+++ South Korea’s industry ministry said Friday it will request the government of FRANCE to review its subsidy policy on electric vehicles (EVs) to include Kia’s Niro. The move came after France plans to offer subsidies for EVs meeting the required environmental score while excluding vehicles with a substantial carbon footprint from the benefits. The list of vehicles eligible to win subsidies announced Thursday was mostly European, with Hyundai’s Kona manufactured in the region being the only Korean model to be included. The Kia Niro EV, produced in South Korea, however, was not on the list, making it ineligible to win subsidies for those sold after Saturday. “The ministry plans to work together with local industry and file an official complaint so that the Niro, which was excluded from the list, receives a reassessment”, the Ministry of Trade, Industry and Energy said. +++

+++ The HYUNDAI KONA ELECTRIC will continue to be eligible for cash incentives offered by the French government to buyers of electric vehicles. Paris on Thursday released a list of 78 EVs from 22 brands eligible for the government incentives. According to the announcement, the Kona Electric was the only Korean vehicle that remained eligible, whereas 2 Kia vehicles (the Niro and Soul) were excluded from the list. The new eligibility list reflects the French government’s recently announced EV cash incentive policy that measures the carbon footprint throughout the entire process of car manufacturing from production to shipping. Auto exporters to France were expected to take a hit from the stricter policy. The subsidy list is based on the sum of carbon emissions across an evaluation of six categories: steel, aluminum, other raw materials, battery, assembly and shipping. Only the EVs with more than 60 out of 80 points are eligible for the French government incentives. The fact that Hyundai Motor’s Kona is manufactured at the Korean automaker’s plant in the Czech Republic and shipped from there to France is likely to have been a positive factor in ensuring its eligibility for France’s EV incentives. But as Kia has been exporting the Niro and Soul from Korea to France, the latter 2 models are at a disadvantage in terms of their carbon footprints. Korea’s Ministry of Trade, Industry and Resources said Friday that the government will raise an official objection to France’s decision, arguing for the inclusion of other Korean EVs on the incentive eligibility list. “Considering that the revised French incentive policy can impact Korean auto exports, the Trade Ministry has carried out working-level talks with the French government over Paris’ EV incentive amendments since June”, said the Trade Ministry in a statement. The ministry explained that both sides agreed to a clause that allows companies to submit their calculations of carbon emissions to the French government through an official procedure if there is an objection to France’s evaluation of a model’s sum of carbon emissions. It added that it will work with the Korean car industry so that the Niro’s emissions might be re-evaluated. French automakers such as Citroen, Peugeot and Renault and other major European carmakers including BMW, Mercedes-Benz, Volkswagen and Volvo dominated the incentive eligibility list. Chinese-made EVs such as Dacia’s Spring and SAIC’s MG, which are among the cheapest EVs available in the French market, were excluded from the list. About 65 percent of the EVs sold in France made the list. The French government provides a cash incentive of between 5.000 euros and 7.000 euros to EV consumers. +++

+++ The HYUNDAI MOTOR GROUP could compete head-to-head with Apple in software, a domain where Apple, as the world’s most valuable company, is known to excel, as the South Korean automaker is progressing toward its own software-defined vehicle vision that aims to incorporate its proprietary connected car operating system into all new models by 2025. This bold move could be part of its strategy to dominate in-car screens with its own software, potentially opening new revenue streams through content and user data collection needed to pave the way for future autonomous vehicles. Hyundai’s competitor is Apple’s CarPlay software, which integrates iPhone features into car displays, allowing access to navigation, music and more. At its 2022 Worldwide Developers’ Conference, Apple claimed that 79 percent of US car buyers prioritize CarPlay when choosing a vehicle. However, Hyundai was conspicuously absent from the list of carmakers that support Apple’s latest CarPlay iteration, unveiled during the conference. The next generation of CarPlay offers deeper vehicle integration with vehicle telematics like gauges and the engine and supports multiple displays, including the central screen, instrument cluster, and passenger-side screens in advanced vehicles. It also introduces customization options like personal wallpapers and car-optimized widgets from iPhone apps. “We are committed to developing proprietary software, focusing on enhancing vehicle performance and enriching the driving experience through our custom-built operating system”, a spokesperson from Hyundai commented on the lack of support. 14 automakers, including Land Rover, Mercedes-Benz, Lincoln, Audi, Volvo, Honda, Porsche, Nissan, Ford, Jaguar, Acura, Polestar, Infiniti and Renault, are set to support the new CarPlay, with model announcements expected by late 2023. When it comes to driver satisfaction, Hyundai has fared better than Apple and other automotive rivals. Its Genesis brand achieved a 74 percent satisfaction rating in a 2022 Consumer Reports Survey, surpassing Apple CarPlay’s approximately 60 percent and leading the pack among 33 car brands. Hyundai offers 2 advanced vehicle operating systems that power these infotainment features: the Connected Car Integrated Cockpit for its premium Genesis models and the Connected Car Navigation Cockpit for other models. The CCIC, exemplified in the Genesis G90, merges dual 12.3 inch displays into a comprehensive interface, integrating driving, media, and navigation data. The CCNC, introduced first in the all-new Grandeur, offers 2 separate displays with similar, but less flexible functionality. “Automakers have the final say on adopting the next-gen CarPlay, and it’s not dependent on vehicle specifications. Even cars without the latest integrated displays, like those merging the cluster and center screen, can support it”, said an engineer from the Korean auto parts maker Hyundai Mobis who wished not to be named. Although Hyundai offers a comprehensive vehicle operating system encompassing telematics, infotainment and vehicle control, Apple’s next-gen CarPlay is starting to blur these boundaries. It’s evolving beyond a mere iPhone-powered interface, encroaching into areas traditionally managed by vehicle-specific operating systems. “Hyundai might believe it can hold its own against a tech giant like Apple with its car software. They might reckon it’s good enough not to deter buyers while giving them the control and data they want. You know, supporting next-gen CarPlay won’t necessarily double their sales”, said Koo Sang, a professor at Hongik University and an expert in automotive and mobility design who had worked at Kia Motors Design Institute. “Plus, there’s always the question of what Apple might do with all that vehicle telematics data from CarPlay”, he added. In an abrupt strategic pivot, General Motors announced in April that it would eliminate Apple CarPlay and Android Auto across its EV lineup, transitioning to Google-backed infotainment systems in future models. This move is seen as central to GM’s aggressive push toward its proprietary Ultifi software platform, a shift aimed at enhancing data collection and bolstering subscription-based revenue streams. GM wants to dramatically expand its subscription revenue, targeting an increase to $25 billion by 2030. Hyundai, on a parallel track, is committing 12 trillion won ($9.2 billion) on software development, a whopping 60 percent of its entire electrification investment by 2030, to boost software sales to 30 percent of its total revenue. The company’s swift adoption of SDV strategy, following a trend set by Tesla in 2014, has been enabled by partnerships with entities like Hyundai Mobis, mobility software provider Hyundai Autoever, and in-vehicle and cloud software developer Sonatus. However, the advent of Apple’s next-generation CarPlay presents Hyundai with the dilemma between realizing its SDV vision for self-driving data collection and in-car infotainment revenue streams and addressing market demands to incorporate popular systems like CarPlay that might sway consumer decisions. “Whether Hyundai’s software, boasting improved driving functions, sleek interfaces, and clever features, can go toe-to-toe with Apple’s advanced CarPlay is still up in the air. However, they seem to have the upper hand right now, given the highest-rated top-notch infotainment system, broad partnerships and significant investment in SDV”, Koo said. +++

+++ JAPAN ’s slow transition to electric cars has been blamed on the usual suspects: high prices, few models, limited charging infrastructure and range anxiety. To help overcome some of those hurdles, gaming company DeNA (which started a mobility division in 2015 and developed applications for car-sharing, self-driving and taxi dispatch services) has developed an EV simulation tool that can assess the lifespan and cruising range per charge of battery cars over time. The web-based tool, called FACTEV, uses data from vehicle inspection certificates and periodic servicing information to analyze how a gas car is actually used. By adding road characteristics (for example, highway versus city driving) and weather conditions (batteries drain faster in extreme heat or extreme cold), the simulator then selects a suitable EV alternative and provides data on practical performance. For example, FACTEV shows that a Nissan Leaf electric car driven on the northern island of Hokkaido (home to the Sapporo Snow Festival) will get between 106 kilometers and 212 kilometers per charge in its first year and will still go 99 kilometers to 198 kilometers per charge in 5 years. The comparison vehicle (a gasoline-powered Nissan Note) covered an average 41.7 kilometers per trip, and a maximum of 100 kilometers. DeNA has so far conducted a trial of the service with Japan’s 4 major car-leasing companies (Mitsubishi Auto Leasing, Nippon Car Solutions, Orix and Sumitimo Mitsui Auto Service) and aims to commercialize the service next year, including at dealerships. It takes more time and effort for a dealer to sell an EV compared to a gasoline car or hybrid because of buyer reluctance, said Kiyo Sako, group manager at DeNA’s EV Solutions Group. Battery EVs accounted for just 2% of car sales in Japan last year, compared to 51% for ICE vehicles and 43% for hybrids, according to Bloomberg Intelligence. “Dealers are doing business from hybrids and gasoline cars, so they don’t see the need to sell EVs, where they hear negative comments from customers regarding lack of charging infrastructure and subsidies”, Sako said. DeNA has received positive reviews regarding its service from leasing companies, saying the data “proved to be a boosting factor to make a decision to purchase an EV”, she said. FACTEV also has applications for the second-hand market. Using the same driving data and harnessing artificial intelligence, the tool can predict the lifespan of an EV and its future driving range without requiring battery performance information, said Tooru Futami, a DeNA fellow in charge of developing the product. Also, “leasing companies would want to use second-hand EVs for a long time, given their maintenance costs are less than gasoline cars”, Sako added. Futami, who was involved in developing Nissan’s Leaf earlier in his career, said that developing a market for second-hand EVs is crucial to accelerating overall sales of electric cars in Japan. He sees huge potential for used EVs if driver needs are known beforehand. An average driver covers around 50 kilometers a day, and second-hand EVs can run for at least around 100 kilometers per charge, he said. “In Japan, consumers are inclined to buy cars worth ¥3 million ($20.400) at maximum, so people don’t buy Teslas or Nissan’s Ariya, but prefer something like a Sakura”, Futami said, referring to Nissan’s pint-sized $13,000 EV that’s only available in Japan. A well-established second-hand EV market with wider options of affordable battery cars and increased trade-in prices would encourage leasing companies to buy more new EVs, he said. “EVs and their battery life have gotten better with time, but the old mindset hasn’t changed”, Futami said. “From now, more solutions to assess EV health will surface”. +++

+++ KIA will present its future sustainable mobility strategies and unveil five new concept vehicles for the first time at the CES tech show in Las Vegas early next month, the Korean automaker said Thursday. Returning to CES for the first time since 2019, Kia said it will redefine the “Purpose-Built vehicle”, or PBV, the brand’s total mobility solution, to “Platform Beyond Vehicle” to offer experience-based values that suggest new business and lifestyles. The automaker added that it will look to focus on spreading Kia’s new PBV vision and business strategies as the event marks its first participation since it relaunched its brand from Kia Motors to Kia in 2021. Under the theme of “All Set for Every Inspiration”, the automaker plans to debut five new PBV concept cars, including 3 midsized vehicles, a large vehicle and a small vehicle at its exhibition booth set up at CES. Along with the new PBV concept cars, Kia said it will showcase new technologies, including “Easy Swap” that can change the life module of a vehicle depending on the purpose of transportation. For instance, the technology can turn a taxi into a delivery-only vehicle. The automaker will also display “Dynamic Hybrid” technology that can assemble different sizes of car bodies to produce various models in smaller production to suit the needs of customers. Kia will have an outdoor exhibition to boast its all-electric vehicle lineup such as the EV6 and EV9. Kia will unveil its detailed plans for the PBV mobility strategy during its official press conference on Jan. 8, 2024. CES will take place at the Las Vegas Convention and World Trade Center from January 9 to 12, 2024. +++

+++ NISSAN is expanding its research ties with a leading Chinese university as it and other foreign car companies try to claw back market share in the important Chinese market. The Japanese automaker announced Sunday that it would launch joint research next year with Tsinghua University on reaching Generation Z (defined for this project as those born between 1995 and 2009) and on the social responsibility of automakers in battery recycling, charging stations and other electric vehicle-related issues. The major auto companies were caught flat-footed by a boom in electric vehicles in China that has given rise to new Chinese competitors that have gobbled up market share at home and are now moving into Southeast Asia, Europe and other overseas markets. Nissan’s sales in China plunged 34% in the 6 months from April to September compared with a year earlier. “Market conditions in China have become extremely tough”, Masashi Matsuyama, the head of Nissan’s Chinese investment company, said at a news conference in Beijing. Nissan plans to develop 10 further new-energy vehicles for the Chinese market, 4 under its own brand by 2026 and the other 6 for Chinese joint venture partners. The company is aiming to launch the first Nissan-branded model in the second half of next year. The automaker is also stepping up its electric vehicle offerings in other markets. Nissan, which has an alliance with Renault, announced last month that it would retool a factory in Great Britain to make electric versions of its 2 best-selling vehicles. China’s electric vehicles have become a trade issue for the European Union, which has launched an investigation into Chinese government subsidies to determine whether they have given China-based manufacturers an unfair competitive advantage. Nissan and Tsinghua University have been research partners for several years. They established a joint center in 2016 to study electric vehicles and autonomous driving for the Chinese market. +++

+++ POLESTAR recently announced its plan to produce the new all-electric ‘4’ at Renault Korea Motors’ Busan plant in 2025. The new partnership comes as Polestar, a spinoff from Volvo in 2017, is seeking to secure a bigger footing in the burgeoning EV market with a more diversified product lineup from the ‘2’ sedan and the ‘3’ SUV to the latest ‘4’ coupe-styled SUV. At a time when it is crucial to beef up its production, especially for sales in North America and Korea, the carmaker decided to team up with Renault’s Busan plant. “Located with direct access to exporting ports, the Busan plant has 23 years of experience in vehicle manufacturing and about 200 employees”, Polestar CEO Thomas Ingenlath said upon the partnership announcement in November. Established in 1997, the Busan plant has a production capacity of 300.000 vehicles per year and boasts the lowest defect rate of 0.15 per car among Renault’s 20 factories around the world. “When the plant produced Nissan’s X-Trail for exports to North America in 2014-2020, it secured 50 percent more orders than planned”, said a Renault Korea official. “Adding to the car’s upbeat sales, the Busan plant showed better quality even compared to those in the US and Japan”. Another distinctive feature of the Busan plant is its “mixed production line”, where a single assembly line can produce multiple models regardless of engine type. 7 different cars were produced on one production line in 2016-2019. The planned production of the Polestar 4 suggests the French automaker’s strategic goal that goes beyond simply improving manufacturing output. “While Renault Korea is accelerating its electrification efforts, it aims to harness its own expertise from its partnership with the premium EV maker both in production and quality management”, the Renault official said. Renault Korea has big plans for the coming years, with the Aurora 1 hybrid project in 2024 and a brand-new EV project in 2026. The carmaker is also committed to sharing growth with the local community. In May, it signed a memorandum of understanding with the Busan city government, parts makers and research institutions to navigate the port city’s future automotive industry. +++

+++ PORSCHE South Korea’s annual sales exceeded 10.000 for the first time this year, according to Korea Automobile Importers and Distributors Association, Thursday. The figure for January to November reached 10.442. The German luxury brand’s Cayenne took the highest portion at 4.440. The Panamera, Taycan and 911 followed in order. The record came after the brand’s regional office was founded in 2014 and saw annual sales ratcheting up from 4.204 in 2019 to 7.779, 8.431 and 8.963. The last figure, from 2022, was the fifth-highest sales number among the company’s regional markets globally. One of the reasons behind the record sales is the brand’s diverse vehicle options that have expanded in the past few years, catering to a broader range of consumers. Following Taycan’s launch in South Korea in 2020, the brands’ lineup includes gasoline, hybrid and EV cars in the styles of coupe or more spacious sedans. The Cayenne, with its gasoline and hybrid engines, is now available in 11 different editions, proving to be the most attractive model in the country and ranking fourth-largest in sales for Porsche across all of its global markets this year. Next year the brand is adding 2 more editions under the Panamera for the Korean market. Porsche’s popularity peaked this year partly because of its continued investment in after-purchase services. Last October, the company opened its Porsche Now Seongsu dealership and a new studio in Songpa District (with the world’s first 24-hour EV recharging service) both in Seoul. They are new additions to its 14 dealerships, 14 service centers, 5 second-hand shops and 4 studios across the country. The brand’s charity continues to build upon donation records each year since launching the campaign “Porsche Do Dream” in 2017. Offering financial support for school gym construction, scholarships for art and sports talents, building traffic safety systems and preserving the country’s non-tangible national heritages, the firm has spent nearly 5.9 billion won ($4.5 million) in the past 6 years. The philanthropic walks prompted the Seoul Metropolitan Government last week to present Holger Gerrmann, CEO of Porsche Korea,with the city’s honorary citizenship, an annual honor for 15 selected Seoul citizens of foreign nationality. The recognition follows the brand’s winning the city mayor’s plaque for the corporate-social-responsibilit

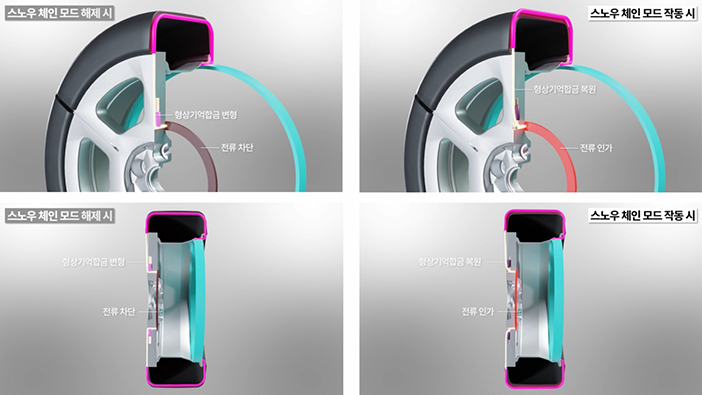

+++ Hyundai and its sister company Kia on Monday unveiled a new tire technology that promises to improve winter driving safety and convenience by offering an automatic, hassle-free alternative to traditional SNOW CHAINS . The patented technology integrates snow chains into the tire using a shape memory alloy. Traditional snow chains, known for their cumbersome installation and removal process, often deter drivers from using them. This new technology enables automatic deployment and retraction of snow chains with the push of a button. The core of this technology lies in embedding shape memory alloy modules within the tire and wheel. These modules, normally hidden, can extend outwards to act as snow chains when activated by the driver. The design features grooves in the wheel and tire, which is where these modules are housed. When applied with an electric current upon driver activation, the shape memory alloy changes form. In its inactive state, the alloy sits in an “L” shape inside the wheel. When activated, it transitions to a “J” shape, pushing the module outside the tire to engage with snow. These protruding modules mimic the function of conventional snow chains that provide a rugged, uneven tire surface that increases traction on snow and ice, allowing for a seamless transition to snow-ready tires without manual intervention. This technology also doubles as a wear indicator for the tires. When the tire tread becomes excessively worn, its surface becomes flush with the retracted module, making it possible to alert drivers of critical tire replacements. The Hyundai Motor Group has filed patent applications for this technology in both South Korea and the United States. Plans for mass production are contingent upon further development, including comprehensive durability and performance testing. “Dealing with snowy roads can be tricky, and we know snow chains are a hassle to put on and take off for many of our customers. We’re committed to creating solutions that both keep our drivers safe and make their lives easier,” said a spokesperson from Hyundai. +++

+++ The race to be SOUTH KOREA ’s top auto importer is coming down to the wire as BMW tries to reclaim the No. 1 position from Mercedes-Benz for the first time since 2015. According to the Korea Automobile Importers and Distributors Association’s report, BMW sold 69.546 vehicles in the Korean market from January to November. Mercedes-Benz sold 68.156 units in the same period, 1.390 cars less than BMW. The bestselling models of the 2 German automakers are the BMW 5 Series and the Mercedes-Benz E-Class. The former has sold 18.907 units and the latter, which is the bestselling model among all imported vehicles in Korea, has sold 22.211 units so far this year. Up until July, it appeared to be smooth sailing for BMW to reclaim the top importer of the year status for the first time in 8 years, as its accumulated sales were some 3.000 units more than Mercedes-Benz to give the automaker a comfortable lead. However, Mercedes-Benz started catching, up as it rolled out discounts and promotions in August. With the New E-Class slated to hit the domestic market in the first half of next year, the automaker has been carrying out discounts of up to 10 million won ($7.600) to offer the existing E-Class at a price as low as a little over 60 million won. As a result, Mercedes-Benz took the monthly top auto importer spot for four months in a row while selling over 10.000 units of the E-Class just between September and November. To cope with the fierce competition, BMW selected Korea as the first country for the global launch of the New 5 Series in October. According to online car shopping platform Getcha, BMW’s latest premium sedan was already having discounts of 4.5 million won despite its recent debut in the market. According to the KAIDA report, Mercedes-Benz sold 7.168 units and BMW sold 7.032 units in November. Given this, the current gap of over 1.300 units between BMW and Mercedes-Benz may seem too large to be filled with just one month left for this year’s calendar. However, large-scale, aggressive promotions can turn things around and impact the standings quickly. Last year’s competition came down to the very last month. BMW was 188 units ahead of Mercedes-Benz in total sales in November, raising the possibility it might regain top auto importer status. However, the final results after December showed that Mercedes-Benz once again continued its reign at the top in 2022, as it sold 80.976 units, which was 2.341 cars more than BMW. +++

+++ SUBARU has unveiled to the press its new development base set up in their Gunma plant in Ota, Gunma Prefecture, ahead the start of its operation next month. The new facility aims to speed up development of electric vehicles and includes a space dedicated to co-manufacturing with makers of auto parts. The carmaker spent approximately ¥30 billion to build the 7-story facility which spans 48.000 square meters of floor space, which is twice the size of their headquarters.Subaru hopes that the operation of the facility will help reduce the development time of EVs to one-half that of gasoline vehicles. A 12-meter-wide high-definition display on the 7th floor will show computer graphics of cars in development to simulate how they run and how light reflects on their bodies. “We used to develop gasoline-powered vehicles by passing the baton from one department to another, but the same approach cannot speed up the development of EVs”, said Hiroshi Watahiki, managing executive officer of Subaru. “We want to proceed with developing EVs in an integrated manner, including with our suppliers”. +++