years. Buyers were chomping at the bit to get new electric models even before gas prices skyrocketed, and now that the pain at the pump has become extreme, that excitement has grown. Of course, prices can’t keep climbing forever and the early adopters will eventually move on, so automakers will have to balance pricing with costs carefully going forward to maintain demand. Widespread EV adoption will depend on there being affordable and readily available vehicles in the future, so it’s a cooling off in pricing will be in everyone’s favor. +++

+++ The covers have only just come off the Ioniq 6, but HYUNDAI ’s design boss is already generating buzz around future iterations of the sleek 4-door. Asked whether he and his team had considered a hatch-style liftback for the Ioniq 6 (instead of the conventional saloon tailgate on the production car) chief designer SangYup Lee told: “I can make a great hatchback out of that; a shooting brake”, suggesting that a more practical model is on the cards. Further to this, Lee said: “The Ioniq 6 would also make a great performance model”. We already know the Ioniq 5 will gain a hot N-badged variant in 2023, but this is the first suggestion that additional electric N cars are in the plan. It’s likely the Ioniq 6 N will use a similar set-up to Kia’s EV6 GT, with a 77.4 kWh battery and up to 600 hp. That should allow for 0-100 kph in less than 4 seconds and a top speed of more than 230 kph. Finally, Lee hinted that more impactful design may mean future Hyundais may have a shorter overall lifespan, and that the conventional mid-life facelifts might focus more on substantial over-the-air updates rather than minor tweaks to the lights and bumpers as they do now: “Making a timeless EV makes lifecycle management much easier”, Lee said. +++

+++ HYUNDAI and KIA are expected to post their highest ever profit for the second quarter and the entire year despite the industry’s dim outlook amid higher costs and murky situations in China and Ukraine. Hyundai will likely post 2.14 trillion won ($1.66 billion) in operating profit for the April-June period while Kia’s operating profit is forecast at 1.71 trillion won, bringing their combined quarterly profit to an all-time high of 3.85 trillion won, according to the market consensus. In the first quarter of this year, the 2 companies ran a combined operating profit of 3.54 trillion won. For the full year, Hyundai’s and Kia’s operating profits are forecast to reach 8.29 trillion won and 6.57 trillion won, respectively, bringing their total to 14.86 trillion won. If realized, the companies’ earnings will surpass their previous record high of 11.96 trillion won in 2012. Last year, Hyundai and Kia earned a combined 11.74 trillion won on the operating level. The rosy prospects come as global automakers witnessed declining sales and profits as soaring inflation fears, coupled with the resurgence of the Covid-19 pandemic in China and the ongoing Russia-Ukraine war, spook new car demand. Analysts said Hyundai and Kia will likely be less affected by encroaching external uncertainties thanks to the growing popularity of the Korean duo’s eco-friendly vehicles, including electric models. Last month, Hyundai said its premium Genesis brand saw considerable growth in its US car sales as all other major carmakers reported a significant drop amid a continued automotive chip shortage. Genesis was the only brand among major carmakers that posted sales growth in April while Kia said its accumulated US sales passed the 10 million mark for the first time since deliveries began in 1993. Strong retail demand has also lowered the 2 Korean carmakers’ global car inventory to a record-low level of about 1 month’s worth of vehicles, down from the usual 3 to 4 months, and slashed incentives offered to dealers. According to automotive pricing and information service providers, dealer incentives in April for Hyundai and Kia cars in the US fell to $597 and $834 per unit, respectively, down 76% and 68% from a year ago. Their incentives are lower than that of the Korean carmakers’ archrival Toyota, which paid out $855 a car. The figures compared with Ford’s $1,523 and General Motors’ $2,046. Hyundai’s rise to become one of the coveted automakers in the US market has been driven by SUVs and premium Genesis models, and now by electric vehicles. Bloomberg News, in a recent report titled “Sorry Elon Musk. Hyundai Is Quietly Dominating the EV Race”, said that it took Tesla a decade to deliver as many electric cars as Hyundai managed in a few short months. Earlier this year, the Korean automotive group rolled out 2 new battery-powered cars on the American market (the Hyundai Ioniq 5 and the Kia EV6) which promptly tore up the sales charts, passing the Nissan Leaf, Chevrolet Bolt and every other electric vehicle on the market not made by Tesla. In the US this year through May, the Korean duo sold 21.467 units of the 2 models, besting even the popular Ford Mustang Mach-E, which was snapped up by 15.718 drivers. “From an EV perspective, Hyundai and Kia are just kind of cleaning the room”, Bloomberg cited car information provider analyst Joseph Yoon as saying. “I don’t know if any dealers around me have any in stock”. In his recent tweet, even the Tesla chief executive said: “Hyundai is doing pretty well”. “EVs usually fetch higher profits than gasoline and diesel cars. The growing popularity of Hyundai and Kia’s electric models bodes well for their profitability in coming quarters,” said Hana Financial Investment analyst Song Sun-jae. +++

+++ Hyundai had the highest electric vehicle sales in INDONESIA last month, an Indonesian automotive industry association said Sunday. Hyundai sold 195 units of the Ioniq 5 and 1 Ioniq Electric in the Southeast Asian market in May, according to the Association of Indonesia Automotive Industries. Hyundai accounted for 98 percent of the 200 EVs sold in Indonesia last month, it said. In the January-May period, Hyundai’s EV sales reached 333 units, or 92 percent of overall sales of 363 EVs there, the association said. Other EV models sold in Indonesia include Nissan’s Leaf, Lexus’ UX 300e and Toyota’s C+pod. When combustion engine vehicle sales are combined, total vehicle sales in Indonesia reached 396.153 units in the first 5 months. Japanese carmakers claimed a share of 93 percent of the overall sales figure. In 2022, Hyundai aims to increase its market share in the Indonesian automobile market from a share of 0.3 percent last year. It, however, didn’t provide a targeted market share. +++

+++ INFINITI has had a tumultuous time in the last few years. However, a new plan is under way to revive Nissan’s luxury marque, and to give it some much-needed direction. Now, Infiniti chairman Peyman Kargar has detailed his plans for the first time, and revealed that the QX80 will be at the vanguard of this new push. Left to languish under former Nissan boss Carlos Ghosn’s quest for market share at the cost of all else, Infiniti’s lineup failed to receive the necessary updates in several hotly contested segments. In a time when the luxury brands have seen record profits, Infiniti has instead seen its sales plummet. In 2018 the brand was among the first to announce a date by which it would “go electric”. That was taken by many to mean solely electric or hybrid vehicles after 2021, but that time has come and gone. Infiniti missed its own deadline for a first EV model last year, and sales have nosedived by more than 50 percent since 2019 (117.708 in U.S. sales in 2019, dropping to 58.553 in 2021). Part of that is due to the pandemic and resulting semiconductor shortage that’s plagued the entire industry, but there’s no doubt that the brand is seldom uttered in the same breath as Mercedes, BMW, Lexus or Audi. Kargar outlined a 3-phase plan to get Infiniti back on its feet. The first phase, focusing on restructuring and recovery, was just completed in March. Infiniti has now turned record profits globally, Kargar said. Phase 2 has now begun and will play out through March 2026. By this time next year, designers will have locked in a new corporate face to take over on all new models. Leading the charge with that identity will be a new QX80 that arrives in late 2023 or early 2024. Kargar didn’t disclose details, but called it the future flagship of the marque. It will have enhanced performance specs to distance itself from the Nissan Armada on which it is based. Infiniti hopes that the QX will be seen as a competitor against the likes of the Cadillac Escalade, Lexus LX and Range Rover. Despite riding on the same platform as the Patrol (a Land Cruiser-like body-on-frame SUV) since 2010, the QX has not fallen in sales as much as other models. Part of the rebranding also includes a unification of Infiniti’s identity. Kargar spoke of a new dealership look and feel, which includes a “brand scent” for showrooms and a “sound signature” that will tie in apps, websites, and call centers. Consistent branding is a hallmark of luxury companies, but the article notes that the dealership revamp will only apply to new showrooms and existing ones will not be required to remodel. Phase 3 of the plan will see expanded electrification and new models. An all-electric sedan will replace the Q50 debuting in 2025, followed by a EV crossover. Electrification may also bring an entry-level crossover and a coupestyle fastback crossover about the size of the QX60. Most importantly, the new plan is not strictly about sales figures. Seemingly a rebuff of Ghosn’s philosophy, Kargar says he sees “steady, sustainable growth” as a priority. He puts the blame for Infiniti’s current product stagnation squarely on pursuing market share. The emphasis on product over volume is a good sign that Infiniti (and Nissan) has turned a corner. Going all out for market share has rarely worked out for auto companies (see GM, Toyota). Cohesion in branding is a good start, but it’s the absolute minimum a luxury brand should aspire to. A unique character, the more difficult to replicate or manufacture the better, is also key to setting oneself apart. With the current trend of go-anywhere, truly off-road capable SUVs showing no signs of abatement, the QX80 is a smart choice for flagship. In many parts of the world variants of the Patrol rival the Land Cruiser in ability and cachet. Hopefully, the QX isn’t simply a dumbed down badge swap for American consumers. +++

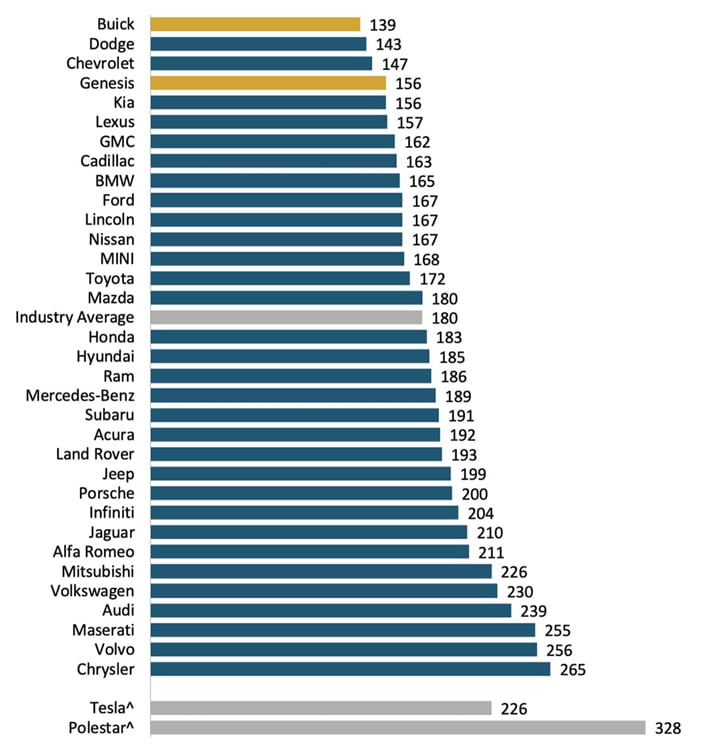

+++ People, economies and supply chains weren’t the only things continuing to get sick over the past year. The 2022 J.D. Power INITIAL QUALITY STUDY (IQS) is out, showing the average rate of problems per 100 vehicles (PP100) during the first 90 days of ownership increased overall. The average figure for the 32 ranked manufacturers in 2020 was about 166 problems per 100 vehicles. In the 2021 IQS, that dropped to an average of 162. This year, the average jumps to 180 problems. J.D. Power says that figure is a record high over the 36-year history of the study. Buick leapt to the top of the rankings this year with the fewest issues, at 139 problems per 100 vehicles in the first 100 days of ownership. After Dodge became the first American automaker to lead the IQS in 2020, followed by Ram in 2021, this year marks a 3-peat for U.S. carmakers. Dodge took second this year at 143 PP100, Chevrolet third with 147 PP100, Genesis the first luxury maker on the chart in 4th with 156 PP100. Between February and May, this year’s study gathered responses to 223 questions from more than 84.000 new 2022-model-year car owners and lessees. The questions are designed to zero in on real-world problems new owners encounter with nine categories of vehicle features: Infotainment; features, controls and displays; exterior; driving assistance; interior; powertrain; seats; driving experience; and climate. As has been the case in the past few year, infotainment has proved to be the most problematic bugbear making scores worse. Considering features individually, 6 of 10 of the worst problem areas dealt with infotainment, causing infotainment’s score of 45 PP100 to be 19.5 PP100 worse than the second-placed feature. Consumers ranked getting Android Auto and Apple CarPlay to connect reliably as the most troublesome. GM didn’t just score with Buick, which was one of only 9 of the 33 ranked brands to show improvement this year. The conglomerate earned first place with the fewest PP100 among all the automaker groups, and scored the most model-level awards with 9, ahead of BMW / Mini with 8 and the Hyundai Motor Group with 3. This year’s study again showed a gap between luxury and mass-market makers, thought to be down to the amount of tech in luxury vehicles that consumers aren’t properly informed about or that doesn’t act as expected; that latter issue exacerbated by the chip shortage. Mass-market brands collectively rung up 175 problems per 100 vehicles during the first 90 days of ownership, whereas luxury vehicles collectively rung up 196 PP100. Electric and electrified vehicles were caught in the technology snare as well, BEVs not including Tesla scoring 240 PP100 compared to 239 PP100 for PHEVs and 175 PP100 for the old internal combustion engine. Tesla made the official rankings for the first time, although again with an asterisk. The company doesn’t give J.D. Power access to its consumers in such states where law demands the automaker must consent. On top of that, the organization doesn’t want the preponderance of what Teslas it can find out about to skew the entire BEV category. So, on its own and with those caveats in mind, Tesla scored 226 PP100, showing 2 years of improvement. David Amodeo, director of global automotive at J.D. Power, said, “Given the many challenges automakers and their dealers had to face in the past year, it’s somewhat surprising that initial quality didn’t fall even more dramatically”. +++

+++ With JAGUAR finally breaking its lengthy silence over its future plans, there’s a lot to unpack. 3 brand new models are on the way, all of which are set to be built on a new platform and feature EV power. However, there’s still a lot we don’t know. So who better to enlighten us on the firm’s future than Nick Collins, Jaguar Land Rover’s vehicles boss? “It’s huge, but we’re absolutely where we want to be. I’m conscious we’ve been quiet on Jaguar, but that has been deliberate. We had Land Rover’s Range Rover, Range Rover Sport and Defender 130 to launch, and we needed to get that done. But we’ve been working like crazy on the new Jaguars with a fiercely dedicated team locked away from distractions”. Question: You’ve mentioned 2024. What’s the significance of that? Previously, a 2025 relaunch was spoken of. Answer: “Both years are significant. In 2024, we will show the world what a new Jaguar will be like; in 2025, we will deliver cars to customers. We’re still working on options for communicating and marketing the vehicles. We have plenty of ideas, but we haven’t yet decided which way to go”. Q: You’ve talked about “curating the journey” to 2025. What does that mean? A: “That refers to what we will do with existing models. Our supply chain issues have created opportunities to cut the number of variants. We’ve learned a lot about being a value-over-volume company. With the F-Pace, for instance, we can go from around 55 variants to 16. You’ve seen our recentF-Pace SVR Edition 1988: we will do more like that, including with the XF and XE, which will be back soon. And next year we will celebrate 75 years of Jaguar sports cars by doing something special with the F-Type. It will be our last-ever V8 sports car. Maybe it will be like the old Land Rover Defender and have a bumper year”. Q: Does “a copy of nothing” imply that new Jaguars won’t have a visual relationship with previous models? A: “I can’t talk specifics, but the way to understand the link between new and old is to think about the brand’s specifics. Summarise the emotions that Jaguars have always generated, then think how to represent them in a modern product. For me, it’s similar to the job we did with the new Defender: we were never hindered by the old one when we did it. We’ve recently honed Jaguar values to a few words. I won’t reveal them, but they let us maintain the absolute purity of the brand”. Q: Is it true that the new Jaguar designs have been signed off? A: “Yes, we’ve signed off the whole portfolio. We’re in the final maturation phase, getting the cars ready for production by dealing with production surfacing and practical stuff like aerodynamics and cooling. But we cling very closely to the company’s core principle of making very few changes for production. We see our task as being to bring great designs to life”. Q: What stage have you reached with the mechanical and software development? A: “We first looked at using a partner platform, but it became clear we would never achieve our ‘copy of nothing’ objective without bespoke architecture. However, we’re using some of the building blocks we already have, and have planned for other future models, to streamline the process. As for prototypes, they will be running in the next couple of months, using Range Rover Sport bodies”. Q: Will you show a concept car before 2024? A: “I love concepts, and this is certainly an idea we’ve talked a lot about, and maybe we will do something. But in line with everything else about this new Jaguar project, we will have to ‘Reimagine’ how we do it”. Q: No recent car has had new architecture for both body and chassis, a new form of powertrain, a new production system and a new marketing proposition and been built for a new breed of buyers. Do you acknowledge the risk in this? A: “We believe risk can also contain opportunities. In any case, the bigger risk would have been to keep things as they were. We had to do something very different, just as we did with the Defender, and that’s what we’re doing. But I can tell you the new cars are absolutely stunning and very thought-provoking propositions, in a good way. Every time I see one in the design studio, I catch my breath. But that’s an effect that the greatest Jaguars have always had. We won’t decide pricing until just before launch, and that’s years away, although of course we know perfectly well how we want to position the cars. My own view is that a great product defines its own pricing. How much we can charge is down to the quality of the job we do”. +++

+++ The lukewarm reception for POLESTAR , the latest electric-vehicle company to go public in the U.S., is sending an ominous message to other startups: the purge isn’t over. Yes, the auto industry is due for a transformation as oil prices soar and the need for cleaner transportation becomes increasingly apparent. But, runaway inflation and a looming economic downturn is making investors leery of speculative investments, which includes EV makers despite the allure of the coming revolution. Polestar’s tepid welcome (the stock jumped 16% on its first day of trading and then dropped 15%) is the latest evidence of that skepticism. The Swedish electric carmaker went public after merging with blank-check company Gores Guggenheim. The company’s market valuation stands at about $24 billion. “EV stocks benefited greatly from the abundance of liquidity that had been sloshing around the system for 2 years”, said Matthew Maley, chief market strategist at Miller Tabak + Co. “Now that this liquidity is disappearing, investors are going to have to revalue these EV names”. Tighter market conditions aren’t the only obstacles facing startups. The challenges are manifold, with raw material costs surging, supply-chain shortages refusing to let up and high car prices threatening to weigh on demand. Any new entrant to the EV industry is in an especially tricky situation, since materials used in EV batteries have seen some of the most intense inflation, forcing companies to raise the price of their already expensive cars, trucks and SUVs. On top of that, the automakers don’t yet have loyal customer bases to lean on. That’s a big advantage for stalwarts like General Motors, Ford and even EV market leader Tesla. “When you are spending that kind of money for a vehicle, you at least want it to be reliable and know that the company will be around in a few years time”, said Greg Martin, managing director and co-founder of Rainmaker Securities. Several EV-makers have lately seen the initial enthusiasm for their stocks evaporate. Anaheim, California-based Phoenix Motor is trading nearly 11% below its June 7 IPO price of $7.50 per share. Rivian Automotive has fallen 64% since its debut in November, while Luxembourg’s Arrival SA has lost more than 90% since listing in the U.S. They’re part of a broader wave of weakness among recent IPOs as investors shy away from risk due to higher market volatility; a main reason this has been the weakest first half in nearly 2 decades for global stock offerings. Yet, the market valuations of EV startups Rivian or Lucid Group still don’t fully reflect all the risks, experts said. Rivian is currently valued at about $26 billion, while Lucid Group stands at around $31 billion. In comparison, century-old Ford, which has a slew of EVs coming out in the next few years and a broad portfolio of profitable internal combustion cars and trucks, is worth about $48 billion. Rivian shares trade at a multiple of 129 times its sales, and Lucid at 359 times. For Ford, that number hovers around 0.4 times. For EV trailblazer Tesla, often criticized for its own high valuation, the price-to-sales multiple is 12. “The entire EV sector, Tesla included, remains overvalued based on any conventional metrics”, said Steve Sosnick, chief strategist at Interactive Brokers. While investors are still willing to pay a premium for the prospect of an EV future, certainly not all of the startups can meet the promise that the market is pricing in, Sosnick said. “That promises more swings ahead as investors handicap the eventual winners and losers”. +++