+++ AUDI will continue to use the Volkswagen Group’s MEB platform for entry-level EVs, including an electric replacement for the Audi A3 by 2027. The only Audi currently based on MEB is the mid-sized Q4 e-Tron and questions hung over whether the firm would continue to use the platform, given the new Q6 e-Tron spearheads a range of cars based on the new PPE structure and the Group’s new SSP platform will be in production by 2028. But speaking at the Munich motor show, Audi’s technical development boss Oliver Hoffman revealed that Audi will use MEB “in the coming years, especially for ‘A-segment’ cars”. ‘A-segment’, for Audi, refers to cars the size of the A3 and Q2. No doubt the electric A3 equivalent will use the heavily updated version of MEB, dubbed MEB-Evo, which is envisaged to serve as a bridging architecture to SSP. This is set to support charging speeds of between 175 kW and 200 kW, but retain today’s 400 Volt hardware in a reflection of its entry-level billing, though further details remain under wraps at this stage. Pressed for details on what Audi considers an entry-level EV, Hoffman said: “In the ICE world, our A-segment is A3, Q3 and Q2, and our Q4 e-Tron is our so-called ‘high-end’ A-segment car in terms of its size. We have a clear view for our A-segment based on the MEB”. The firm has already confirmed it will not directly replace the A1 and closely related Q2, so the electric A3 equivalent will be its smallest electric car. Under Audi’s new naming strategy, whereby EVs are given even number designations and combustion cars given odd numbers, it could possibly be badged A2 e-Tron, reviving a nameplate that hasn’t been used for nearly 2 decades. Asked how Audi can remain a premium brand while extending its electric line-up downwards, Hoffman said: “We have a clear strategy regarding this. We are in the decade of transformation; we have decided on a completely new generation of ICE and PHEV cars, and we will launch our last ICE/PHEV car in 2026. “Starting in 2026, we will only launch BEV cars worldwide, and that means we will bring in all our core segments (A-segment up to D-segment (A8 and Q8) battery-electric vehicles”. “But in parallel”, he added, “especially in this decade of transformation, we will have ICE and PHEV cars in parallel”, suggesting the combustion-fuelled A3 can remain on sale in some form, alongside an electric equivalent, as is the plan for the A4, A6 and Q5. Hoffman stopped short of giving a launch date, but emphasized that the next 2 years are the busiest period for new product launches in Audi’s history, with nearly 20 new cars due in dealerships by this time in 2025. At a conference last year, Hoffman said categorically that the new model will be “comparable to the A3”. Autointernationaal.nl was previously told that the A3 replacement has been conceived as a 5-door hatchback and 4-door saloon, both with incremental increases in dimensions. Those privy to early design proposals say Audi designers have taken full advantage of the packaging solutions offered by the dedicated electric vehicle platform, providing the A3 successor with altered proportions, including shorter overhangs, a shorter bonnet line, a longer cabin and larger wheelhouses. Using the rear-driven MEB platform means standard versions of the A3 replacement will abandon front-wheel drive for the first time since the model’s introduction in 1996. The car, as with the current model it will replace, is expected to spawn more potent variants, such as the S3 and RS3; no doubt with a second motor on the front axle for 4-wheel drive. As Audi goes EV-only, an electric RS3 will be the entry point into the newly electrified performance line-up. Audi Sport’s transition to an electrified portfolio kicked off with range-topping variants of the Audi e-Tron and e-Tron GT, and it is expected to ultimately match the diversity and scope of its current performance range, which comprises highly strung versions of most Audi models. Instant-torque electric power will enable any ‘RS3 e-Tron’ to outpace the current 5-cylinder petrol car in a straight line, so expect a sub-3.8 seconds 0-100 kph time, and the innovative torque-vectoring functionality fitted to Audi’s existing fast EVs will no doubt trickle down to upcoming entrants to mimic the combustion car’s dynamic agility. It could also be the first of a new breed, with rivals BMW, Mercedes-Benz and Volkswagen yet to unwrap electrification plans for their own hottest hatchbacks. +++

+++ Covering new cars, particularly the raft of new FEATURES added every year to them, you start to get an idea for what new car buyers are wanting. Or at least you think you do. AutoPacific on the other hand, actually surveyed 11.700 people looking to buy a new car in the next 3 years to learn the truth. And there are some features on here we would not have guessed: 1. led fog lights, 2. wireless device charging (front row of seats), 3. Unresponsive-driver Stop Assist, 4. automatic power folding mirrors, 5. wireless device charging (rear row of seats), 6. heated and ventilated front seats, 7. household 220 volt power outlet, 8. a sunroof, 9. self-cleaning exterior cameras / sensors and 10. Driver Profile settings. The top-2 entries were selected by 48% of respondents, and at the other end of the spectrum were the driver profile settings at 36%. I was particularly surprised that fog lights of any sort, let alone led ones specifically, would end up at the top. While they can be nice for a bit more illumination and can be a nice styling touch, I wouldn’t put them so high on the list. Wireless charging I understand a bit more, particularly as more cellphones support wireless charging and wireless Apple CarPlay and Android Auto are much more common on cars. So it makes sense it would be in high demand. And the fact that it comes up twice for 2 different positions in the car makes it clear it’s a big deal for consumers. Unresponsive driver stop assist, taking the third spot on the list, needs a little explanation. According to AutoPacific, this is a feature that would bring the car to a safe stop at the side of the road. It’s interesting to see this so high up without other advanced driver aids such as hands-free highway driving assist along with it. I’m not completely sure what to make of it except that maybe buyers are more interested in emergency semi-autonomous features than convenience ones. The one big thing I was surprised was missing from the top 10 was Apple CarPlay / Android Auto. It might simply be that it’s become nearly a standard feature across all brands and price points, so people aren’t thinking about it as much. But considering the uproar about General Motors dropping the 2 phone mirroring systems in its upcoming EVs, we would’ve expected it to place among these other features. +++

+++ A ‘high-performance’ variant of the FISKER PEAR electric hatchback, dubbed the Pear Extreme, has been confirmed by the American EV start-up. Fisker has yet to confirm performance targets for the new variant, but it’s highly likely to significantly reduce the 6.5 seconds (claimed) 0-100 kph sprint time of the regular Pear, thanks to a dual-motor, 4-wheeldrive powertrain. For reference, the larger Ocean Extreme features a 282 hp motor on each axle for a combined 564 hp and 720 Nm. This allows the 2.434 kg SUV to reach 100 kph from a standstill in 4.0 seconds. Autointernationaal.nl expects that the Pear Extreme will be positioned as a rival to the MG 4 XPower, whose 435 hp dual-motor powertrain allows it to hit 100 kph in 3.9 seconds; faster than the entry-level Porsche Taycan and on a par with the Taycan GTS. The Extreme is likely to feature the larger battery planned for the Pear. Fisker claims this yields a 560 km range in regular variants, but this will doubtless be reduced in the high-performance model. High-end versions of the Pear will also feature a solar-panelled roof, like that featured on the Ocean, to passively top up the battery with additional charge. The cheapest variant of the Pear, on the other hand, will use a significantly smaller pack giving a claimed range of 320 km. This entry-level rear-wheel-drive variant, which Fisker expects to be the most popular, will be priced from $29,900 (before incentives) in the US. That equates to €40.000 in the Netherlands. “In 2 years, you will see people realizing they don’t need that much range, specifically if they have a second car”, said Fisker Inc founder Henrik Fisker. “There are a few cars out there that have a 160 to 240 km range and aren’t selling”, he added. The Pear’s low claimed entry cost is also attributable to its simple design: the 4.550 mm-long crossover (sized roughly in line with the Volkswagen ID.4) is based on a steel chassis said to use 35% fewer parts than a conventional platform. This platform will also give the Pear “sporty handling”, said Henrik Fisker. Under the skin, it uses a dedicated computing architecture dubbed the ‘Blade’, which uses fewer, more centralized computers. Chief technology officer Burkhard Huhnke said in February that this approach reduces the material cost of the vehicle and “increases the performance drastically”. Chief financial officer Geeta Gupta-Fisker added the Pear will be “driven by software, not hardware”. High-speed 5G networking makes the car a “cloud connected mini data centre”, according to a statement by the start-up, offering “multi-gigabit” networking speeds – although such capabilities are highly reliant on local infrastructure. The Pear will also feature a barebones interior with “zero moving parts” according to Henrik Fisker: “We don’t have the typical centre console that you can open up, and the typical glove compartment, and all these types of things”. This simplification extends to the instrumentation and infotainment, which is all displayed through a central touchscreen in similar fashion to the Tesla Model 3, Tesla Model Y and the upcoming Volvo EX30. A large 17.1 inch display will be offered as an optional extra. The interior will be offered in 5- and 6-seat configurations, with the latter swapping the front-row bench for a van-style layout with room for 3 occupants. At the rear end, the Pear features a novel ‘Houdini’ boot, in which the tailgate folds away into the rear bumper. This “simplifies cargo loading in city parking”, according to Henrik Fisker. Additional storage is provided under the bonnet, where a small “drawer-like” cargo space is provided, with optional insulation said to be capable of keeping food hot or cold. Initial deliveries of the Pear are currently scheduled to begin in July 2025. The car, which was revealed earlier this month in near-production form (only the door-mirror cameras are “still under review” according to an official statement) will be shown at the Fisker Lounge in central Munich, coinciding with the Munich motor show. The Pear will also form “the basis” of Fisker’s ambition to produce a carbon-neutral car by 2027, the start-up said in a statement, hinting at the eventual release of a pared-back variant featuring more sustainable materials. +++

+++ MERCEDES-BENZ will launch a baby G-Class model within the “next few years”, expanding the scope of its legendary off-roader into a new market segment. Confirmed by company CEO Ola Källenius at the Munich motor show, the “little G” will arrive as “a son or daughter of the iconic big G”. “It will be worth the wait”, he told at the unveiling of the new CLA concept. The G-Class line-up will expand next year with a new electric Mercedes EQG and the new ‘little G’ will follow in 2026. Mercedes-Benz design chief Gorden Wagener told that the new machine will take strong design cues from the “iconic DNA” of the existing G-Class, saying: “It will have its own character, but it will be a G”. Mercedes has launched a new Mercedes Modular Architecture (MMA) that will be used for a range of entry-level cars in the coming years starting with the new Mercedes-Benz CLA, but Mercedes bosses have confirmed that the ‘little G’ will sit on a different platform, no doubt due to its need to offer true off-roading ability. Asked about the new car’s positioning, Wagener added: “It will be further up in the market than a compact car. I’m not here to talk about price, but segment-wise it will probably be above a C-segment car”. Autointernationaal.nl has previously reported that it will offer both internal-combustion and electric powertrains, and four-wheel-drive ability will be a given. The forthcoming EQG will use a quad-motor set-up that is unique in the Mercedes EQ electric range. This platform will be different (but likely take learnings from) that of the full-sized electric EQG, which will use a reworked version of the existing ICE G-Class’s ladder-frame chassis. As well as giving Mercedes a foothold in the increasingly popular rugged SUV market, joining the inbound Jeep Avenger, Mini Aceman and Ford Explorer, the baby G-Class will be crucial in establishing G as a Mercedes sub-brand in the same vein as Maybach and AMG, building on the success of its blocky Land Rover Defender rival. Källenius said last year: “Most luxury companies build their portfolio on the basis of 1 or 2 true icons. Mercedes-Benz has the good fortune to have multiple iconic products and brands at the upper end of its portfolio, such as the S-Class, the SL, the G-Class as well as the AMG and Maybach brands. “We see great potential here to expand our top-end portfolio with even more fascinating products”. His comments hint at the possibility for each of those four brands to spawn more comprehensive line-ups. Like the upcoming CLA, the new compact SUV will have an 800 Volt electrical architecture, allowing for 400 km of range to be added in just 15 minutes via a 250 kW charger. It will likely also be fitted with a new type of electric motor developed and produced in-house and making its debut in the CLA. In that compact saloon, outputs will range from 201bhp in the entry-level rear-wheel-drive variant up to a 550 hp in a dual-motor AMG model. The baby G-Class is expected to follow the CLA in offering a choice of lithium-iron-phosphate (LFP) and lithium-nickel-manganese-cobal

+++ The new PEUGEOT e-3008 will be revealed on 12 September, arriving with pure-electric power and a totally new look modelled on the brand’s radical Inception concept. With images unveiled of a heavily camouflaged car shown on the brand’s social media, the 3008 will be the first model in the Peugeot line-up to feature a newly updated i-Cockpit infotainment system. The new system, which will eventually roll out onto the majority of the Peugeot model range, features a 21 inch, curved, panoramic display, which stretches from behind the steering wheel to the center of the dashboard. There’s also a new digital instrument cluster, ambient led lighting and a redesigned steering wheel, which controls several of the cabin’s interior functions, replacing traditional buttons. Elsewhere, the firm’s i-Toggle touchpad system also returns, and the gear selector has moved to the dashboard next to the car’s start button. The e-3008 will be the first car from the brand to sit atop parent company Stellantis’s new STLA Medium architecture, which promises a step-change in terms of performance and functionality compared to the legacy PSA Group platforms currently used by Peugeot EVs. Peugeot said the e-3008 will offer a choice of 3 powertrains, including a dual-motor, 4-wheeldrive option; a first for the brand. It has also promised a range of up to 700 km from the variant with the largest battery. An electric version of the larger Peugeot 5008 will follow atop the same platform and likely with the same array of powertrains and batteries. Peugeot product boss Jerome Micheron promised the new crossovers will be “born EV”, meaning they will be designed around their new EV-specific architecture, whereas the brand’s current EVs, the e-208, e-308 and e-2008, ride on adapted versions of ICE-car platforms. Further details remain under wraps, and it’s not expected that the 680 hp, 800 km Inception concept gives any real clue as to the future technical make-up of the SUVs, which are highly competitive in their respective segments. However, Peugeot has now released a preview of its future all-EV line-up, showing how each of the seven new cars due by 2030 will be influenced by the Inception. 3 SUV-shaped models are included in this line-up, and no doubt the e-3008 is in the middle of them, sitting between the e-2008 and e-5008. Each will have much more rakish proportions than its predecessor and wear a striking new visage modelled on the Inception, defined by a new led interpretation of Peugeot’s ‘claw’ light signature. The e-3008 will show exactly how Peugeot plans to rethink the concept of the traditional SUV with a focus on aerodynamic efficiency, and thus range per charge. Company boss Linda Jackson highlighted that the Inception’s rakish form points to a need to avoid tall, flat-fronted silhouettes in future production cars, saying: “I don’t think anybody is saying SUVs are going to disappear because they’re still very popular, but we’re all looking for ways to make them more aerodynamic, so therefore, you start to move into different silhouettes”. +++

+++ RENAULT GROUP boss Luca de Meo says there’s no reason to hinder the progress of Chinese car makers in Europe, but emphasized the need for a definitive industrial strategy that allows established manufacturers here to compete with them. Speaking at the Munich motor show, where his firm’s new Scenic crossover is on display alongside new models from BYD, Nio, Seres and others, De Meo outlined his reaction to the increasing prevalence of Chinese brands in the market. “The only thing we can do is to accept that, to actually look at them and be humble, but not playing the victim”, he told. He brushed away suggestions that Europe should embrace protectionist policies like that of the US’s Inflation Reduction Act (IRA), citing historical evidence that the rapid growth of of new players in a market doesn’t necessarily mean they will come to dominate it. “When the Japanese and Koreans came to Europe, it was the same thing”, he said. “They can play the game. If you sum up all the non-European brands in Europe, it’s 25%, not 95%. So I’m sure (I speak personally; you might have very different opinions; there are people who sway between protectionism, laissez-faire and laying down the red carpet) that there’s no reason why we shouldn’t allow people who do good stuff for the European consumer to enter the market, to offer people what they want”. However, De Meo used the arrival of these new marques as evidence for his argument that European manufacturers should be able to lean on similar support systems to those available to Chinese manufacturers. “We also have to recognize that globally we’re in the kind of race that’s a form of asymmetrical competition. America is playing the protectionist game with IRA and we’re facing on the other side a Chinese ecosystem that’s supported heavily by authority, by clear industrial policy, including subsidies on manufacturing, giving money for investment. “The thing that isn’t in the habits or the rules of the European Union is manufacturing support. We tend to finance innovation projects but not manufacturing, so you get the money to develop a platform but not to put the platform on the line. The money is there, but the logic only addresses one part of the story. When you want to sell cars, you have to produce them and to produce them, you have to build plants and infrastructure. And the system of subsidies in general across sectors isn’t designed to support manufacturing development, only R&D”. The ACEA will publish a study in the coming weeks, conducted by an independent body, that compares the structures and impact of the 3 systems: United States, China and Europe. “It’s very difficult to compare them”, De Meo said. “I think it will be very useful”. He said that European manufacturers “want to be listened to” by the European Commission and suggested that the carbon-reducing regulations imposed upon car makers aren’t a suitable stand-in for structured support. Asked how he and other industry representatives can promote this argument, he explained: “That’s part of the work we are doing with the European Automobile Manufacturers Association (ACEA). “For sure, the starting point isn’t glorious for us as an association, as a sector, because we’ve always played a little bit defensive but finally ended up doing the things in the end. We say ‘no, no, no’, but there’s an assumption that we will complain but then we will do it. I think that impacted the credibility of the industry”. Car companies in Europe, he said, must demonstrate that they can achieve the collective decarbonization goals in their own way, suggesting that simply mandating the end of ICE car sales doesn’t constitute a comprehensive decarbonization strategy. “There’s a new generation of leaders in the industry”, he said. “We have to have at least a chance to get some credit, to show that we’re a bunch of professional people who share the overall objective of decarbonizing transportation, but we need a strategy. “To have a strategy, you have an idea, then you make a plan, and you have a timeline (a series of actions) and you define objectives, and you see if you have the resource, and you have KPIs [key performance indicators] to see if it works, and you have a certain flexibility in doing the things. “The feeling you have is that the approach is more in defining regulation, piling up regulation. Regulation doesn’t mean you have a strategy”. The current system doesn’t organically allow for manufacturers to pursue different decarbonization strategies, De Meo suggested, including hydrogen propulsion and synthetic fuels. “Look at Formula 1: you start on medium tires and you see it doesn’t work, so you change and go to hard tires, then it rains and you go to intermediates, then there’s a crash and you go to safety car and you change again… And you find at the end of the day that it’s not going to be the thing ‘you’re only going to use hard tires’. It feels like car companies are in the situation of: ‘if it rains, we stay on hard tyres’. There’s no discussion. And there’s going to be no crash, don’t worry…” +++

+++ SEAT ’s long-term future lies away from being a mainstream car maker and that role will instead be taken by Cupra, its chairman has confirmed. When asked about the future of Seat, Thomas Schäfer said: “The future of Seat is Cupra”. Schäfer said that the existing Seat models will continue to be produced in their current lifecycles (several of which are planned to run through much of the 2020s) but the brand would ultimately have a new role in the future. The Seat brand name won’t be retired; Schäfer said the Volkswagen Group “would find a different role for it”. It’s likely to pivot into other vehicles and mobility solutions, such as e-scooters, as it has started to do with the Seat Mó. Small cars remain an option too. Schäfer said it was prohibitive to invest in both Seat and Cupra as mainstream brands and the earning potential for Cupra was ultimately far greater. To that end, Schäfer said the Volkswagen Group would “invest strongly in Cupra; this will ramp up”. Cupra has moved into making its own bespoke models, having started as a performance arm of Seat. The Cupra Formentor is being followed by the Cupra Tavascan; plus the firm has previewed a new entry-level hatchback with a concept called the Cupra UrbanRebel and a sports car with the Cupra DarkRebel. The production version of the UrbanRebel (named the Raval) will go into production in 2025 at Seat’s Martorell factory in Spain, alongside its platform twins from other Volkswagen Group brands, including the Volkswagen ID.2. Schäfer said such an investment in manufacturing at Martorell showed the Volkswagen Group’s commitment to Spain, something further seen by the German giant being an investor in a new €10 billion EV battery factory in Valencia. “There are no problems with the government”, he said on the decision to move away from Seat, adding that Spanish customers had also responded well to Cupra. He also highlighted that, further afield, Cupra was the fastest growing brand in Europe. Schäfer said the wheels had been set in motion for Cupra to take Seat’s role long ago. He said it had always been a long-term brand, but Cupra’s success had cemented the thinking that this was the right thing to do. There had been debate about trying to reinvigorate Seat, he said, but the brand had a history of making losses and ultimately Cupra’s greater earning potential cemented the decision. “I think it was the right decision in hindsight, but it’s a gamble”, said Schäfer. “I’ve seen lots of new names come up and go, but this was a good decision. Cupra is bigger than Alfa Romeo and Polestar, so not just new brands but also old”. It’s possible that the Seat name could be dropped completely from the Leon when that car is facelifted in 2024, leaving it solely as the Cupra Leon. The Ibiza is unlikely to be replaced in its current form when it’s phased out, while Cupra is also planning to launch an SUV based on the Audi Q3 in 2024. In effect, the more profitable and successful Seat models will be absorbed into Cupra, the new brand at the same time launching into higher segments with more strikingly designed cars. In the longer term, Cupra is investigating a halo sports car based on the Cupra DarkRebel concept revealed at the Munich motor show. +++

+++ A quick trawl through social media reveals that not everyone is enamoured by how the alternatives to ICE-powered cars are shaping up. That could have much to do with the fact that the ICE ban will force people out of new cars for which no comparable alternative exists, but that doesn’t mean it never will. TOYOTA ’s next-generation battery tech, due in 3 years, is an example. It will give a range of up to 1.000 km, reduce cost by 20% and have a charging time of 20 minutes “or less”. Since ‘alternative propulsion’ began to be taken seriously a couple of decades ago, no engineering consultant, independent research body or self-respecting car maker’s R&D department was without a technology roadmap representing how various types of ever more efficient engine tech would evolve. As far as the greening of the car was concerned, the message was always: ‘There is no single solution’. Back then, BEVs were seen as likely being confined to town use, and nobody predicted they would become this capable this quickly. As a result, the BEV has overtaken earlier predictions to the point that drivers expect nothing less than a like-for-like replacement for an ICE car without any compromises such as refuelling time, range restriction or a sparse charging network. But according to those roadmaps, technology is probably exceeding expectations, and there’s a chance that in the next 15 years, today’s EVs will look positively ancient. That work being done on battery technology by past-master Toyota is an example of how quickly development is progressing. Despite the Prius being a loss-leader for years after its 1997 launch, Toyota stuck to its guns, and in the process it must have compiled an impressive knowledge base on battery development. On that basis alone, its claims about what comes next on the technology roadmap should be worth taking seriously. Earlier this year, the Japanese manufacturer announced a new next-generation lithium battery that will arrive by 2026 to power next-generation BEVs. These vehicles will be ground-up developments based on a modular structure with the bodies divided into three sections: front, center and rear. The center section will house the battery, so any changes in rapidly progressing battery technology will only affect that section. The 1.000 km battery will be the ‘performance’ version; there will also be a ‘popularization’ version that gives a 20% increase in cruising range compared with existing batteries, charging in less than 30 minutes, combined with, crucially, a reduction in cost of 40% compared with existing tech. The cost reduction is due to the use of a ‘bipolar’ structure that essentially means combining 2 electrodes in one, reducing the number of parts by 20%. The solid-state battery, which Toyota now hopes to commercialize in 2027 or 2028, promises even better range and a charging time of less than 10 minutes. +++

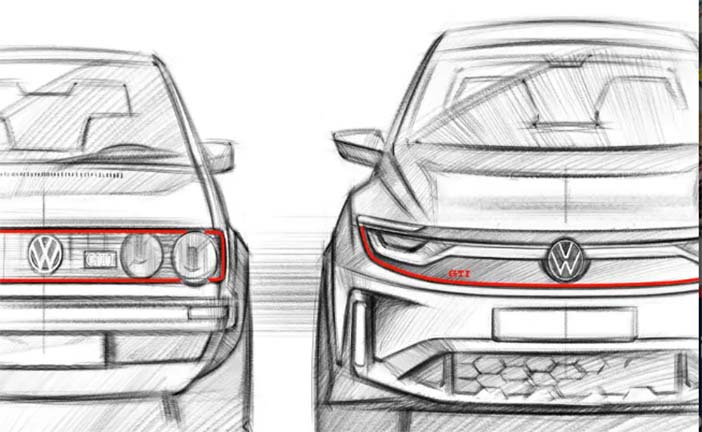

+++ Oliver Blume has laid out his plans for the VOLKSWAGEN GROUP in an address to the media on the eve of the 2023 Munich motor show, confirming design is set to become a key pillar in the company’s operations in the future. In the address, made a year after he succeeded Herbert Diess as CEO of the German car maker, the 55-year-old German revealed that design is set to take on an even more important role within the Volkswagen Group as part of a broader ten-point plan aimed at navigating the company through the transformation from traditional internal combustion engine models to more contemporary electric-powered models. Reflecting on the Volkswagen Group’s efforts to provide greater differentiation between each of its individual car brands, which include Volkswagen, Volkswagen Commercial Vehicles, Škoda, Seat, Cupra, Audi, Lamborghini, Bentley, Porsche and Scout, Blume said design is one of the most critical factors in determining success. “With sharpened design identities, we create distinctive products and enhance brand differentiation. In exterior, interior, and digital presence. The Volkswagen Group is becoming a design-driven company”, he told journalists an other media representatives. Against a backdrop of the Volkswagen brand’s new ID.GTI Concept (photo) and Cupra DarkRebel show car, Blume said the Volkswagen Group’s new design-led approach will “aim for high design quality and strong brand differentiation. The design strategy focuses on the evolution of established models, electric technology beacons and product icons of the Volkswagen Group”. Further points within the ten-point plan referred to by Blume include an improved platform strategy and more competitive technology profile, advancing the “in China for China” strategy with local Chinese partners, and a growth plan for the USA, including the relaunch of the Scout brand with electric models featuring a unique design for the North American market. Blume, who is also CEO of Porsche, also said the Volkswagen Group board had developed a “refined portfolio plan for the company’s Cariad software division. He also referred to the ramp-up of battery production division PowerCo and the recent decision to establish a new battery gigafactory in Canada and the introduction of an integrated mobility platform under Moia. Speaking about the renewed focus on design, the head of the Volkswagen Group’s design operations, Michael Mauer, said efforts are being made to ensure the individual design bosses at each of the company’s brands work closer with their respective CEOs. “Design works because it translates what a brand is at its core. Through direct exchange with the CEO, a comprehensive implementation of design principles for a consistent brand experience will be ensured: from corporate presence to products and digital offerings for each brand. The focus remains consistently on the customer and the product”, said Mauer, who is also the design boss at Porsche. +++