+++ BMW Korea overtook Mercedes-Benz Korea to become the leading foreign automobile company in South Korea last year in terms of sales, industry data showed. According to the Korea Automobile Importers & Distributors Association (KAIDA), the number of newly registered BMW models last year reached 77.395 units out of the total 271,034 foreign vehicles sold in the country in 2023. KAIDA said accumulative foreign car sales fell 4.4 percent on-year from 2022. Tesla was not included in the tally, as the company is not a registered member of the association. Mercedes-Benz came in at a close second, selling 76.697 units last year. Mercedes-Benz had led the foreign automobile sales market for 8 years since 2015. Audi came in a third place, selling 17.868 units, followed by Volvo and Lexus, selling 17.018 and 13.561 units, respectively. In terms of individual model lines, Mercedes-Benz’s E Class was the most popular, selling 23.642 units, followed by BMW’s 5 Series, selling 21.411 units. Mercedes-Benz’s S Class and Audi’s A6 finished third and fourth, respectively. +++

+++ HONDA is considering building an electric vehicle plant in Canada. The company is also considering in-house production of automotive batteries for EVs at the plant, aiming to start operations by around 2030. Honda wants to strengthen its production system in North America, which it regards as an important market, the sources said. The new plant in Canada will be Honda’s second production base in North America, as the company has already announced a plan to begin EV production in Ohio in 2026. A large investment is expected in the new plant. Honda is considering building the factory near its finished vehicle plant in Ontario. Honda aims to increase the combined share of electric and fuel cell vehicles to 40% of its new unit sales in North America by 2030, and to 100% by 2040. The company is also considering in-house production of automotive batteries, a core component of the vehicles. In the United States, Honda plans to produce the batteries jointly with LG Energy Solution Ltd., a major South Korean battery maker. The Canadian government has announced a policy to ban the sale of gasoline and other engine-powered vehicles by 2035. The U.S. government is also offering tax incentives of up to $7.500 (¥1 million) for EVs whose vehicles and batteries were manufactured in North America. Honda hopes to increase EV production in Canada to boost EV sales in North America as a whole. +++

+++ HYUNDAI said Wednesday its 2023 sales rose 6.9 percent from a year earlier, helped by the release of new SUV models and eco-friendly cars. Hyundai sold 4.216.680 vehicles last year; up from 3.942.922 units in 2022 on strengthened sales of new SUVs and strengthening of its eco-friendly model lineup, the company said in a statement. Domestic sales rose 10.6 percent on-year to 762.077 units while overseas shipments gained 6.2 percent to 3.454.604 units. According to a company representative, Hyundai was able to “strengthen sales in North America and Europe by launching competitive new models and reinforcing the company’s eco-friendly vehicle lineup”. The Hyundai Motor Group said in a regulatory filing that it aims to sell a total of 7.443.000 vehicles under Hyundai Motor and Kia combined this year; up 1.9 percent from the group’s combined sales in 2023. +++

+++ New car sales in JAPAN grew 13.8 percent in 2023 from the previous year, climbing for the first time in 5 years as manufacturers ramped up production following an ease in the global semiconductor shortage, data from industry bodies showed. Automakers sold 4.779.086 cars domestically last year, including mini vehicles with engines of up to 660 cc, although the numbers failed to recover to 2019 levels before the spread of the coronavirus pandemic, according to the Japan Automobile Dealers Association and the Japan Light Motor Vehicle and Motorcycle Association. The increase comes after domestic auto sales in the country dropped to their lowest level in 45 years in 2022 at around 4.2 million vehicles. Sales of cars other than mini vehicles increased 18.4 percent to 3.034.167 in 2023, with 7 of the 9 major automakers, barring Daihatsu and Mitsubishi, logging a rise in sales. A total of 1.75 million regular passenger cars were sold, hitting a fresh record high for the first time in 4 years. By brand, Toyota saw new car sales jump 27.2 percent to 1.548.594 vehicles, while those of the company’s upscale Lexus brand grew about 2.3-fold to 94.645. Nissan’s sales gained 7.0 percent to 291.046 and Honda Motor Co sold 275.722 units; up 2.5 percent. Sales of mini vehicles rose 6.5 percent to 1.744.919 units in 2023. But Daihatsu, a Toyota subsidiary that holds a large market share in such cars, saw sales sink 22.6 percent in December to 41.067 as it halted shipments at home and abroad amid a safety test falsification scandal. An official of the Japan Light Motor Vehicle and Motorcycle Association said inflation has weighed on sales, even as an introduction of new models and recovery in production helped address an order backlog. In December alone, new car sales increased for the 16th consecutive month, rising 5.4 percent to 362.839 vehicles from the same month a year before. +++

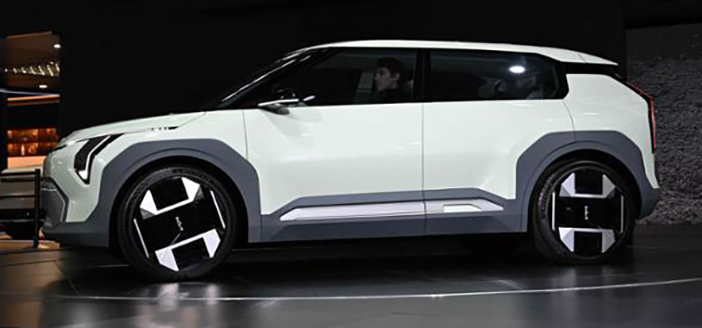

+++ KIA has set a new record by selling 3.08 million vehicles across the world last year, Korea’s second-largest automaker said. Kia sold 563.660 cars in South Korea and 2.51 million vehicles overseas; up 4.6 percent and 6.7 percent on-year, respectively. The automaker’s previous record was 3.04 million units in 2014. Kia’s SUVs led the company’s record year. The 3 bestselling models were the Sportage with 523.502 units sold, the Seltos with 344.013 units sold and the Sorento with 242.892 units sold. The automaker said the target for this year is to sell 3.2 million vehicles through strategies of launching more affordable electric vehicles, enhancing product quality based on connectivity technology, realizing the company’s business model of purpose-built vehicles and focusing on profitability. Kia wrote new records in some of the most important auto markets in the world: the United States, Europe and India. The carmaker sold 823.910 units in the United States, 606.788 units in Europe and 255.000 units in India last year. “Last year, we recorded the highest annual sales performance ever through the launch of competitive new cars such as the EV9, the updated Sorento, the new K5 and the new Carnival, along with increased production and supply due to the easing circumstances of semiconductor parts supply chain”, a Kia official said. “This year, we will complete the construction of the Kia AutoLand Gwangmyeong, Hyundai Motor Group’s first EV-dedicated plant, to begin the sales of the EV3 (photo), a compact all-electric car, and strengthen our position in the global EV market”. +++

+++ Combined sales of carmakers in SOUTH KOREA rose over 7 percent last year to exceed 8 million units, industry data showed. 5 automakers in South Korea (Hyundai, Kia, GM Korea, Renault Korea Motors and KG Mobility) sold a combined 8.301.221 units in 2023; up 7.5 percent from the previous year, according to data provided by the firms. It marked the first time for the tally to surpass the 8 million mark since 2018. Industry leaders Hyundai and Kia sold 4.21 million units and 3.08 million units last year, recording 6.9 percent and 6.3 percent on-year sales growth, respectively. GM Korea, the South Korean unit of General Motors, and KG Mobility, formerly known as Ssangyong Motor, also logged 30.3 percent and 2.2 percent on-year sales gains, respectively. Sales of Renault Korea, the South Korean unit of Renault, however, plunged 38.5 percent to 104.276 units due to weakened demand both overseas and at home. Last year’s most popular vehicle model in South Korea was Hyundai’s Grandeur sedan, selling 113.062 units to become the sole model to surpass 100.000 units in 2023. +++

+++ Vehicle sales in the UNITED STATES got a boost from strong demand in 2023, due in part to attractive offers by automakers and dealers in the face of high interest rates and stubborn inflation. Industry experts estimate that around 15.5 million vehicles were delivered in the country last year, marking an increase of almost 13 percent from 2022. “Auto sales ended up being much stronger than most expected in 2023”, said Garrett Nelson, senior equity analyst at CFRA Research. “We’re getting closer to pre-covid levels”, he told. Sales exceeded 17 million vehicles annually over the 2015-2019 period. Nelson expects sales to rise by 3 percent in 2024, to around 16 million units. Automotive research firm Edmunds is less optimistic, however, expecting just a 1 percent rise in sales to 15.7 million units. According to Nelson, sales have benefited from improved supply chains and more inventory at dealers. There was also greater choice for buyers, who took advantage of promotions, price cuts and federal subsidies. Electric vehicle maker Tesla, for example, was among those to lower prices. “Prices overall were down about 2 to 3 percent, much more than that for electric vehicles, but they’re still at elevated levels”, Nelson said. Holding on to its crown as the top-selling automaker in the United States last year was General Motors, which claimed a 16.3 percent market share and reported 2.6 million in vehicle sales. GM “had great success” with affordable SUVs, said its North America president Marissa West. This enabled it to sell more than 1 million SUVs in a year for the first time. Shoppers are “seeking options on the affordable side of the new vehicle market”, according to Edmunds. It added that vehicles below $50,000 are sold out within an average of 30 days, compared with 47 days for more expensive models. Meanwhile, the share of electric vehicles in the market should continue rising, from 6.9 percent in 2023 to 8 percent of all sales in 2024. Tesla, which does not detail its sales by country, delivered 1.8 million vehicles globally last year; a 38 percent jump from 2022. Even as automakers lauded the performance of their electric models, the pace of sales has fallen short of expectations, prompting some to review their projects. GM, for one, has delayed the transition of its Orion plant into an EV truck factory by a year to 2025. But overall, the company logged EV sales of 75.883 units; a 93 percent jump. Ford, whose U.S. sales rose to almost 2 million vehicles in 2023, also noted “accelerating sales of its electric and hybrid vehicles to new records”. Alongside Stellantis, which delivered 1.5 million vehicles last year, GM and Ford form the “Big Three” automakers hit by a 6-week strike ending in late October. The end of the labor action came with new collective agreements involving better wages and other benefits. “Their margins are going to be under pressure from those higher labor costs and the new labor deals”, said Nelson. Among other major players is Toyota, which reported US sales of 2.2 million vehicles last year, including over 657,000 electrified (hybrid) vehicles. The group has announced investments of nearly $16 billion in the United States, including almost $14 billion for a major battery plant in North Carolina. +++