+++ ALFA ROMEO has posted dramatic sales increases in each of its core markets in the first half of 2023, hailing the uptick as a “consolidation of clear, steady growth”. While the Italian brand acknowledged that “2023 is proving to be complex and full of global variables that pose a challenge”, it boosted registrations significantly in Europe, China, the Middle East and Africa for a global hike of 57%. Sales in Europe, most notably, doubled year on year. Alfa Romeo hasn’t published a detailed breakdown of sales per model, but the introduction of the new Tonale will have made a sizeable contribution to that increase. Meanwhile, in China (an increasingly important market for Alfa Romeo as it looks to cement its positioning as a premium brand in the vein of BMW and Mercedes-Benz) it’s also enjoying a resurgence, recording a 35% increase in Giulia saloon sales from January to June and a 94% overall sales increase in May alone. As testament to the Asian market’s importance to Alfa Romeo, the brand recently revealed the updated Giulia and Stelvio in China and has opened a new flagship dealership in Hong Kong. Alfa Romeo also highlighted that sales in the Middle East and Africa were up by a massive 173%, pointing to Turkey in particular as “the global leader in terms of volume growth rate”. Its performance in the UAE (a crucial market for premium brands) was promising too, with sales rising 37%. CEO Jean-Philippe Imparato said: “The results for the first half of the year vindicates the work done by the entire team. We’re achieving the goals we set for ourselves with great humility and self-sacrifice. The discipline with which we’re pursuing our strategy is based on the desire to establish ourselves as a leader in the premium sector in terms of quality, and the awards we’ve received are the proof of that. We’re therefore maintaining our passion and determination to ensure that 2023 ends with results that remain on track and become even better than an extremely positive first half of the year”. Alfa Romeo hasn’t given any indication of its first-half performance in the US, a market to which it returned just 6 years ago following a 22-year absence. In the first quarter of 2023, however, it sold just 2.390 cars Stateside; a 27% drop on the same period in 2022. Cracking North America is crucial to Alfa’s volume ambitions, and indeed it’s planning to launch a US-centric electric large saloon in 2027. +++

+++ ASTON MARTIN will introduce plug-in hybrid versions of each of its cars from 2024, using technology from stakeholder Mercedes-Benz. The Gaydon firm’s first PHEV is the Valhalla supercar, due in 2024, but following that will be electrified versions of each model in the ‘core’ line-up, currently comprising the Vantage, DB12, DBS and DBX. The news was confirmed as Aston Martin announced its medium-term product strategy, following a lucrative first half of 2023 in which it boosted revenues and profits substantially. In a statement accompanying the financial report, company chairman Lawrence Stroll announced: “Our electrification journey will start with Valhalla, our first PHEV supercar, and we plan to expand our PHEV range into our core vehicles, which will bridge the customer journey from ICE to full BEV”. Stroll later confirmed that this hybridisation strategy applies to all model lines and will be underpinned by electrified drivetrain technology supplied by Mercedes, which has provided engines and infotainment systems to Aston Martin since 2016. The Mercedes-derived V8 used by the Vantage, DB12 and DBX is already used as the basis of a hybrid system in the Mercedes-AMG GT 63 E-Performance and Mercedes-AMG S 63 E-Performance, and it is likely that Aston will deploy a variation of this set-up in its own PHEVs. Aston Martin, of course, is already using a version of this system in its maiden PHEV, the mid-engined Valhalla. In Mercedes-AMG’s super-hybrids, the twin-turbo 4.0-litre V8 is paired with an electric motor mounted on the rear axle for a combined output in the region of 800 hp and more than 1.300 Nm of torque. Lithium ion batteries mounted in the boot (13.1 kWh in the S 63 and 6.1 kWh in the GT 63) give electric-only ranges of 35 and 14 kilometers respectively, and Aston Martin will no doubt use different packs for each of its models, depending on their billing. The larger unit would make sense in the more luxury-focused DBX, for example, while the smaller, lighter battery might befit an electrified Vantage. The DB11 replacing DB12 will begin deliveries in the coming months, as the first of Aston’s 3 heavily overhauled front-engined sports cars. Replacements for the Vantage and DBS will follow within the next 15 months, Aston Martin bosses confirmed, and it is likely that PHEV technology will be rolled out to the line-up as part of that process. The DBX, meanwhile, is already available with a mild-hybrid straight-6 engine in China, but it will be the PHEV that marks the electrification of Aston’s SUV line in Europe. No timeframe was given for the arrival of the DBX PHEV, but given the SUV launched in early 2020, a hybrid could be expected to arrive as part of a facelift in 2024. +++

+++ GENERAL MOTORS lifted its full-year profit guidance on Tuesday, in large part because it plans to invest less in new products and cut operating costs by an additional $1 billion through the end of next year. GM said net income for the second quarter rose by nearly 52% to $2.6 billion, as revenue grew 25% from the year-ago period when production was hobbled by semiconductor shortages. The Detroit automaker said it now expects full-year net income of $9.3 billion to $10.7 billion, up from a previous forecast of $8.4 billion to $9.9 billion. The new outlook does not factor in the potential costs of a strike by the United Auto Workers union should it fail to reach a new contract with GM by the September 14 deadline. GM’s more bullish outlook comes after 6 months of stronger demand and richer pricing than expected earlier this year, chief financial officer Paul Jacobson said during a media conference call. GM’s higher profit outlook also reflects decisions to ratchet down spending. GM said it will spend $11 billion to $12 billion on capital investments this year, down from an earlier plan to spend $11 billion to $13 billion. Jacobson did not identify specific projects that would be cut. “There’s a lot of focus on winning with simplicity”, he said. The automaker said it also will expand a previously announced drive to cut operating costs by $2 billion through the end of 2024. GM will now target an additional $1 billion in overhead, marketing and other costs, Jacobson said. In contrast to Tesla CEO Elon Musk’s strategy of cutting prices to accelerate demand, GM pushed average transaction prices in North America up by $1.600 to about $52.000 in the latest quarter, Jacobson said. “We’re focused on profitability. Our recent results demonstrate that we’re not sacrificing margin for volume. We will continue this strategy to help drive a fundamentally stronger company beyond 2023”, he said. GM’s decisions to cut new product investment and operating costs come as the automaker’s profit margins are under pressure. GM’s pretax profit rose from a year earlier to 7.2% of revenue in the second quarter. But for the first 6 months of the year, GM’s pretax margins fell to 8.3% of revenue, down from 8.9% a year ago. GM’s second-quarter results included a $792 million charge for “new commercial agreements” with South Korean battery maker LG Energy Solution. GM said it has agreed to shoulder more of the costs for a recall of Chevrolet Bolt electric vehicles to replace LGES batteries that could catch on fire. Other agreements with LGES should result in lower battery costs for GM in the future, Jacobson said, without elaborating. In China, GM’s second-largest market, the automaker reported a profit of $78 million, reversing a year-ago loss. But GM is still earning far less than it once did in China as Chinese EV brands and Tesla gain market share. “The environment there remains challenging”, Jacobson said. “We saw the economic recovery slow down a little bit and a lot of price competition there”. GM increased its combustion vehicle sales by 38%, but petroleum-fueled vehicles are losing market share overall in China. +++

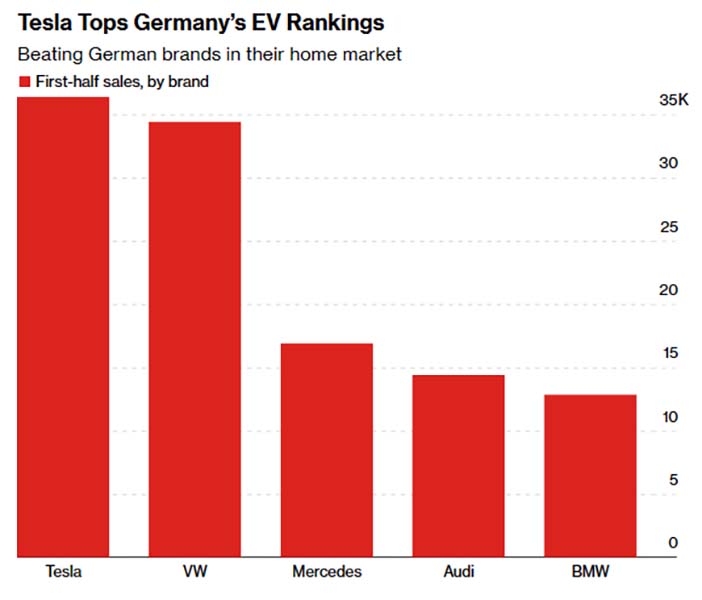

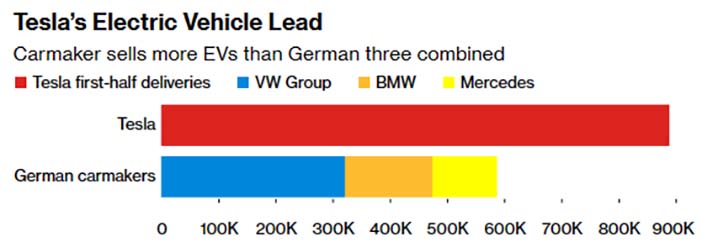

+++ GERMANY ’s automakers announced bold plans the past few years to shift to electric cars and challenge Tesla’s dominance. Instead, they’re only falling further behind. Tesla delivered almost 890.000 cars in the first half of this year, more electric vehicles than Volkswagen, BMW, Mercedes-Benz and Porsche combined. The Germans are struggling as software issues delay key models and contribute to waning sales in China, their biggest market, where Tesla and local champion BYD have raced ahead. They’re even playing second fiddle in their home market, where Tesla remains the top EV brand.

Investors will hear from 3 of the German companies this week, with Porsche reporting quarterly earnings Wednesday, followed by Mercedes and Volkswagen on Thursday. As Tesla pushes for more volume with aggressive price cuts, it’s dialing up the pressure on legacy manufacturers that are struggling to keep pace. Tesla’s EV sales increased 30 percentage points more than VW’s in the 3 months that ended in June, widening its lead. While the Germans are mired in difficult talks with unions about retooling their combustion-era production sites, Tesla plans to expand its German factory and is preparing to build a new plant in Mexico. “Tesla is still miles ahead of the German carmakers in all the major markets”, said Matthias Schmidt, an auto analyst based near Hamburg. “They’re under pressure to boost volumes to reach the kind of economies of scale needed to make EVs profitable”. Germany’s automakers thrived in the past because they perfected the production of vehicles running on gasoline and diesel, with hundreds of high-quality local parts makers supplying them with gearboxes, fuel injectors and crankshafts. Now that the battery is taking over, their “Vorsprung durch Technik” has evaporated. In Europe’s biggest economy, inflationary pressures, a dearth of skilled workers and high energy prices are adding to the structural challenges posed by the EV shift. German automakers’ expectations are at their worst since the 2008 financial crisis, according to a survey the Munich-based Ifo Institute published this month. The Germans’ biggest threat is their weakening position in China. VW, BMW and Mercedes dominated combustion-car sales in the world’s biggest auto market for decades, but recently have fallen behind Chinese brands that have been better at churning out affordable EVs with technology and software geared to local tastes. Mercedes slashed prices in China for its flagship electric sedan, the EQS, late last year after disappointing sales. VW, in particular, has come under pressure, with BYD outselling the company in China during the first quarter. The German manufacturer’s EV sales in China dipped in the first half in a market that grew 20%. EVs are expected to make up 90% of the Chinese market by 2030, adding urgency for the Germans to accelerate more competitive EV offerings. Europe’s biggest automaker last month replaced the CEO of Audi partly because it wants to halt the brand’s slide in the country. The current EV leaders in China “will tighten their grip on the market”, analysts from HSBC said in a report this month. “With the exception of Tesla, we think they will all be China EV brands”. All is not lost. Elon Musk has left open a window of opportunity for incumbents looking to catch up, having launched his last new passenger vehicle (the Model Y) in 2020. Tesla hasn’t redesigned the Model 3 since it went into production 6 years ago, though work on a refresh is underway. BYD meanwhile is steering clear of the U.S. market because of trade barriers, and several smaller Chinese EV startups may not survive the industry’s price war. The German companies still generate healthy profits selling combustion-engine models, including in China. Mercedes and BMW aren’t following Tesla out of premium price segments and are still roughly doubling EV sales, year-over-year. Plans by the Germans to introduce EV-focused platforms around the middle of the decade to lower the cost of their electric cars and equip them with new technology could alter the dynamic. VW is readying a compact EV priced at less than €27.500 (Dutch pricing; a people’s car for the electric age) that’s a couple of years away from production. Europe’s largest carmaker recently bolstered its rolling five-year spending plan to €180 billion, with more than two-thirds going to software and EVs. Its ID.7 sedan that will hit showrooms later this year comes with an augmented-reality display that beams information into the driver’s field of vision. Mercedes will introduce an electric version of its CLA in the US next year to better compete with Tesla’s Model 3, according to an Automotive News report. It’s also electrifying the iconic G-Wagon. BMW is betting that its “Neue Klasse” underpinnings, due to arrive around 2025, will help accelerate sales. The manufacturer aims to cut battery costs by half and increase range and charging speed 30% compared to current models. “The next-generation EV platforms from the Germans could change things”, said Bloomberg Intelligence analyst Michael Dean. “That’s when you’ll see a big push from them, also in China”. +++

+++ The investment in the reborn JAGUAR stands at around €2.6 billion, JLR’s chief financial officer Richard Molyneux has confirmed, and the firm is on course to launch its highly anticipated electric GT in 2025. Molyneux said that JLR’s total investment in the business will be €17.5 billion over the next 5 years, and as Jaguar is expected to make up around 15% of JLR’s future sales “the investment is proportionate” to that, resulting in that €2.6 billion figure. JLR CEO Adrian Mardell confirmed the plan was still to reveal the first new Jaguar in 2024 ahead of a 2025 launch, and while there was “work still to do”, the company is on track to deliver it. He said he is also comfortable for Jaguar to go it alone in developing a bespoke EV platform for Jaguar, despite Audi recently teaming up with Chinese company SAIC when faced with a similar challenge. He pointed to JLR’s access to technology within the Tata Group, and other partnerships with the likes of Nvidia on autonomous cars, as reasons why Jaguar was well placed with what it already had at its disposal. Jaguar’s new 4-door GT will be revealed in 2024 and go on sale in 2025 as the first of 3 models in the new Jaguar family. Each will be built on an all-new bespoke EV architecture called Jaguar Electrified Architecture (JEA). It will have a range of up to 700 km, a starting price in excess of €120.000, and is likely to have 2 motors for 4-wheeldrive and a power output in excess of 600 hp. The target time for charging is 320 kilometers of range in 15 minutes. Prototypes of the new GT will hit the road before the end of the year, ahead of its reveal in 2024. Virtual testing of the car is already almost complete ahead of this crucial next phase of its development, where the car will come to life for the first time. JLR’s chief creative officer Gerry McGovern said the styling of the GT and subsequent future Jaguars would be “the copy of nothing”, invoking the mantra and philosophy of Jaguar founder Sir William Lyons. He said it was an “honour” to be asked to lead the rebirth of “a brand as loved and cherished” as Jaguar and vowed to return it to its past positioning as a ‘true British luxury brand”. He referenced the E-Type and XJS as models that provided a blueprint (but not a retro copy) for how the reborn Jaguar would operate in creating shocking but beautiful designs and how the current Jaguar range was created under a different strategy that the brand would no longer be following. He said: “The E-Type in its time looked like it had dropped from space. The XJS was equally compelling and a copy of nothing. It started again and didn’t copy the E-Type. The designs of current Jaguars aren’t bad. The strategy was more one of universal appeal and chasing more mainstream premium, which made the cars more normal. We want to go back to the old philosophy. It’s a complete reimagining”. McGovern said the 4 pillars of future Jaguar design would be exuberance, fearlessness, uniqueness and progressiveness. “Being exuberant is a real task, as there’s nothing else around like that”, he added. “Jaguars need to have a jaw-dropping moment, a sense of wow”. The 3 new Jaguars are the result of an internal design competition that encompassed everyone in JLR’s creative team across all brands. The creative team was split into three teams as part of Project Renaissance, which McGovern believes will go down as a pivotal moment in Jaguar’s history, with each given the same brief to create a family of models for Jaguar’s future. A total of 18 cars were created as full-sized models in just 3 months across the teams, but the winning team accounted for just 3 of them. McGovern said the verdict on choosing this team’s design was “unanimous”. “There was no debate. We said ’that’s it’. We derived the design direction from there and evolved the designs from those 3 cars. The designs are at an advanced stage”. While the first model will shock, the second and third models will reinforce that design and the models will clearly all be part of the same family. The 2 cars to follow the GT, likely to be crossovers, will come at a rate of no more than 1 per year after the launch of the initial car. Volumes will be around 50.000 cars per year for the range as a whole. The cars will all be built at a new dedicated area within JLR’s Solihull production facility. Around 100 suppliers have already committed to the new Jaguar project, which isn’t just about creating new cars but also changing every part of the brand and how customers interact with it. “We’re creating an entirely new brand, new business models and new competencies, with every part of the client journey reimagined”, said chief commercial officer Lennard Hoornik. “The way cars are bought and are serviced, this is all being done from the ground up, including online and offline journeys”. This ground-up reinvention includes dealers and Hoornik said Jaguars “would not be available everywhere”, confirming reports that the firm is going to reduce the number of dealers selling its cars. “But equally, there will be a range of 3 other brands (Range Rover, Discovery and Defender), all electric and with dedicated areas”, he added, a reference to the fact the Land Rover brand would be taking a back seat, with Range Rover, Discovery and Defender becoming model ranges in their own right alongside Jaguar in a 4-strong line-up of JLR brands. Commenting on the relaunch of Jaguar, new JLR CEO Adrian Mardell said: “Jaguar will not disappoint. It will begin to put right unfinished business”. He said it wasn’t a “last chance” for the brand and that “this cat was going to purr”. “There are no such things”, he said on whether it was a last chance. “We create chances by what we deliver. I believe this brand will be here in 50 years”. McGovern doesn’t believe the new brand positioning for Jaguar will alienate existing customers, although he admitted there will always be those resistant to change. “Things have to move on, and we’re going to create such a compelling proposition that if there’s red blood in their body”, said McGovern on whether this new Jaguar would appeal to existing customers. “EV is a propulsion method, as is ICE. EV can be as compelling as long as you have everything else with it. It’s like with watches: when a new one comes out, you still prefer the old one, but over time you see what it’s about and you change your mind. “We respect existing customers, but we’re going after new ones as well, ones who think less about the vehicles and are more culturally driven, more artistic. When you go to something new, people look back, but that’s fine”. McGovern gave little away about the car’s design, but he said that going electric “opened up more space inside” and allowed for the “exuberant proportions”. Hoornik said the cars had “wowed” people in clinics and the firm had been “pleasantly surprised” as to how they had viewed the value proposition of the cars and the new brand. +++

+++ JAGUAR LAND ROVER (JLR) ’s financial recovery gathered pace after it boosted revenues, profits and orders in the first quarter of the 2023/24 financial year and posted its best-ever free cashflow in the period. Revenues stood at £6.9 billion in Q1, an increase of 57% year on year, while profits before tax and exceptional items were up nearly £1 billion on the previous year, at £435 million, giving an EBIT margin of 8.6%, up from 6.5% in the previous quarter. This was negative a year ago. The free cashflow for the quarter was £451 million, while net debt was down to £2.5 billion, as JLR worked towards its goal of being net cash-positive. “The good financial performance in the quarter reflects the strength of our luxury brands”, said Richard Molyneux, JLR’s recently appointed chief financial officer. JLR’s wholesales for the quarter were 93.253 units, a 30% rise year on year but a small decrease on the previous quarter; something that JLR said was down to shipping schedules. “However, total production was up by a quarter”, read a JLR statement. The firm noted an improvement in chip supply and other constraints and now sits on 185.000 orders; down from 200.000 at the end of the last quarter, which is “in line with expectations”. Of those orders, the Range Rover, Range Rover Sport and Land Rover Defender make up just over 75%. JLR said the new Range Rover Sport SV Edition One, which costs nearly £200.000 in its fully loaded guise, was already sold out ahead of its launch, a further indication of the ability of the company’s pricing to increase ever upwards. These are the first set of results since Adrian Mardell was confirmed as JLR’s permanent CEO, a title he held on an interim basis since last year. “I’m pleased to report a third consecutive quarter of strengthening financial performance for JLR”, said Mardell. “We’ve had a strong start to the financial year and delivered our highest production levels in nine quarters and our highest Q1 cashflow on record. “This is testament to the thousands of determined people in the business working tirelessly to deliver every aspect of our Reimagine strategy”. One of the first steps of that plan, which also includes a full reboot of the Jaguar brand, is an electric Range Rover, which remains on track to go on sale later this year ahead of deliveries in 2024. JLR expects its Q2 results to report lower production and cashflow numbers due to the summer shutdowns at its plants, but this shouldn’t impact profitability or wholesales. +++

+++ NISSAN and Renault on Wednesday finalized the terms of their revamped alliance, with the Japanese automaker committing to invest up to 600 million euros in its partner’s electric vehicle unit Ampere. The agreement to conclude the terms of their overhauled partnership will put the two automakers on more equal footing and caps months of sometimes tense negotiations over issues such as the sharing of future intellectual property. The investment in Ampere is consistent with Nissan being a strategic investor and securing a board seat on the new company. Sources have said Ampere could be valued at up to 10 billion euros. That would put Nissan’s investment of up to 600 million euros in Ampere at about 6%, lower than the 15% it had flagged as a maximum share in February. In a statement, Nissan chief executive Makoto Uchida said the Ampere investment “complements and strengthens Nissan’s ongoing electric push in Europe”. The companies said the overhaul was subject to regulatory approvals and completion was expected in the fourth quarter of 2023. With the agreement, Renault confirmed its commitment to reduce its stake in Nissan from around 43% by transferring 28.4% of its Nissan shares into a French trust, which would put the automakers on equal ground. The deal is part of the final considerations in a long-drawn-out re-establishing of the 2 firms’ relationship. +++

+++ U.S.-European carmaker STELLANTIS has reported a 37% boost in earnings in the first half of the year. The results Wednesday were driven by strong North America income and an increase in electric vehicle sales in Europe. Profit in the first 6 months of the year was 10.9 billion euros, or $12.07 billion, compared with 7.96 billion euros in the first half of 2022. The carmaker set record net revenue in the first six months of the year of 98.4 billion euros, up 12% over a year earlier. CEO Carlo Tavares called the first-half performance “outstanding”, saying that it “supports our long-term stability”. +++

+++ It’s sometimes not easy being an early adopter, especially when it comes to electric cars. More than a dozen TESLA owners detailed some of the biggest headaches, or surprise expenses they faced, when switching to owning the electric car. They shared their thoughts in a series of conversations, including adapting to range anxiety, higher insurance rates and dealing with issues at Tesla service centers. While many of the issues could apply to any electric car, some of them point to potential challenges with Tesla’s business model. Here are some of the issues Tesla owners say they’ve faced when they ditched their gas-powered vehicle for an electric one: 1) The tires on electric cars wear out faster. Some Tesla owners say their tires wear out a lot faster than previous ICE cars. Some Tesla owners said they were surprised when they had to replace their tires much sooner than with previous cars. EVs go through tires about 30% faster than traditional combustion-engine vehicles because they’re heavier due to their massive lithium-ion battery, according to Bridgestone. Typically electric car tires wear out between 10.000 to 20.000 miles. Though, Auto Trader editor Brian Moody told speeding and heavy braking accelerate the issue. 2) EV owners can also face higher insurance rates. Auto insurance for Teslas can be more expensive. Some Tesla owners said they were surprised when their insurance rates climbed after they bought their electric car. Previously, it was reported that EV owners typically face higher insurance bills in part because many electric cars are generally more expensive than gas-powered vehicles. Insurance companies also must weight the higher costs of potential damages to the vehicle’s pricey lithium-ion battery, as well as the lack of repair shops that are certified to work on the cars. Earlier this year, The New York Times reported that a Rivian owner was hit with a $42.000 repair bill after a fender bender. Eventually, the cost of insuring an EV is expected to drop as more people and companies transition to all-electric cars. 3) Some Tesla owners have horror stories about the company’s service centers. Over the years, some Tesla owners have complained about issues with the carmaker’s service centers, including long wait times, poor repairs, and exorbitant prices. Last year, Vox reported that Tesla owners had filed thousands of complaints about the company’s service centers. The complaints varied from concerns about available parts and unresponsive service centers to detailed complaints about Teslas that were returned in worse condition than when they went into the shops for repairs. More recently, a Model S owner filed a proposed class-action lawsuit against Tesla over the issue, claiming she’d suffered from Tesla’s “monopolization” of the repair market for its vehicles. She said Tesla had caused her to “suffer lengthy delays in repairing or maintaining” their electric vehicles, “only to pay supra competitive prices for those parts and repairs once they are finally provided”, according to the complaint. A spokesperson for Tesla did not respond to a request for comment regarding concerns about its service centers. Last year, Tesla CEO Elon Musk said the company is working on improving its service in North America. To date, Tesla has less than 200 service centers in the US. For comparison, GM or Ford owners can choose from thousands of independent repair and maintenance shops. “That’s one of my biggest complaints with Tesla”, Steve Almassy, a Model S owner since 2014, said, adding he still loves the car. “They’re getting better, but they still haven’t gotten their service model down to a good process. Unfortunately, they have a long way to go on that”. 4) Tesla door handles can be finicky and prone to breaking, owners say. Tesla’s signature sleek door handles can be a hassle at times, several owners told. From issues with getting the doors to open in freezing temperatures to door handles breaking off: some Tesla owners said the sleek door handles on the EVs can be a source of frustration. Multiple Tesla owners said the handles broke off in their hands on a few occasions. Robbie Mack, a former Tesla salesman and owner of a Model S said it was a common issue with earlier models of the company’s higher-end Model S vehicle that has since been resolved with the Model 3 and Model Y. Other owners said they’ve had trouble getting their phone to connect and open the doors using keyless entry. “It’d be raining, or you’re carrying groceries and you’re having to fiddle with your phone to get it to connect and unlock”, tech YouTuber Austin Evans previously told regarding the keyless entry on his Model Y. “It’s a great feature when it works, but you never know when it’s going to fail you”. Steven Elek, a senior automotive data analyst at Consumer Reports, said the publication has received multiple reports from owners regarding phone pairing issues with Teslas. 5) At-home chargers can add to the initial cost of buying an EV (anywhere from $250 to thousands of dollars). Some Tesla owners said they were surprised by the extra cost of setting up the system. Most cars come with a Level 2 charging cord which can plug into a 220 volt household outlet and slowly trickles electricity into a car’s battery, but it only adds a few miles an hour to the car’s battery life. Many drivers prefer faster methods. Setting up faster charging requires a certified electrician, as well as a home electrical assessment. Ken Sapp, senior vice president at Qmerit, previously told that most of his jobs cost about $1.600. 6) Some Tesla owners say they’ve noticed quality-control issues over the years. For Tesla owners, it’s apparently not uncommon for new vehicles to be returned to local service centers for small fixes upon delivery and Tesla owners have reported minor build issues with the EVs over the years, including poor paint jobs and panel alignment. John Brusniak said when he received his Model S in 2020, one of the doors wouldn’t close properly. “They’re just minor things and they fixed it all for free, but it just shows a lack of attention to detail that you wouldn’t expect for the money you’ve spent on the car”, he said. Chris Harto, a senior policy analyst at Consumer Reports, said the publication’s reliability survey for Tesla owners found that “paint and trim”, “noises and leaks” and “body hardware” are “common trouble spots for Tesla cars”. Tesla has long been known to have some issues with quality control, especially when new models are launched. In 2018, engineering consultant Sandy Munro said Tesla’s Model 3 had serious production flaws. “I can’t imagine how they released this”, Munro said at the time. In response, Musk admitted that the electric carmaker has had issues with quality control. In an interview with Munro, the Tesla CEO warned it might not be a good idea to buy a Tesla during a new model’s ramp-up period. 7) Tesla owners say they’re disappointed with the company’s Full Self-Driving software. Some Tesla owners who shelled out about $15.000, or $199 per month, for the Autopilot add-on say they wish they hadn’t. “FSD is kind of why I bought the car to begin with”, Brusniak told. “I paid extra for it, but I’m too scared to use it now because it has its own way of doing things. It’ll stop 50 yards from a red light or sometimes it’ll even seem to stop at random”. Tesla first released FSD in 2020 to select drivers, and since then, the software has been added to over 100.000 cars in the US. The feature enables Teslas to automatically change lanes, enter and exit highways, recognize stop signs and traffic lights, and park. The software is still in a beta testing and requires a licensed driver to monitor it at all times. Tesla drivers have posted YouTube videos of the buggy software in the past: from turning into oncoming traffic to apparently confusing Burger King signs and even the moon with stop signs and stop lights. Still, some beta testers say the software has improved over the years. Spokespeople for the company have not commented directly on concerns about FSD. Though, Musk has said feedback on the software is “welcome” and has encouraged users to report bugs in the program. 8) Teslas have been known to have apparent issues with phantom braking. Kala Taylor, a former Model S owner, said there were multiple instances when her vehicle would stop, seemingly at random, and it once tried to stop in the middle of a freeway while she was using Autopilot. “It was very scary and I never felt quite safe again driving it after that”, Taylor said. Last year, over 750 Tesla drivers reported instances of phantom braking and many of them said the issued typically occurred while using Tesla’s Autopilot driver assist feature, according to the National Highway Traffic Safety Administration. 9) On the other hand, some FSD enthusiasts say they wish the carmaker would allow FSD transfers to another Tesla. “Tesla gives you zero credit for FSD on a trade-in and doesn’t even let you transfer it over to you next Tesla”, said Nelson Jackson, a Model S owner and FSD user. “That’s a major flaw and huge deterrent when it comes to trading in the vehicle”. Musk temporarily addressed the gripe during the company’s earnings call. The billionaire said he would allow FSD users to transfer the software over for a limited time in next 3 months. “This is a one-time amnesty, so you need to take advantage of it in Q3”, he said. 10) When you buy a Tesla, you might actually want to read the instruction manual, owners say. There’s a learning curve when it comes to owning a Tesla, especially when it comes to the high-tech features in the car, several owners told. “Most people with an ICE vehicle don’t look at a manual because everything is pretty much the same across the board”, Almassy said, referring to a gas-powered car. “With a Tesla, you basically have a computer on wheels that you have to figure out. So you need to take the time to sit down and go through all the things on the infotainment system and read up on all the new features or you’ll be missing out”. 11) Range anxiety can be an issue for Tesla owners, though it’s the best EV when it comes to charging. “There’s been times when I’ve gotten home with only about 2 or 3% to spare,” Nick Caraciolo, a Model 3 owner, said regarding his battery life. “480 km of range can quickly become 150 km of range if you’re speeding or it’s hot outside or too cold. It can be very deceptive and gas-powered car can seem more accurate in that way”. Though, many owners say range anxiety was a short-lived concern. “People who are new to the experience can get super-anxious about the battery just because it’s different from driving a gas-powered car”, Jackson said. “But Tesla always gives you warnings so the only time I really think about it is when I’m going on a long trip”. Tesla has an internal navigation system that will alert drivers to which charging sites will be most efficient and which ones are busy, and it’s a favorite feature with owners. Tesla drivers also have a major advantage when it comes to using the company’s network of Superchargers, which is larger and viewed as more reliable than other charging systems. 11) All hiccups aside, many Tesla owners love their cars in spite, or in some cases even because, of the vehicle’s quirks. Many Tesla owners told that, while they know the car can have its issues, many of the perks of owning the EV outweigh some of the head aches. “If you want to be an early adopter you’ve got to put up with some stuff and people are spoiled if they don’t realize that”, Mack told. +++