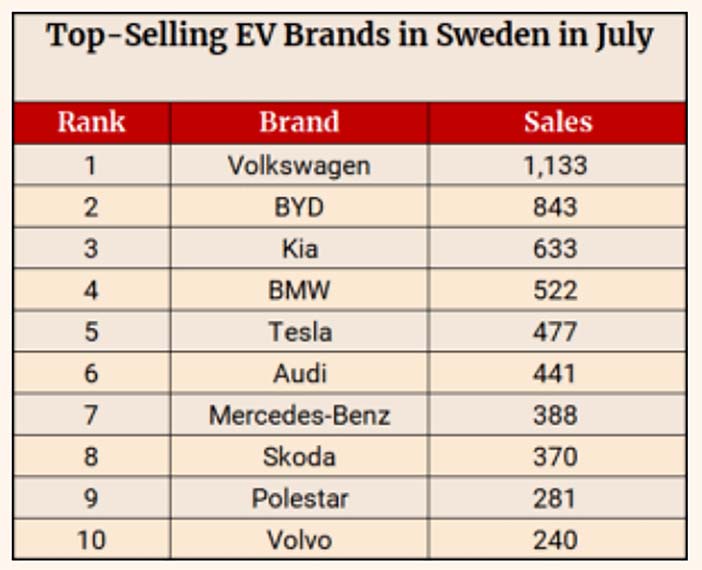

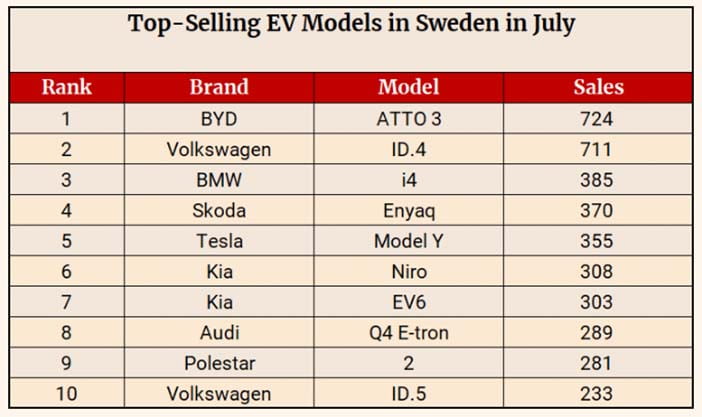

+++ BYD achieved a significant milestone in the European electric vehicle (EV) market in July. The brand sold an impressive 721 units of its popular model, the ATTO 3, in Sweden, making it the best-selling EV in the country for the month. This marked BYD’s first time securing the monthly EV sales champion title in the European market. The Swedish EV market witnessed 6.785 EV registrations in July, highlighting the region’s growing popularity of electric mobility. During this period, Sweden’s top-5 best-selling EV brands were Volkswagen, BYD, Kia, BMW and Tesla. Volkswagen sold 1.133 units and BYD closely followed with 843 units sold, with both brands capturing over 10% of the market share for the month. It is worth noting that this achievement marked BYD’s highest sales month since it began selling passenger cars in Sweden in 2022.

The Volkswagen ID.4 ranked second among the top-selling EV models with 711 sales, while the BMW i4 secured the third spot with 385 deals. Regarding individual EV models, the BYD ATTO 3 emerged as the best-selling EV, with an impressive 724 units sold. Remarkably, even when considering internal combustion engine (ICE) vehicles, the ATTO 3 still stood as the second best-selling model in the Swedish market, with the Volvo XC60 claiming the top spot. An astounding 86% of BYD’s sales in Sweden during July were attributed to the popularity of the ATTO 3, which serves as BYD’s primary export model worldwide. BYD also achieved sales of 64 units of the Han and 54 units of the Tang. Beyond the Swedish market success, BYD’s global export efforts have seen tremendous growth. In July, the company exported 18.169 vehicles from China, marking the largest month for BYD in international sales. BYD has invested in upgrading its transportation infrastructure to accommodate its expanding export volume. 2 car carriers, ordered by BYD, are scheduled to be delivered this fall, further enhancing the company’s capacity to transport and export cars to various markets efficiently. +++

+++ KIA said Tuesday its sales rose 0.3 percent last month from a year earlier helped by strong overseas demand for its SUV models. The smaller affiliate of the Hyundai Motor Group sold 260.472 vehicles in July, up from 259.733 units a year ago, on increased sales of the Sportage and Seltos SUVs, the company said in a statement. Domestic sales fell 7.2 percent on-year to 47.424 units last month from 51.120, while overseas sales were up 2.1 percent to 212.508 from 208.208 during the cited period, it said. From January to July, sales jumped 9.4 percent to 1.836.495 autos from 1.679.219 units in the same period of last year. Domestic sales gained 8.5 percent to 339.527 units in the first seven months from 313.035, while overseas sales were up 9.5 percent to 1.493.811 from 1.364.703 during the mentioned period. In 2023, the company set a sales goal of 3.2 million units, including overseas sales of 2.6 million. +++

+++ Volkswagen is in talks with Chinese electric vehicle startup Zhejiang LEAP MOTOR Technology about the possibility of cooperation for Volkswagen’s Jetta brand, a Chinese media outlet reported on Wednesday, citing sources. A joint venture between VW and state-owned Chinese automaker FAW Group could “buy” a platform of EV technologies from Leapmotor, according to the state-backed financial news website Cailianshe. Leapmotor and VW China declined to comment. Leapmotor unveiled on Monday a new platform it developed in-house for making vehicles, which its chief executive said it wanted to license to other automakers. CEO Zhu Jiangming told reporters that Leapmotor was in advanced talks with 2 foreign companies about such a partnership, including a new player in the electric vehicle segment, which could produce Leapmotor-developed models in overseas markets. Volkswagen and Xpeng announced last week a partnership to jointly develop EVs on Xpeng’s ‘Edward’ platform on which the Chinese startup’s G9 model was built. +++

+++ Even in death, SAAB could not rest in peace. In life, the Swedish automaker never managed to get out from between the sales rock and the financial hard place. After GM bought half the company in 1989 and took full control in 2000, the inevitable brand engineering led to cars like a Saab 900 on an Opel platform, a Subaru Impreza rebadged as a Saab 9-2X and a Chevrolet Trailblazer turned into a Saab 9-7x. This went as well as anyone who knew Saab would expect. Come January 2010, Saab was dead. Or rather, Saab had entered a zombie state rebranded as New Electric Vehicle Sweden (NEVS) with 2 Chinese companies in succession buying the automaker’s intellectual property, both having to walk away due financial issues at the parent companies. Earlier this year, NEVS showed one of the projects it continued to work on throughout the turmoil, a 4-seat battery-electric car called the Emily GT. NEVS said it was looking for a buyer for the project or the entire company. Now, it appears the search has succeeded and the Emily will come to life. In March of this year, a Swedish company called Stenhaga Invest bought 80% the the Stallbacka factory and office complex in Trollhättan where Saab used to build its cars, NEVS holding onto the remaining 20%. An as-yet-unknown European investor has signed a letter of intent to purchase two of the 13 projects NEVS said it has been working on, the Emily GT and the PONS, an autonomous shuttle. Svante Andersson, who runs Stenhaga, is reported to have said the unnamed investor is interested in taking control of “a substantial area” of the Trollhättan facilities, “indicating that a significant number of people will be employed in Trollhättan”. Back in March, an NEVS engineer said properly funded development could get the Emily GT into production in less than 2 years. Based on the sports sedan 9-3, that seems reasonable. Ineos chief Sir Jim Ratcliffe announced the Ineos Automotive Grenadier in 2017, showed a concept in 2020, and had a model running the hill at Goodwood in 2021: 4 years for a ground-up design. Saab Planet writes that “a timeline for relaunch is expected to be announced after a meeting between the parties involved during week 32”, which would be the week of August 7. A hopeful schedule sees the beginning of renewed activity at the factory this fall. The last version of the Emily GT on show was powered by a 175 kWh lithium-ion battery feeding 4 motors that combined to provide 492 horsepower. Estimated 0-100 kph time is 4.6 seconds, estimated range is 1.000 WLTP kilometers. There’s supposedly a more potent version coming with 765 hp and 2.200 Nm of torque that drops the 100 kph dash to 3.2 seconds. One of the big questions about a potential production version is what to name it. Saab AB is a military aircraft concern that started building cars in 1947 as Saab Automotive. The military outfit let GM continue with the Saab name when the Detroit company bought in. When GM exited, the airplane manufacturer took its name back. No one knows if Saab AB will consent to another Saab Automotive. We could find out next week. +++

+++ SOUTH KOREA ’s 5 carmakers posted record sales in the first half of this year, and the trend is expected to continue as exports of SUVs rise and demand in the U.S. remains strong. Hyundai, Kia, GM Korea, KG Mobility and Renault Korea sold a combined 651.288 cars in July; up 1.2 percent from the same period last year. Their domestic sales dropped 5.8 percent to 114.818 cars, but overseas sales rose 2.8 percent to 536.470. In the U.S., Hyundai and affiliate Kia sold a combined 73.086 cars in July, up 40 percent on-year. Their SUV sales there grew 48 percent to 48.585 cars, while exports of electric vehicles including the Ioniq 6 more than doubled to 8.501 cars. But uncertainties remain. American consumers may be reluctant to buy new cars after the U.S. Federal Reserve raised the key interest rate again in late July. The Inflation Reduction Act, which scraps tax credits for EVs not manufactured in North America, is another obstacle for Hyundai and Kia, slowing demand for their cars. +++

+++ SUBARU will target annual sales of 600.000 battery electric vehicles by 2030 so that they make up 50% of its global sales target, the Japanese automaker said on Wednesday. It also said it planned to invest about 1.5 trillion yen ($10.51 billion) by around the start of next decade in electrification. “The coming 5 years to 2028 are a really important period for us to realize those goals”, said Atsushi Osaki, chief executive of the company. Previously Subaru aimed to have battery EVs and hybrids account for at least 40% of annual global sales that are expected to total around 1.2 million vehicles by 2030. The maker of the Outback said it would aim to sell 400.000 battery EVs in the United States in 2028, and expand its battery-powered lineup to 8 models by the end of that year. It currently makes its first mass-produced EV, the Solterra, at Toyota’s Motomachi plant, and will introduce 3 new EVs by the end of 2026 and 4 more by the end of 2028. With its new target, Subaru, which is known for its dependence on the North American market, followed bigger Japanese automakers such as Toyota in intensifying its electrification effort. Toyota, the world’s biggest automaker by sales, laid out in June a strategy to better compete in the global battery EV market. It includes an overhaul of its supply chain and the development of batteries to extend car driving ranges. Subaru, a fifth owned by Toyota, is likely to kick off battery EV production in the United States around 2027 or 2028, Osaki said, a move dictated by the pace at which U.S. consumers are switching to EVs. +++

+++ TESLA has been polarizing for some time, largely due to its chief executive, Elon Musk. So far, this hasn’t really impacted Tesla’s stronghold on the electric-vehicle market. Even as new buyers enter the market, Tesla could stay immune for some time, experts say. Generally, Musk has an extremely loyal customer base despite controversies like his acquisition of Twitter and shoulder-rubbing with certain political figures. But regardless of some worsening opinions of Musk, Tesla’s reputation has remained mostly unscathed. People buy and drive the cars regardless. For some time, many American car buyers swore off purchasing a non-American-made vehicle. Yet the industry eventually saw the proliferation of automakers like Toyota, Hyundai, and Honda; largely due to their affordability and fuel efficiency. “There’s a difference between people’s allegiances to their country and what they buy at the store”, Bill Russo, CEO of advisory firm Automobility, told. People swore off Volkswagen after its several-billion-dollar diesel emissions scandal, yet the brand saw a bounceback. And many were calling to boycott GM after it received a massive bailout during the 2008 financial crisis, though the company has retaken the top-selling crown in the US. It goes to show buying behavior and ideology aren’t always synced up. “One thing that’s absolutely universal is people buy affordability”, Russo added. Likewise, upcoming EV buyers might (and in some cases, already do) find themselves compromising on the way they feel about Tesla simply as a result of it being one of the best EV options in today’s market. “Whether you like Tesla or Elon Musk or whatever, it’s probably irrelevant”, Martin French, managing director at consultancy Berylls, said. “They’ve proven that they’re the leader in EVs, and now they seem to be encroaching on some market share” from the gas-powered market, too. Early EV adopters have been less financially motivated and more interested in a unique vehicle that’s futuristic, according to a Berylls study, thus automatically pulling them to Tesla. Future waves of buyers are going to lean more on what price tag makes sense. Either way, a lot is working in Musk’s favor. He’s gotten a headstart on the rest of the EV industry, and the recent price war he’s waged makes his vehicles incredibly competitive. Tesla Model 3 and Model Y EVs are going for as low as $40.240 and $47.740, respectively, while the average transaction price for EVs overall is $53.438 right now. Carlos Tavares, CEO of Stellantis, recently said the EV pricing sweet spot is “around $25,000”. If that’s the case, Tesla is one of few EV-makers close to that number, particularly when you take into account tax credits. In fact, Tesla earlier this week reminded customers about $15.000 worth of credits available to eligible California-based buyers, saying: “You could drive home a new Model 3 starting at $25.240 before taxes and fees, after combining the state vehicle rebate of up to $7.500 with the $7.500 federal tax credit”. To be sure, there are other affordable EV offerings, including the $26.500 Chevrolet Bolt EV; the $27.800 Nissan Leaf; the $33.550 Hyundai Kona Electric; the $38.995 Volkswagen ID.4 or the $39.950 Kia Niro (note, not all of those qualify for the tax credits that could bring their cost down another $3.750 or $7.500). Customers could choose from these brands or wait for the right product at the right price; several automakers say they have more affordable EVs in the works for the coming years. But Tesla also has the longstanding advantage of its Supercharger network. Despite Tesla slowly losing market share over the past few years (down from 79% of the market in 2020 to 65% of the market last year), the company sold a record 466.000 cars in the second quarter of 2023. “All of the research that we’ve done with EV intenders to date has demonstrated that Tesla might not get the sale, but if you are an EV intender, you will always have them in the consideration set”, Stephen Beck. “It doesn’t mean you’re going to look at a Tesla and look at a Mustang Mach-E or a Taycan or what Hyundai is doing or what Mercedes is doing, and still select that Tesla. But it does mean that today”, Beck added, “they’re going to be looked at”. Any impact of less-than-positive sentiment is yet to materialize substantially. “I wonder how fickle that’s going to be”, French said, “and how that will change in the next few years”. +++

+++ Buyers in the market for a small, city-friendly pickup might have an unexpected option later in the 2020s: the TOYOTA COROLLA . While nothing is official, the Japanese brand is reportedly considering releasing a Corolla with a cargo box that would be positioned below the Tacoma. The model “remains under discussion.” If it receives the proverbial green light for production, it would land as a unibody pickup developed for light-duty hauling and towing, meaning it would compete in the same segment as the Ford Maverick. My crystal ball tells us it would have 4 doors, a rugged-looking design and decent ground clearance. It’s too early to provide specifications, largely because I don’t know what “Corolla-based” means. The current Corolla made its debut as a hatchback for the 2019 model year and as a sedan for 2020, so it will likely get a makeover in the coming years. However, the newer Corolla Cross illustrates one way Toyota can steer the nameplate into a new territory while retaining the values it represents. There’s no word yet on when Toyota will decide whether to turn the Corolla into a truck. If the model is approved, production could take place in the same Blue Springs, Mississippi, factory that currently builds the Corolla. The catch is that it won’t arrive until 2027 at the earliest. +++

+++ Several VOLKSWAGEN GROUP brands announced they would buy EV platforms from Chinese automakers in recent weeks. Audi will team up with Alibaba & SAIC’s backed IM Motors and use their iO Origin electric platform, Volkswagen will launch 2 mid-sized EVs by 2026 with Xpeng inside and underpinned by their older Edward platform, and VW’s China-only brand Jetta is in talks with Leapmotor to use their ‘Four Leaf Clover’ EV architecture. In Europe, Jetta is known as a family car and Passat alternative, but in China, it is a whole autonomous subbrand established in 2019 with its own lineup. Now, VW wants Jetta to enter the EV business. But as an MEB-based ID. series are not selling well in China, and they chose to underpin them with a Chinese EV drivetrain with a track record. 2 weeks ago, Leapmotor announced that they are in talks with 2 foreign companies to license their EV technology. One of them was rumored to be a Japanese automaker. Today, an insider revealed that the second one is Volkswagen’s Jetta. It’s a desperate move from VW, and it must be hard for folks in Wolfsburg to admit their EV tech is not good enough. However, hats off to them for such a bold move. Xpeng has great EV platforms when compared with Volkswagen. The transaction has been 8 months in the making and was revealed in July when VW bought 4.99% of Xpeng. Today, VW increased its stake in Xpeng to 6.85%. German legacy maker announced they will launch 2 EVs by 2026 based on Xpeng’s 800 Volt Edward platform, which also underpins large SUV G9 and P7 sedan. Interestingly, they will not use Xpeng’s latest SEPA 2.0 platform, which underpins the G6 smaller SUV launched in June. But the EV platform is not everything VW gets access to. Xpeng has a top-notch ADAS system called XNGP. It works pretty well on highways and recently got a permit to roll out semi-autonomous driving capabilities in Beijing; other cities will follow. Keep in mind that Tesla’s FSD is not allowed in China. But VW is not the only one to benefit from the deal. Possibly hundreds of thousands of VW’s EVs using XNGP in the future is a massive bait for Xpeng. Also, VW’s endorsement gives the 9-year-old startup more credibility; both for EU expansion, which is not going very well, and a boost for their domestic sales. With over 90 EV makers in China and lots of them going bankrupt (Hengchi, Letin, Niutron, etc.) and more to come, Chinese consumers are thinking twice before purchasing a car: nobody wants to lose a warranty if the company ceases operations. Such a boost is a message: Xpeng is not going anywhere and is meant to stay. So expect the increase in sales to follow. Finally, with all the Barbeheimer buzz, I don’t see why VW cars with Xpeng inside shouldn’t be called Xwagen. SAIC owns the MG brand, but I wouldn’t introduce it that way in China. Especially outside tier 1 cities, people probably wouldn’t know MG at all. But they would know SAIC for sure. The Shanghhai-based state-owned automaker sold 5.3 million vehicles in 2022, ranking the first in China for the 17th consecutive year. Recently, they pushed hard into the EV segment, and one of their assets is called IM Motors, a joint venture with Alibaba. The subbrand sells 2 EVs: an L7 premium $64.000 sedan and an LS7 SUV. Both are based on the iO Origin platform, which Audi chose for their new EVs as developing their own PPE is too slow. Despite both L7 and LS7 being fair enough EVs, they don’t sell very well, partly because of the lack of trust in SOEs and partly because of the interior. Also, the LS7 being the copycat of Aston Martin DBX isn’t helping. But what is essential is that all is in the right places under the hood and the passenger seat and it seems Audi knows. If you read up here, you probably notice one common trait for all 3 Chinese EV makers who will license their technology to Volkswagen. They have excellent in-house developed EV drivetrain, SW, or ADAS, but their sales are lower than expected. In the case of IM, low sales are obvious; in the case of Xpeng, it is much better after the launch of G6, but P5 or G9 (despite being excellent cars on paper) were a sales disaster. It’s like Xpeng is doing a great job but always missing the last piece of the puzzle. Leapmotor is probably the best of those 3, but they sell many budget cars with a small margin. So, this is not one-sided and shouldn’t be viewed as Volkswagen being saved by the Middle Kingdom. The Chinese EV companies are also fighting for survival, and a boost from the German legacy automaker might be vital for them. On July 27, Volkswagen cut its delivery estimate for 2023 to 9 million vehicles from 9.5 million. The reduction is mainly because of declining ICE sales in China and no EV sales to compensate for that loss. With that in mind, it is unsurprising that VW moved to licensing technology. The 40-year-lasting era just ended this month. In October 1984, SAIC Volkswagen Corporation Ltd. was established in Shanghai: the first automotive joint venture between Western and Chinese automaker. Since then, dozens of JVs have been formed as goverment required every foreign automaker to team up with local producers. And the Chinese kept learning from the world’s top-notch car makers. Now the tables have turned, and legacy automakers are preparing to sell their EVs with China tech inside. Toyota already started the trend with their BYD-inside BZ3, and as mentioned above, Germans are following as Audi prepares SAIC-inside, VW prepares Xpeng-inside and Leap Motor-inside EVs. And it’s not just Germans; Ford is building a CATL-inside battery plant in the US, while Renault partnered with Geely to develop PHEV powertrains. This April, legacy executives received a wake-up call at Shanghai Auto Show when they saw the progress Chinese EV startups made in 3 years while China was closed due to covid. And only 3 months later, we see 3 new deals between German legacies and Chinese EV makers. Not talking about that the software unit of VW Cariad fired its top executives just a month after Shanghai. Of course, the agreements were in the making for some time; for example, the VW-Xpeng deal negotiation started in December 2022. Still, I’m sure the Shanghai Auto Show speeded things up and confirmed to the VW executives the leverage is not on their side in the negotiation process. Volkswagen realized something that readers of Autointernationaal.nl have known for a long time: their MEB-based EVs are not competitive in China. Every year since the launch of ID. series in China, they always missed the sales target, and despite Volkswagen being a love brand for Chinese for decades, even the hardcore fans were not buying their EVs. Solid hardware is not enough anymore; you need connectivity, great software, UX and good digital experience in general. Everything that VW lacks of. There were dozens of surveys warning VW that Chinese customers consider their EVs dumb. The result: After several rounds of discounts, you can now buy ID.3 for about $16.500 in China, and VW still sold less in the first half of this year than in the same period as last year. Volkswagen CEO Oliver Blume recently said €20.000 (€22.000 in the Netherlands) EV could be possible in the next 5 years. If VW just imported the China-made ID.3, they could have it immediately, even considering tariffs and shipping costs. But I guess unions would go wild. It will be interesting to watch if the VW China strategy (‘In China, for China with Chinese tech’) will further transform into ‘In Europe, for Europe, with Chinese tech’. Volkwagen bought some time by partnering with Chinese, but if they want to stay relevant long term, now they really need to start taking EVs seriously. Instead of constant lobbying to avoid European ICE ban. +++