+++ ALPINE will launch the A110 Legende GT, a more luxurious version of its sleek A110 sports car as it looks to branch out from its core French market and consolidate a jump in sales last year, CEO Patrick Marinoff said. Renault revived the Alpine brand and its 2-seat models in 2017, updating a classic design that hit a peak in the 1960s and 70s. But Renault is struggling with slumping demand in emerging markets and outlined cost cuts in February to try to turn around a decline in operating margins. Pricier models such as the Alpine could help improve the group’s profitability and growth in the longer run as the brand goes even more upmarket and plans more launches, Marinoff said. “If you look at profit potential in the future, Alpine is the tool and the weapon for Groupe Renault to harvest that potential”, he said in a telephone interview to replace an event planned for this week’s Geneva auto show, which has been canceled due to the coronavirus outbreak. In the short term, Alpine is bracing for stalling growth after the hype of its first launches dies down. Sales of the Alpine A110, which is produced in Dieppe, France, and includes an engine from Renault’s alliance partner Nissan, doubled to 4.835 in 2019. “Looking at our numbers, we do not expect growth this year”, said Marinoff, a former Daimler executive. “We had a fantastic record year last year. We had a fantastic start, but to expect more growth would be definitely too ambitious, we are looking at consolidation”. The A110 Legende GT will be a grand tourer, or a luxury sports car designed for long drives, with extra capacity for luggage and storage built in, as well as touches such as leather seating. Its first production run will be limited to 400 cars and it will cost about €13.500 more than Alpine’s most affordable exisiting models. The brand is looking to push into markets such as Germany, the UK and Switzerland and beyond France, where it made twothirds of its sales last year. “We intend to broaden the customer base”, Marinoff said. “We will focus more on people who are looking for a certain lifestyle, for the refinement that a Grand Tourer can deliver”. +++

+++ BMW said its China sales have taken a hit this year because of the new corona virus, but stuck to its target for growing passenger car sales for the year and said its global supply chain has not been disrupted. “There has been a significant impact in China”, chief executive Oliver Zipse told journalists in a conference call. The slowdown in sales will last until March, and it is too early to make predictions about whether BMW would fail to meet its global sales targets, he said. “We see no impact outside China. We’re sticking to our target of achieving slight growth in car sales”, Zipse said. BMW, which has factories in China, the United States and Europe, said its global supply chain had not been disrupted by travel bans and logistics bottlenecks caused by the coronavirus. “We only have short-term visibility. Supplies have been secured for the next 3 weeks”, Zipse added. +++

+++ BYTON , the Chinese EV startup, has announced more details about the European market launch of the M-Byte crossover. That’s perfectly normal of them but the company says the new information comes “prior to the Geneva Motor Show”. Well, of course we all know that the event has been canceled this year, but anyway, Byton has announced retail, service and charging partners in Europe so here’s what you need to know in case the M-Byte interests you. For starters, you should know the launch of the M-Byte on the continent is more than a year away as Byton plans to enter the first European markets by the end of 2021. Based on current reservations, the M-Byte will launch in several waves in Europe, with the first wave including markets like Switzerland, Germany, Norway, France, Netherlands and Sweden. Speaking of reservations, Byton claims it has 25.000 of them from Europe, out of a total of 65.000. That’s not bad at all but one has to consider the fact that customers did not need to pay anything to secure a reservation. However, reservation holders will need to put their money where their mouths are when pre-orders open in the second half of 2020. That’s because they will need to pay a fully refundable €500 fee to secure an early position in the production. The M-Byte will start from €45,000 in Europe, excluding taxes. The base model features a 72 kWh battery and a 272 hp rear-mounted electric motor with the range WLTP rated at 360 km. Byton will also sell a high-performance 4WD variant equipped with a 95 kWh battery and 408 hp motors offering a range of 435 km. The 2WD version of the same powertrain will be able to cover 460 km on a single charge. Byton says it will offer a premium Hybrid Sales Model (online-to-offline), with its first flagship store (called Byton Place) in the region to open in Zurich, Switzerland in the second quarter of 2021. As for charging, Byton signed a strategic partnership with Munich-based Digital Charging Solutions (DCS) to develop a fully integrated charging experience. Key features will include access to 150.000 charging points for both AC and DC fast charging in 28 European countries, as well as charging stations of over 450 major chargepoint operators (CPOs) such as Ionity, FastNed, EnBW, Allego, Innogy, NewMotion, Izivia, Swisscharge and local utilities. Charging solutions will be both physical and digital for home, commercial and public charging. They will include a 22 kW mobile charger and 22 kW connected wall box. An AC charger as well as a 150 kW DC fast-charger will be offered for commercial customers. +++

+++ CHINA ’s vehicle sales forecast for 2020 was cut by credit ratings agency Moody’s last week, as the coronavirus outbreak continues to reduce demand and disrupt automotive supply chains. Moody’s said on Wednesday that car sales in China will fall 2.9 % this year, whereas previously it predicted 1 % growth. Before the corona virus outbreak in December, the China Association of Automobile Manufacturers estimated that sales in the country were likely to fall 2 % to 25.31 million in 2020, which will mark a third straight year of decline. An official at the CAAM said China’s auto sales will continue to show negative growth or remain flat in the next 2 years, but are expected to grow from 2022 onwards and perhaps even see a 4 % increase from 2023-25. According to the latest statistics from the CAAM, carmakers delivered 1.94 million vehicles in January; 27 % less than in December. The association also warned it expects significant declines in China’s automotive production and sales levels in February due to the coronavirus outbreak. The epicenter of the epidemic Hubei province is responsible for around 9 % of China’s car manufacturing. So far, carmakers in the province have postponed all production. LMC Automotive Consulting Co said containment measures in various countries, including quarantines, travel restrictions as well disruptions to production and transportation could hurt economic growth and cut into confidence. The risk of a recession could be quite damaging especially in markets for expensive durable goods such as cars, LMC said. To counteract the negative effects of the coronavirus outbreak on the auto industry, the Ministry of Commerce said last month that China is considering a slew of measures to boost car sales, including encouraging local authorities to stimulate sales of new energy vehicles, offering a larger quota of license plates and favorable trade-in policies. The Moody’s report also said that global vehicle sales will decline 2.5 % in 2020, narrowing from a 4.6 % drop in 2019, but worsening from the 0.9 % decline that it had previously projected for this year. “Our outlook on the auto manufacturing sector remains negative and we expect global sales to rebound only modestly in 2021 with growth of 1.5 %”, Moody’s said in the report. Car sales in the United States will remain weak, while Western European car sales will decline in 2020 after stronger-than-expected demand at the end of 2019, according to Moody’s. +++

+++ Bentley and McLaren have sought alternatives to their CHINESE SUPPLIERS to mitigate the impact of the coronavirus outbreak, which has halted production at some carmakers’ manufacturing sites around the world. The virus has infected tens of thousands and killed about 3.000 people, the majority in China, confining millions to their homes, disrupting businesses and delaying the reopening of factories after the extended Lunar New Year holiday break. Both Bentley and McLaren said their car production, all of which is in Britain, had not been affected so far. Bentley said it had secured the supply of the 21 basic components that it sources from China until the end of the month, such as silicon chips. “We’ve re-sourced them”, chief executive Adrian Hallmark told, as the firm showcased its new Mulliner Bacalar car, but did not say where the alternative supplies came from. “We don’t see a break in production yet”. McLaren Automotive boss Mike Flewitt said his company was seeking to take similar steps. “We are developing some alternating sourcing opportunities where we can but we don’t have multiple sources for a company this size”, he said as the firm unveiled its 765LT model at an event at its Woking headquarters in southern England. Flewitt said McLaren had also taken steps to mitigate the risk from suppliers in northern Italy, which has suffered Europe’s worst coronavirus outbreak. “We have restricted travel out to those suppliers and we’ve have to make alternative logistics arrangements so that we can get material out”, he told. Some carmakers have seen their production hit by the outbreak of the new corona virus. Last month, Fiat Chrysler said it was temporarily halting production at its Serbian plant, the first such suspension by an automaker in Europe in response to the outbreak in China, which had already forced closures in Asia. China accounted for about 6 % of McLaren’s sales last year, which stood at around 4.700 vehicles; and for 18 % at Bentley, which sold just over 11.000 vehicles. Flewitt said there had been “very few sales at all” so far this year in China for McLaren. For Bentley, the sales rate in China is half what the carmaker would expect and it risks losing some of the 200 to 250 sales from the first 3 months of the year, Hallmark said. “If we see sustained improvement by the end of the quarter, then we think we can cover that back by the end of the year”, he added. “If it carries on, I won’t predict numbers”. In January, Volkswagen boss Herbert Diess criticized Bentley, which is seeking to engineer a turnaround of its business, by saying the unit’s performance would be “more impressive if we had a margin higher than zero”. Hallmark said the company, based in Crewe in northern England, had faced several problems in 2018, returned to profitability last year and is “clearly a strategic part of the group’s brand portfolio”, with improvements being made. “What we need to do is increase the value that we offer to customers, increase the margin that we generate”, he said. +++

+++ CITROEN is edging ever closer to the reveal of an all-new flagship saloon, which the brand’s recently appointed product and strategy director Laurence Hansen says will be “very different” from the current competition. The company is preparing an unconventional return to the D-segment market, and will launch a new electrified halo model in 2021. It appears plans have accelerated since Citroen’s CEO Linda Jackson stepped down last year, in fact. Hansen reassured us a C6 replacement was on the way: “just be sure it’s real” she told. “It is just wow”, Hansen said. “It will be very different. Very comfortable. It’s a great car”. This ties in with previous comments made by Jackson at the 2019 Shanghai Motor Show: “In order to be credible as a world brand, we have to have a range of vehicles that covers small cars, medium cars, SUVs and large cars. Citroen has as much credibility as any other manufacturer to have a large car. It’s just that we won’t do it in a very traditional way. We will have one. There is a market for it, and it will be coming out in a couple of years”, she added. The French brand could line up a 2021 Shanghai show debut for its new BMW 5 Series and Mercedes E-Class rival given its potential importance in China. But the ex-chief executive stressed at the time that the new D-segment car would be a “valid” addition to operations in Europe, too. Citroen could break with tradition by offering the new flagship with the option of a fully electric powertrain and this would be technically possible on the car’s planned platform. The D-segment model will sit on PSA’s EMP architecture for larger vehicles, which is already used by models like the Opel Grandland X and Peugeot 508. For now, this has only been seen supporting plug-in hybrid power and not all-electric set-ups. But an evolution of the EMP architecture that is able to support pure-electric powertrains is being prepared, and will be available in time for the launch of Citroen’s new halo car. In fact, it’ll be the same platform that underpins an electric version of the Opel Vivaro panel van, slated to be launched in 2021. +++

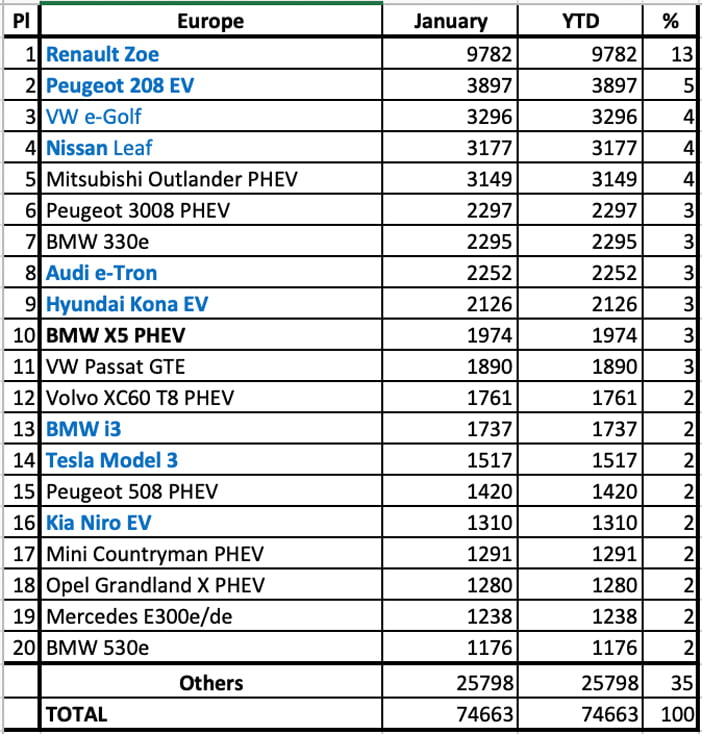

+++ There is nothing better than a continuous stream of positive sales news from the European plug-in ELECTRIC car market, which in January 2020 was reinforced by a new wave of all-electric and plug-in hybrid models, as well as necessity for many manufacturers to sell them in volume to meet stricter emission requirements. A near-record 74.663 new passenger plug-in cars were sold; 121 % more than a year ago and the first three-digit growth rate since 2015! Because the overall market declined by 7 %, the plug-in market share is now at a record high at 6.6 %, compared to 3.6 % for the 12-months of 2019. Currently, all-electric cars stand for 52 % of total plug-in sales (compared to roughly two-thirds in 12-months of 2019). That’s because plug-in hybrids rebounded and are growing much quicker, by 174 % year-over-year, compared to 89 % in the case of all-electric cars. The model rank is quite interesting from the start of the year as there are many changes to what we saw in 2019. First of all, the Renault Zoe set its new record of 9.782 sakes and was followed by another French model, the Peugeot e-208 (3.897). It’s great to see that European consumers are so interested in small electric cars. Then we see 3 well-known nameplates: outgoing, but at the same time experiencing a second youth Volkswagen e-Golf (3.296), Nissan Leaf (3.177) and Mitsubishi Outlander PHEV (3.149). The biggest gain among manufacturers seems to be achieved by the PSA Group, which sold more than 12.000 plug-ins in January. PSA never was at 1.000, which clearly shows how much can change when big OEMs finally launch an EV offensive. +++

+++ FISKER was supposed to introduce the Ocean electric SUV to Euro crowds this week at the Geneva Motor Show, but that’s obviously not going to happen anymore. Despite the setback caused by the Coronavirus outbreak on the Old Continent, Fisker has published new assets about what it refers to as “the world’s most sustainable vehicle”. Not only has the company shared fresh images, but also a first-ever video showing the Ocean in motion. The zero-emissions SUV appears to be in the company of an Alfa Romeo Giulia in Italy at the Varano de’ Melegari track in Parma. Accompanying the driving footage are new technical details about the fully electric vehicle, namely the multi-link rear suspension promising to provide a “supreme balance” between sportiness and comfort. Speaking of comfort, the entire rear suspension is mounted on an isolated subframe to diminish the amount of noise and vibration that goes inside the cabin. The adjacent press release goes on to mention the new electric SUV from Fisker benefits from active aerodynamics as the amount of air sent to the cooling radiator is automatically regulated by a computer. Underneath the skin, the battery pack benefits from extra protection in the event of a side impact, and there are additional reinforcements to the body structure to protect the driver and passengers in a crash. As you probably have heard by now, the Fisker Ocean is 4.640 mm long, about the same length as an Audi Q5, and offers a generous 708 litres of cargo volume provided you take off the parcel shelf. It’ll be a piece of cake to load and unload longer items as the rear glass can be lowered without having to open the hatch. Even without removing the parcel shelf, the cargo area will still be able to swallow 566 litres of your stuff. As a refresher, the standard model will offer 306 hp, but a high-performance version with more power is due to be revealed sometime next year with a 0 to 100 km/h sprint time in 3 seconds. While Fisker estimates the standard Ocean will do more than 480 km on a single charge, we’ll have to patiently wait for the WLTP numbers for the Euro-spec version of the electric SUV. Even though the Fisker Ocean has been revealed pretty much in full, it’s not scheduled to go into production until the 4th quarter of 2021. It means customer deliveries in larger volumes are slated for 2022, with the company estimated to produce more than 1 million examples until 2027. Meanwhile, the company is accepting reservations in exchange for $250 regardless if you go for the full purchase option or a lease program. Details about European pricing are not available at the moment of writing, but Fisker says it will be “adjusted according to each country’s respective import taxes, incentives and other factors. Exact pricing will be announced closer to launch”. +++

+++ GEELY said it is investing $326 million in a new satellite manufacturing plant in China, where it plans to build low-orbit satellites to provide more accurate data for self-driving cars. Geely, one of China’s most internationally known companies due to its ownership of Volvo and investments in Daimler and Proton, is building the facilities in Taizhou, where it has car plants. The company aims to produce 500 satellites a year by about 2025, when it expects its cars will have more functions to connect to the satellites. Geely’s technology development arm, Geely Technology Group, launched Geespace to research, launch, and operate low-orbit satellites in 2018. Around 300 highly skilled staff are working on the project, Geely said. Geespace will begin the launch of its commercial low-orbit satellite network by the end of this year, Geely said. The company said low-orbit satellites would offer high speed internet connectivity, precise navigation, and cloud computing capabilities to cars with autonomous-driving technology. They will also meet demand for high-speed connectivity capabilities that can deliver fast software updates to vehicles. Geely, which sold 2.18 million cars last year, is among global automakers from Tesla to Toyota racing to pursue self-driving technologies. +++

+++ In GERMANY , new electric models will help BMW and Daimler cut emissions from the cars they sell by an average of 20 % this year, the automakers predicted as they strive to meet tough new European pollution rules. In a live-streamed event, following the cancellation of this week’s Geneva motor show due to the corona virus epidemic, BMW presented the i4 4-door coupe with a driving range of up to 600 km, one of a number of new electric models it hopes will stimulate demand for battery-driven cars. In a separate webcast, Mercedes-Benz owner Daimler was also bullish about prospects for its growing range of electric cars. The European Union set automakers a target to cut carbon dioxide (CO2) emissions by 40 % between 2007 and 2021 and has demanded a further 37.5 % reduction by 2030. But pollution levels from cars have been rising as customers increasingly chose to buy gas-guzzling SUVs, meaning automakers need to ramp up sales of electric cars if they are to avoid hefty fines from 2021. They have a mountain to climb. Average fleet emissions for cars in Europe rose for the third year in a row in 2019, with electric vehicles making up only 6 % of overall registrations, analysts at JATO Dynamics said. BMW already has 500.000 electric and hybrid cars on the road and plans to double that number by the end of next year, including through the launch of the i4 and an iX3 as well as an electric version of its Mini. Sales of battery electric and hybrid vehicles are already up by 43 % so far this year, BMW chief executive Oliver Zipse said. “We believe that we can keep the impact on profits under control”, he added, pledging that every car sold would be profitable. Electric cars are generally more expensive to build than petrol or diesel-powered vehicles. But BMW said it was saving money, including by delaying the development of a next-generation Mini, to free up resources for the electric campaign. “If a vehicle architecture does not need to be renewed, then we do not do it”, Zipse said, adding the Mini was being renewed constantly by updating the powertrain and infotainment options. Around 7.000 electric Mini’s have been ordered so far, he added. Daimler, meanwhile, is promoting hybrid cars including a new CLA Shooting Brake, as well as the Mercedes-Benz EQ C and an electric van, the V-class, as part of its drive to reduce emissions by 20 % this year. “We are within striking distance of meeting the target”, chief executive Ola Källenius said. Mercedes-Benz plans to build 50.000 EQ C vehicles this year. Källenius declined to comment on the profitability of electric vehicles. “We don’t communicate individual margins. Electrification is a headwind”. he said. Separately, Volkswagen announced the launch of the ID.4, a fully electric SUV with an operating range of up to 500 kilometers, which will go on sale in Europe, China and the United States, and start production this year. Carmakers are under pressure in Europe to sell more electric cars or face huge fines for breaching new emissions rules aimed at tackling global warming. The European Union set automakers a target to cut carbon dioxide emissions by 40 % between 2007 and 2021, but they are collectively far short of this goal due to the popularity among drivers of heavy, polluting models such as SUVs. EU lawmakers also agreed in December 2018 a further cut in CO2 emissions from cars of 37.5 % by 2030 compared with 2021 levels, raising the bar just as the fines from the previous target are about to kick in. Electric cars failed to gain traction in Europe so far because they take longer to recharge compared with the roughly 3 minutes needed fill up a petrol or diesel tank, although the exact time depends on the type of charger and the vehicle. Many countries have also been slow to roll-out charging points. According to Volkswagen’s subsidiary Electrify America, a 240 volt charger can add 30 to 50 km of driving range in an hour, depending on the capability of the vehicle, and a direct current fast charger takes between 5 and 30 minutes to add 160 km of range. EU lawmakers have set a general target that emissions from all new cars sold by an automaker should on average not exceed 95 grams of CO2 per kilometer by 2021. However, the target for individuals carmakers varies because it takes into account the starting weight of each companies’ fleet in the base year of 2007. Manufacturers with fewer than 300.000 new passenger car registrations in a given year will also be able to apply for exemptions, according to the European Commission’s website here Manufacturers will face a penalty of €95 for each gram of excess CO2 they emit compared with their individual targets. Evercore ISI analysts estimate carmakers face up to a combined €33 billion in fines based on reported CO2 emissions levels in 2018. Analysts at PA Consulting estimate fines for individual carmakers would have been as follows, based on 2018 fleet emissions. The actual penalties are likely to be lower as carmakers sought to sell more hybrid and electric cars in 2019. Fitting more electric components will cost carmakers between €800 and €5.000 per vehicle to ensure compliance with 2021 targets, Evercore ISI say. Mild hybrid systems (where electric motors are used to assist a combustion engine) give rise to an additional cost of between €800 and €1.200 per vehicle, while plug-in hybrids (where the electric motor can take over) add €2.000 to €5,000. Until now, the auto industry has relied on profits between €500 and €1.500 per vehicle in the mass market and between €2.000 and €5.000 for a premium vehicle. Reasons include a lack of charging infrastructure, a threat to employment in the industry and uncertainty over levels of customer demand. Three quarters of all charging points in Europe are located in 4 countries that only cover 26 % of the continent’s total area, the European Automobile Manufacturers’ Association (ACEA) says. Out of the 144.000 charging points available across the EU, more than 26 % are in the Netherlands, 19 % in Germany, 17 % in France and 13 % in the United Kingdom, according to ACEA’s website. Germany’s auto industry association VDA has said a ban on combustion engine vehicles in 2030 would threaten more than 600.000 German industrial jobs, of which 436.000 are at car companies and their suppliers. Jobs will disappear because it takes less time to build an electric car than a conventional one. A combustion engined car has 1.400 components in the motor, exhaust system and transmission. An electric car’s battery and motor has only 200 components, according to analysts at ING. In Europe, there are about 126 plants making combustion engines, employing 112.000 people. The largest is Volkswagen’s factory in Kassel, Germany. A shift to plug-in hybrid cars would help to protect jobs since they take 50 % more time, or up to 9 hours longer, to make than cars with only a combustion engine. But pure electric cars are much less complex. For example, while a Volkswagen Golf has around 50 ball bearings, the electric Chevrolet Bolt has only 6. The drive to sell more electric vehicles, which has increased the industry’s reliance on Asian battery cell makers, has led to supply bottlenecks even before measures to contain the coronavirus caused further supplychain disruptions. Audi has had to slow down production of electric cars at its plant in Brussels due to a battery cell shortage. Volvo and Volkswagen may also face challenges after battery supplier Samsung SDI issued a profit warning due to the coronavirus outbreak. “We have flown parts in suitcases from China to the UK”, Jaguar Land Rover chief executive Ralf Speth said last month, as Britain’s biggest carmaker warned of the impact of the virus on supply chains. The Volkswagen Group said in March 2019 it planned to launch almost 70 new electric models by 2028. BMW has said it plans to offer 25 electrified models by 2023, with more than half being fully electric and expects their sales to rise on average by 30 % a year until 2025. Fiat Chrysler Automobiles plans to offer 12 electrified models by 2021, including both hybrid and full electric vehicles of all types. Ferrari has said it plans to have “a full hybrid range” by 2021 and wants 60 % of its cars sold by 2022 to be hybrids, but will not release a fully electric model until after 2025. +++

+++ Nissan’s lawsuit in Lebanon against former CEO Carlos GHOSN over his use of a Beirut home will wrap up at the end of March, the carmaker’s lawyer told. The Japanese auto giant filed a case 15 months ago against Ghosn on the grounds he was illegally using a large residence paid for by Nissan in central Beirut. Nissan lawyer Sakher al-Hashem said the car manufacturer wants Ghosn, who has been living it since he jumped bail in Japan and took refuge in Lebanon, to vacate the house. A hearing was held and the next, which Hashem said would the last before a ruling, was scheduled for March 30 by a Beirut court. A judge last month rejected Ghosn’s request to have security guards stationed outside his residence by Nissan removed. Ghosn considers he is the rightful owner of the distinctive house with pink walls and pale blue shutters, located on an upmarket street of the capital. The former head of the Nissan-Renault-Mitsubishi alliance fled Japan, where he faces several years in jail on charges of financial misconduct, late last year. He reached Lebanon in mysterious circumstances and has rarely been seen in public since launching a spirited defence at a well-choreographed January 8 press conference. +++

+++ Peugeot chief executive Carlos Tavares said the French carmaker would adjust its partnership with China’s HUAWEI if authorities in the United States make it a precondition for approving a merger with Fiat Chrysler Automobiles (FCA). Peugeot needs the consent of U.S. authorities to complete a $50 billion merger with FCA at a time when Washington is urging its European allies to exclude Huawei from the continent’s telecoms infrastructure. “We have a partnership with Huawei, which is linked with another partnership with French telecom company Orange, we are not in direct relationship with them. But of course on this matter, we will listen to the American authorities and of course we will follow all their instructions”, Tavares told a conference call. “If there was any question or any guidance from the American authorities, we would be eager to follow them”, Tavares said. So far, France has ruled out discriminating against Huawei as a vendor for the country’s 5G networks. Peugeot in 2017 partnered with Huawei to develop a cloud-based connected vehicle system which has been deployed on six million cars in Europe and China. +++

+++ Didier LEROY , the French chief competitive officer at Toyota, is stepping back from his role as the top non-Japanese executive at the automaker. Under a management shuffle, Leroy will resign his post as executive vice president effective April 1 but continue to serve on Toyota’s board of directors. Leroy will also remain chairman of the Toyota’s European operations. Leroy, 62, however, will hand off his duties as chief competitive office, a position he has held since 2016, as well as those as president of business planning and operations. Leroy’s broad portfolio made him one of Toyota’s most influential executives, earning him a place among the so-called Seven Samurai, a group of President Akio Toyoda’s closest confidants. An engineer by training, Leroy started his career at Renault and joined Toyota in 1998. Shigeki Terashi, another of Toyoda’s 7 Samurai, will assume Leroy’s work as chief competitive officer in addition to his current role overseeing Toyota’s zero emissions car strategy. The change was part of a wider management overhaul Toyota said was meant to keep the company nimble and responsive in an era of rapid change sweeping the auto industry. Chief among the changes is the elimination of executive vice president positions and their consolidation into a broad lower tier of operating officer positions. In a statement announcing the shift, Toyoda said the flattening of the management hierarchy aimed to give younger generations more visibility, opportunity and interaction with the top. Toyota named Kenta Kon as its next chief financial officer and said it would scrap executive vice president roles as part of a drive to streamline the company’s structure, improve production systems and cut costs. Kon, who is currently chief accounting officer, will take on the company’s No. 2 position in April, the Japanese automaker said in a statement. Under the new structure, Toyota said it would scrap its 6 executive vice president positions, first introduced at the company in 1982, with current roles becoming chief operating officer responsibilities. 4 of the 6 will largely keep their existing roles without the title. It is the latest in a series of structural changes at Toyota, one of the world’s largest automakers, which is trying to simplify its operations to become more nimble to compete with rivals in developing electric vehicles, self-driving cars and other new technologies. “I have judged that it is necessary for me to directly communicate with the leaders of the next generation and to increase the amount of time for sharing our concerns, by further reducing the number of layers of management”, Toyoda said. Current CFO Koji Kobayashi will keep his role as chief risk officer. +++

+++ The Financial Services Agency said it ordered NISSAN to pay ¥2.42 billion ($22 million) in fines for underreporting the remuneration of former chairman Carlos Ghosn and other executives for years. The fine is the second-highest imposed by the FSA. The heaviest fine, ¥7.37 billion, was imposed on Toshiba in 2015 for falsification of financial reports. The penalty, recommended by the Securities and Exchange Surveillance Commission, was initially expected to reach ¥4 billion, based on the amount of pay left out of the documents Nissan submitted, but the automaker asked the watchdog for a reduction as it reported the matter before the investigation got fully underway. The SESC accepted Nissan’s request. Nissan said the same day it will “take the decision sincerely”. The fine addresses the company’s underreporting of executive remuneration over the four years through March 2018, for which the statute of limitations has not expired. The SESC recommended the fine in December after filing a criminal complaint against both the automaker and Ghosn in 2018. The securities watchdog alleged they violated the financial instruments law by underreporting Ghosn’s pay package by around ¥9.1 billion in the 8 years through March 2018. But the former chairman jumped bail and fled to Lebanon in late December while awaiting trial on charges of underreporting of his remuneration and misusing company funds. He has denied all charges. +++

+++ PEUGEOT boss Jean-Phillipe Imparato has confirmed that there’s plenty of life left in its 108 (with an all-electric replacement a possibility) while larger models would be something he’s interested in once parent brand PSA’s merger with FCA is complete. With some car makers already sounding the death knell for city cars, Imparato has said that his company will maintain production of its 108. Imparato said: “We decided some weeks ago that we will maintain the 108 in our line-up. Why? Because this car has reasonable success and because it’s important. However, I don’t want to lose money on any car in my line-up and I’m trying to protect the residual value of my cars at Peugeot. So we will maintain the 108 until the customer tells us ‘No guys, we don’t want it any more’ ”. While city cars are set to disappear from some makers’ line-ups in the quest to cut average CO2 figures, Peugeot doesn’t have that problem. “At the moment we’re at a very positive CO2 level and we don’t have to struggle in terms of CO2”, said Imparato. “Even if this segment isn’t completely aligned with the CO2 offensive we are doing, if the customer wants the car, for the moment, we will continue with the 108 in the market that wants this type of mobility. If one day we have a huge question to face in terms of CO2 we take some other decision, but for the moment the market is asking for the car”. Imparato also hinted that the next generation of 108 would have to be electrified. “If it was to be replaced one day, I don’t see any other solution than 100 % EV”. A new 108 wouldn’t, however, share anything with the recently revealed Citroen Ami electric city car, with Imparato saying: “It’s cool, isn’t it? Ami is not a car, it’s a device! For my colleagues in Citroen it’s the right way to go. We are sharing a common vision in terms of PSA group, but each brand is writing its own story. Will we do something around that? It’s not something for Peugeot on my plan”. It’s possible that a new 108 could share a platform with the new Fiat 500 Electric, when the PSA/FCA merger is completed, however Imperato made it clear that no discussions on technology sharing are going on until the merger is completed. “I’m not studying anything around the platforms of FCA; we’re in a period of merger of the operations and at that time it’s forbidden to study anything during the merger. I’m happy to discuss after the closing of the deal”. However, Imparato did hint that larger Peugeot models sitting above the 508 (which sits on the largest version of PSA’s EMP2 platform) could be a possibility using FCA tech when the deal is completed by 2021. Asked specifically if larger cars were part of his plan, he said, “In terms of intention we will validate the upmarket move of the brand Peugeot, my global upper level mix is super-high, I’m selling 50 % of GT-line versions of my cars at the moment. “The answer is starting to tell us that Peugeot can compete against others. I’m waiting for 2022 to have this sensation, especially in the B-segment and the D-segment, then obviously I will open the question box. “If this upmarket movement is confirmed, therefore Peugeot would be interested in some other cars, but it’s another story in 2021”. +++

+++ POLESTAR has hired a former Volkswagen Group senior sales executive as its China president, as the Gothenburg-based automaker accelerates a sales push in the world’s biggest auto market. The move comes as the brand ramps up production ahead of the start of deliveries of its 2 full-electric car later this year in China, where its main rivals include Tesla, Nio and BMW. Polestar became an independent electric car brand in 2017 with capital investment from Geely and Volvo, both controlled by the Zhejiang Geely Holding Group. Polestar China’s new president is Gao Hong, who at Volkswagen (the biggest foreign automaker in China with annual deliveries of around 4 million vehicles) oversaw sales of Volkswagen Group brands including VW, Audi, Skoda and Bentley. Polestar aims to expand sales channels in China, where it currently has just 2 showrooms, dubbed Polestar Spaces. The brand, which is adopting a direct-sales model, will build showrooms with new and existing Volvo sales partners, a person with direct knowledge of the matter told. The automaker builds cars at a factory in Chengdu and plans to share a production line with Volvo and Geely in Taizhou. Polestar started delivering a hybrid sports car 1 last year and will begin deliveries of the mass-market 2 later this year. The starting price for 2 will be 298,000 yuan before subsidies. By comparison, the starting price of Tesla’s China-made Model 3 is now at 299,050 yuan after subsidies. Polestar is also introducing a new concept, the Precept, that signals future styling, autonomous technology, sustainable materials and connectivity. Geely’s listed unit, Geely Automobile Holdings, said it and Volvo planned to merge and list in Hong Kong and possibly Stockholm. The new entity would include Polestar, Lynk & Co and new energy brand Geometry. +++

+++ An all-electric PORSCHE 911 will not be produced before 2030 at the earliest, according to Porsche sports cars line director Frank-Steffen Walliser. “The 911 will be the last Porsche to become electric”, he told, “coming hopefully after my retirement so I’m not responsible any more and no one can blame me. I will fight to let the 911 keep its gasoline engine”. He also distanced himself from recent speculation that a hybrid version of the 911 is waiting in the wings. “It’s really difficult to do with the 911 and the way it is packaged. We want to keep it as a 2+2, we want to keep decent trunk space and we don’t want to destroy the shape of the 911. Also, I am not ready to put that amount of additional weight into the car. If you wanted to make such a car, it would be easier to make a completely new car”. Given the 7-year model cycle of each 911, this implies that a hybrid version will not be introduced before 2026 at the earliest. More immediately, Walliser is intent on turning around the reputation of the just-launched flagship 911 Turbo S as being the fastest but not the most enjoyable of the 911 range. “We are aware of the feedback and have taken steps to address it”. As a result, and in addition to the extra power of the new model, its lowered suspension and stiffer springs, Porsche will later this year introduce as an option a new lightweight version. “It will be a package the customer can choose, made up of some our lightest parts and also looking at areas like sound insulation. It’s a number of small bits and pieces but together they add up”, Walliser said. Asked if that included measures like removing the rear seats and replacing the glass with polycarbonate, Walliser said: “We are going in that direction”. The lightweight package will also be available on more affordable Carrera and Carrera S models, which may well preclude the need for a T version later in the lifecycle. Walliser insisted that the Carrera T version of the 911 was well received but that it didn’t spend sufficiently long enough in the marketplace for Porsche to know for sure whether it should become a permanent fixture of the range. He also ended speculation that the new GT3, likely to be unveiled this time next year, will use a more highly tuned version of the brand-new 4.0-litre engine created for the 718 Cayman GT4 and Boxster Spyder. “The answer is ‘no’. We stick with the race engine”, he said. “It’s expensive but we develop it on the track and learn more with every passing race. That is the way we will continue”. Nor can he see a role for the 4.0-litre in other versions of the current, 992-generation 911, including the GTS, which will continue in very much the same vein as the previous model and not be dramatically differentiated from lesser 911s, as has now been done in the 718 range by using the 4.0-litre 6-cylinder motor in the Boxster GTS and Cayman GTS. Walliser said: “There has to be a business case to do it and sadly we cannot see what that is at present”. Porsche has no desire to follow the array of electric hypercars with 4-figure power outputs into the market, according to the brand’s design chief. Michael Mauer expressed that he has other ideas about what is important for enthusiasts. “I think now it is so challenging with the weight of batteries to find the best compromise of performance, drivability and lower weight”, he said. “These hypercars are not only heavy, they are very much driven by aerodynamics, so they end up looking very similar. There is also the fact that with an EV, the engine power and character is not a big deal any more, and therefore I would love to do something different. “What I personally find very challenging is not to have another hypercar with 2.000 hp, but for the Porsche brand to look into something smaller, something lighter, with more of a drivability focus”. The comments reinforce an Autocar report from last November that plans to launch a pure-EV hypercar to succeed the 918 Spyder had been wound back as solid-state battery technology has not progressed as quickly as hoped. It is believed instead that Porsche engineers are pursuing a plug-in hybrid drivetrain originally developed by its motorsport division for an aborted return to the Formula 1 grid as an engine supplier. Such a powertrain should give it the engineering integrity, performance and character to compete head-on with other motorsport-inspired hypercars such as the Aston Martin Valkyrie and Mercedes-AMG One. Talking more widely about EVs, Mauer predicted that as the demand for aerodynamic performance increases to boost electric range, we would see “much smaller cars, lower cars, more efficient aerodynamics”. “You can question how long this hype of SUVs will continue”, Mauer continued, citing the upcoming Taycan Cross Turismo as an example of a car that offers SUV versatility in a lower, more range-friendly shape. +++

+++ The PSA Group has met its EU CO2 emissions target so far this year, helped by strong sales of diesel cars and low emissions electrified vehicles. “We said that being compliant on CO2 in Europe is a must for PSA and we have been delivering this on a monthly basis. We achieved this in January and in February”, CEO Carlos Tavares said. Strong sales of full-electric and plug-in hybrid cars are helping to keep down PSA’s CO2 average, Tavares said in a web conference call that took place instead of interviews with journalists at the canceled Geneva auto show. Tavares said that PSA was able to be compliant so far with its CO2 target of 93 g/km because sales of low emissions vehicles (LEVs), an EU definition that includes battery-powered models and plug-ins, currently account for 6 % of the automaker’s sales in Europe. 2 years ago, Tavares predicted that PSA would need 7 % of its sales to be LEVs to stay in line with its EU target. “A 7 % rate was needed in a worst-case scenario of the diesel share in Europe collapsing to 10 %. Our diesel sales have stabilized at about 30 % so we are compliant with sales of LEVs of about 6 %”, Tavares said. PSA currently sells 4 battery-electric cars, including the electric versions of the Peugeot 208 and Opel Corsa, and 6 plug-in hybrids. Tavares said that penetration of LEV variants in model lines that have them range from 10 % to 20 %. As part of the European Union’s efforts to combat climate change, PSA must cut its fleet CO2 emissions to 91.6 grams per km by 2021 or face fines. Automakers will struggle to meet their targets because of falling sales of diesel cars, which emit less CO2 than gasoline cars, analysts say. PA Consulting predicts that PSA’s emissions in 2021 will fall 4 gram short of its target, leaving the automaker facing a €938 million fine. Separately, the new CEO of PSA’s upscale DS brand, Beatrice Foucher, said that 30 % of sales of the 7 Crossback are plug in hybrids and 18 % of sales of the the 3 Crossback are the full-electric E-Tense version. +++

+++ Most automakers decided to go through with their scheduled debuts, even though the Geneva Motor Show got canceled. TOYOTA however had a sudden change of heart and postponed the unveiling of its new small SUV by “weeks or months”. The Japanese automaker was supposed to reveal the B-segment crossover at the Geneva show, but in the wake of the event’s cancelation, it decided not to stage a digital unveiling this week. Toyota’s move contrasts with most other automakers’ decisions to present their new cars via livestreams. In all fairness, Toyota had already reduced its Geneva activities after moving its traditional media event from the eve of the show to January. At the beginning of the year, the carmaker showed in Amsterdam the second-generation Mirai fuel-cell sedan, RAV4 plug-in hybrid and the all-electric Lexus UX 300e. The company had saved the small SUV for Geneva, but given the show’s cancellation, it sees no reason to rush with the unveiling, especially since the B-segment crossover will not go on sale until March 2021. When it arrives in European dealerships, the as-of-yet unnamed crossover will offer a variant of the 3-cylinder gasoline-electric full-hybrid setup used in the new Yaris. Toyota will offer the small SUV with 4-wheeldrive, something that’s very rare in the segment. Both the Yaris and the upcoming crossover share the same GA-B platform and will be built at Toyota’s factory in Valenciennes, France. The carmaker expects these 2 models to make up about 30 % of its sales volume in Europe by 2025. +++

+++ PSA boss Carlos Tavares remains “eager to invest” in VAUXHALL ’s Ellesmere Port factory should a suitable business case be made for it off the back of UK-EU trade deal talks. However, should tariffs be imposed on cars or car parts then Tavares said the UK government would need to make the investment as it “would not be ethical” for PSA’s employees at profitable factories outside the UK to be paying for an arrears at Ellesmere Port, where the Opel Astra is built, just to keep it running. To that end, Tavares repeated his call for a free trade deal between the EU and UK. “If conditions of trade are positive and there are no tariffs, then most of the investment would be made by PSA”, he said. “We don’t want to be a burden and want to bring wealth and value. But it is fair to ask the UK to create the business for this to fly”. Tavares said PSA “respected and loved” its workers at Ellesmere Port, “but it was also time for the UK government to respect and love its people and support them. We’re trying to support them and we’re really crossing fingers for good sense to prevail”. A decision on whether or not Ellesmere Port will be 1 of 2 plants to build the next-generation Opel Astra hinges on the outcome of these trade talks. Tavares said he was very happy with the overall performance of the Opel / Vauxhall business, and it had generated €1.1 billion of profits last year at a margin of 6.5 %. “I express thanks to and appreciate the efforts of all employees”, said Tavares. On PSA’s wider production in general, Tavares said he hoped the firms plants in China could reopen on March 11 following government clearance after shutdowns caused by the corona virus. For its European operations, some 300 of its 8000 suppliers come from China, and Tavares said that the firm was “looking at alternatives and so far have been successful”. While production was holding up, keeping up consumer confidence to ensure demand remains would be the next phase of what the coronavirus brings, said Tavares. +++

+++ China is transferring tens of thousands of Uighur detainees out of internment camps and into factories that supply some of the world’s leading brands, an Australian think tank said. Top global brands such as Apple, BMW, Sony and VOLKSWAGEN have been accused of getting supplies from factories using the forced labor, an explosive allegation that could reverberate in boardrooms across the world. The Australian Strategic Policy Institute said the Chinese government has transferred 80.000 or more Uighurs out of camps in Xinjiang and into factories across the country. “Uighurs are working in factories that are in the supply chains of at least 83 well known global brands in the technology, clothing and automotive sectors”, the think tank said. “Some factories across China are using forced Uighur labor under a state-sponsored labour transfer scheme that is tainting the global supply chain”. The brands, it added, included “Apple, BMW, Gap, Huawei, Nike, Samsung, Sony and Volkswagen”. “Companies using forced Uighur labour in their supply chains could find themselves in breach of laws which prohibit the importation of goods made with forced labour or mandate disclosure of forced labor supply chain risks”, the report said. “The companies listed in this report should conduct immediate and thorough human rights due diligence on their factory labour in China, including robust and independent social audits and inspections”. AFP has contacted the firms for a response to the claims. An estimated 1 million mostly Muslim ethnic minorities have been held in internment camps in Xinjiang. After initially denying their existence, Beijing cast the facilities as “vocational education centers” where “students” learn Mandarin and job skills in an effort to steer them away from religious extremism, terrorism and separatism. Rights groups and witnesses accuse China of forcibly trying to draw Uighurs away from their Islamic customs and integrate them into the majority Han culture. Officially, the Chinese government says it is transferring “surplus” Xinjiang labour to other regions in the name of poverty alleviation. According to official news agency Xinhua, more than 25,000 workers from Xinjiang were slated to be transferred “inland” in 2019. China’s foreign ministry and the Xinjiang government did not immediately respond to requests for comment on the report. +++