+++ AFEELA , the new electric vehicle joint venture between Sony and Honda, is planning to introduce a lineup of 3 vehicles by the end of the decade, aiming to compete with the likes of Tesla. In addition to the sedan it has already showcased in pre-production form, there are plans for an SUV and a low-cost compact electric vehicle. Japanese giants Sony and Honda revealed their collaboration in establishing a new joint venture named Sony Honda Mobility in 2022. The partnership debuted its first prototype, a spacious and technologically advanced all-electric sedan, at CES 2023. This vehicle will be marketed under the newly formed Afeela brand. Now, reports indicate that the sedan was just the start. Unnamed sources told that, following the debut of the production version of the sedan in 2025, a related SUV will be unveiled in 2027, and an affordable compact car will arrive in 2028 or later. All 3 vehicles will be introduced under the Afeela brand and will utilize the same platform to streamline production costs. Although specific details are currently limited, reports indicate that the SUV will boast even more advanced technology compared to the sedan. Meanwhile, the compact vehicle will prioritize cost reduction by featuring fewer tech features and will be similar in size to a Toyota Corolla or a Volkswagen Golf. Additionally, it will share components with Honda’s EVs, which are being developed independently of any Afeela products. Although still in the development stage, Sony Honda Mobility states that the Afeela sedan will feature a 91 kWh lithium-ion battery pack and motors at each axle that combine to produce 489 hp. Tech development is being spearheaded by Sony, which is collaborating with brands like Microsoft to craft a conversational voice assistant leveraging its AI technology. The infotainment system, co-designed with Epic Games, incorporates gaming-inspired features such as monster mode. Additionally, reports suggest the company is working on video games that drivers can enjoy directly from their vehicles. +++

+++ First released in 2013, the i3 marked BMW ‘s initial foray into the realm of mainstream electric vehicles. Primarily designed as a city car rather than a long-distance traveler, 3 years after its demise, the BMW i3 remains a dapper little puddle jumper that isn’t too expensive on the used-car market. Like most luxury cars though, and especially ones from established European marques, it’s not the initial cost but the lurking maintenance expenses that can catch you off guard. I’ve encountered numerous i3 owners lamenting and reporting that dealerships frequently demand over €30.000 for battery replacements. BMW sold the i3 as both an all-electric vehicle and as a range-extended hybrid with a small combustion engine. Now that the small car has left production, it appears as though dealers are slapping i3 owners with huge repair bills. The issue comes down to the high-voltage battery used in the i3 design. It consists of 8 cells and when just one goes bad, the repair bill can get crazy. It’s also worth considering that, in theory, a person might be able to find a third-party shop willing to do this kind of work for far less. Many believe that of the 8 cells in an i3 battery, only 1 typically goes bad at this sort of mileage. If true, again, in theory, it could be replaced by a reputable shop or a skilled mechanic for under €10.000 since a single module is available for less than €3.500 from the dealer. Regardless, it’s clear that sometimes, the cheapest BMW i3 doesn’t end up being so inexpensive in the long run. +++

+++ CHINA already leads the battery industry and is now looking to establish itself as a juggernaut of solid-state batteries, creating a massive consortium of major battery manufacturers, researchers, and government officials. The consortium, dubbed the China All-Solid-State Battery Collaborative Innovation Platform (CASIP), includes CATL, BYD’s battery arm FinDreams Battery, CALB, Svolt Energy Technology, EVE Energy and Gotion High-tech, as well as automakers Nio and BYD. These firms represent 6 of the 10 top automotive battery makers globally and other unspecified state-owned Chinese automakers will also be involved. The aim is to build a supply chain for solid-state batteries by 2030. Additionally, CASIP will work on basic research, key technologies and the joint development and manufacturing of electric vehicles with solid-state batteries. Several key government members are also involved, including the Ministry of Industry and Information Technology, the Ministry of Science and Technology, the Assets Supervision and Administration Commission of the State Council, and the National Energy Administration. While speaking at an event to celebrate the launch of the consortium, the vice-chairman of the Committee on Economic Affairs of the Chinese People’s Political Consultative Conference, Miao Wei, said that “the ratio of new-energy vehicles to new car sales will be more than half by 2025 or 2026” and “we should take advantage of having a large market for new-energy vehicles to realize the early industrialization of all-solid-state batteries”. The all-star line-up of battery manufacturers and automakers will do battle with Toyota. The Japanese company has more than 1.300 patents for solid-state batteries while Chinese companies have less than 100 combined. Toyota has partnered with oil refiner Idemitsu Kosan and wants to commercialize solid-state batteries in 2027 and 2028 before reaching full-scale mass production. “AI is changing the way we do materials research and development, and it will vastly accelerate the speed of all-solid-state battery R&D”, added Tsinghua University professor Ouyang Minggao, also involved in the consortium. “By around 2030, we will have a higher chance of achieving a breakthrough for the industrialization of all-solid-state batteries”. +++

+++ The CHRYSLER Pacifica is currently the brand’s only vehicle but it won’t stay that way for long with confirmation that an all-electric SUV will join the brand’s line-up in 2025. This new Chrysler model will not be a production version of the Airflow Concept but instead a yet-unknown SUV. It is expected to be underpinned by the STLA Large platform and may be similar in size to the Jeep Wagoneer S. Chrysler chief executive Christine Feuell noted the brand is committed to a rapid growth of its line-up over the coming years. “The brand was not invested in for a very long time”, she said. “When I joined in 2021, we set out to develop a product and technology road map to revitalize the future of Chrysler. We have a really healthy cadence of new-product development and launches starting with the battery electric vehicle launching in 2025. We’ll have a Pacifica refresh coming, and then some more new vehicles launching in quick succession after that”. An update to the Pacifica could prove to be particularly important for the brand. Last year, Chrysler sold 120.000 Pacificas, significantly more than the 75.000 Toyota Siennas, 66.000 Honda Odysseys and 43.000 Kia Carnivals sold over the same period. “We believe in the future of the minivan. I think we just need to reframe and reimagine what it can be”, Feuell added. “This is a segment that Chrysler created, and I’m looking forward to re-creating what the segment could be in the future”. It is unclear what updates Chrysler has in the works but an all-electric version is certainly a possibility. “Look, I’d always love to have more and faster, but I can tell you that we’ve not only grown sales, we’ve improved the profitability of the brand significantly over the last 2 years and that is helping to fund the new-product development that you’ll see going forward”, Feuell concluded. +++

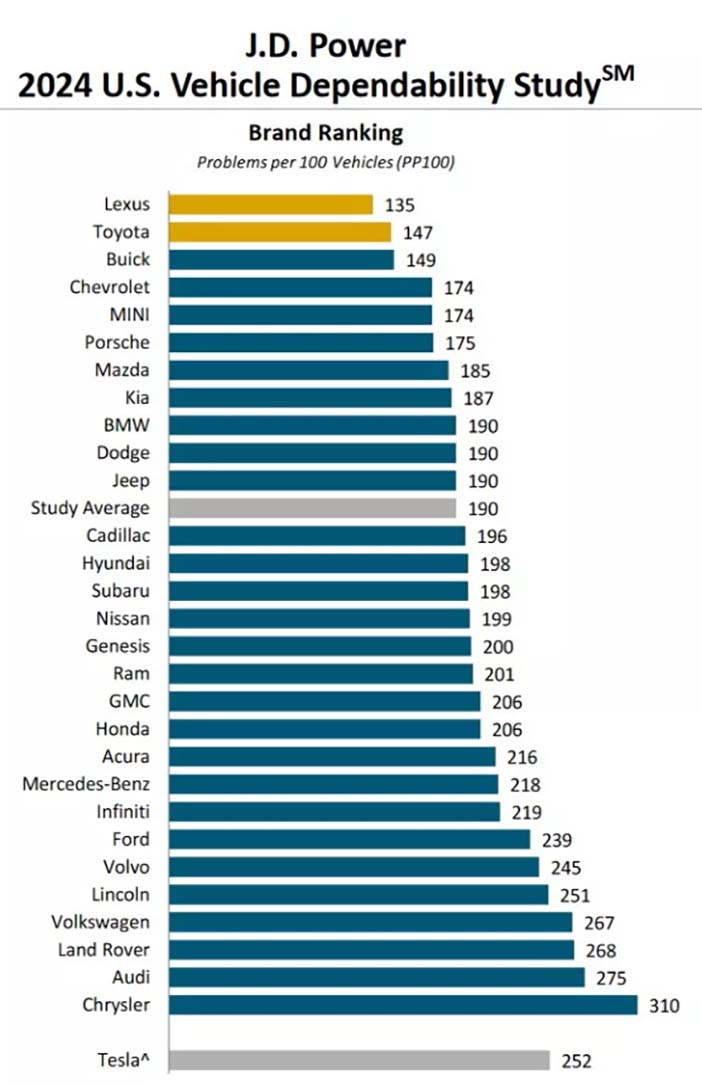

+++ The latest DEPENDABILITY study results from J.D. Power make for grim reading if you’re in the market for a new car. The longer-term reliability of two thirds of all brands has decreased, and industry-wide, drivers are experiencing 190 problems per 100 vehicles. That’s 4 more problems per 100 vehicles than the study found 12 months ago. Worse still, the rate at which problems present themselves has increased. A year ago, 12 percent of people experienced an issue in the first 90 days to three years of ownership. Now, the rate is up to 17 percent. It should be noted here that JD Power’s 2024 U.S. Vehicle Dependability Study collected feedback from 30.595 original owners of 2021 model-year vehicles after three years of ownership. This study took place from August through November 2023. Fortunately, according to J.D. Power’s senior director of auto benchmarking, Frank Hanley, there may be mitigating factors. This drop in dependability can likely be attributed to the pandemic, the pressures it put on manufacturing, and its impacts on the automotive market. That suggests that it could get better as supply lines normalize, but it still leaves automakers with some important considerations. “The average age of vehicles on American roads today is approximately 12 years, which underscores the importance of building a vehicle designed to stand the test of time”, said Hanley. “Automakers must ensure new vehicle technology introduced today will still meet the customer’s needs years down the road”. The area that has proven to be the most problematic for automakers is in-vehicle tech. Owners experience 49.1 problems per 100 vehicles as a result of their infotainment systems. That’s roughly twice as many problems as the next most problematic area, vehicle exteriors. Connecting to Apple CarPlay and Android Auto is the top problem in this area, and a vehicle’s built-in voice recognition system is close behind in second place. Since high-tech features are some of the most problematic, it may not surprise you to learn that electric vehicles are the ones that owners complain about the most. EVs experience 256 problems per 100 vehicles, plug-in hybrids 216, hybrids 191, and internal combustion vehicles experience just 187 problems. High-tech issues aren’t the only ones for EVs, though. J.D. Power finds that 39 percent of EV owners say they have replaced their tires after three years of ownership. For owners of ICE vehicles, just 20 percent of owners have had to change their tires. So which brand does it best? The answer is easy: Toyota. The automaker’s central brand leads the mass market segment with just 147 problems per 100 vehicles, while its premium brand, Lexus, leads the luxury segment and the overall industry for a second year in a row, with just 135 problems per 100 vehicles. Unsurprisingly, the company earns the most reliability awards by model. In fact, Toyota’s nine dependability awards is the most any brand has won in a single study since 2017, when it won 10 awards. On the other end of the table we find Chrysler, with 310 problems per 100 vehicles, whereas Tesla is not included in the study as, according to J.D. Power, it does not meet the study’s award criteria. Nevertheless, it is estimated to get a score of 252 issues per 100 vehicles, which is way worse than the study average of 190 and would put it in the bottom 5 brands. When it comes to individual models, the top spot overall goes not to a Toyota or Lexus, or even a mainstream car for that matter, but to the Porsche 718 sports car series, comprising the Boxster and Cayman. Some of the highest-ranking models in their class include several Toyotas like the Corolla and Camry, the Lexus IS and the BMW X6. +++

+++ JLR (Jaguar Land Rover) will slow its introduction of battery-electric vehicles in the coming years and look to introduce more plug-in hybrids due to shifting consumer sentiment. In 2021, the automaker revealed that it would launch 6 full-electric Land Rovers and 2 electric Jaguars by 2026. However, during a recent earnings call, Jaguar Land Rover chief executive Adrian Mardell said the number of electric Land Rovers being launched has been reduced to 4. The first of these will be the Range Rover Electric set to arrive later this year and soon after its launch, an electric Range Rover Sport will hit the market. “We are a little bit slower than we said 3 years ago”, Mardell said. “We are taking our time to make sure that we put the best vehicles we have ever developed into the marketplace”. Following the launch of these 2 models will be a pair of smaller EVs using the firm’s new EMA platform. Limited details about this duo are known but they could serve as electric successors to the Range Rover Evoque and Range Rover Velar. A Defender EV is also on the cards, with the firm simply announcing it will land before 2030. Jaguar will be relaunched in 2025 with a new 4-door GT that will be followed up by a second electric vehicle. While the brand is still going all-in on BEVs, Mardell noted that demand for them has started to cool and as such, JLR is working to make more plug-in hybrids available in the interim. “What you have seen from other OEMs is that the race to BEV is starting to stutter a little”, said Mardell. “PHEV acceptance has been quite a surprise. We are working hard in the interim time to make more PHEVs available to the marketplace”. JLR increased its sales of PHEVs more than any other car manufacturer last year in Europe selling 45.224 units, a 68% rise. The brand ultimately wants 60% of all its sales to be BEVs by 2030 before rising to 100% by 2036. +++

+++ European buyers, once vocal critics of North America’s seemingly insatiable appetite for SUV cars and crossovers of every imaginable type and form, have now come full circle, embracing the body type themselves over traditional hatchbacks, sedans, wagons and MPVs. This shift, driven by many factors like evolving family needs and the rise of electrified options, has seen SUVs reach critical mass in Europe, becoming the dominant force not only in their respective segments, but also across the overall market. The continued rise in the popularity of SUVs and crossovers shows no signs of abating with the popular body style accounting for 51% of all new vehicles sold in Europe throughout 2023. Data from Europe indicates that approximately 6.63 million SUVs were sold across the continent last year, marking a significant 19% increase compared to 2022. The small SUV segment emerged as the largest, boasting 2.159,427 sales, representing a 14% rise from the previous year. Compact SUVs followed closely behind as the second-largest segment, with 1.904.669 sales. According to Dataforce figures, SUVs now constitute half of Europe’s 10 largest vehicle segments. Trailing the small SUV and compact SUV segments were small cars with 1.730.015 sales and compact cars with 1.508.061 deliveries. The premium midsize SUV and premium compact SUV segments followed closely behind, with 834.939 and 721.376 units , respectively. Demand for premium midsize SUVs outpaced all other market segments, primarily driven by the Tesla Model Y, which experienced an 85% surge in sales, totaling 254.822 units. The Mercedes-Benz GLC also saw a significant increase in popularity, with sales rising by 32% to reach 91.259 units. Notably, 48% of all premium midsize SUVs sold last year were Battery Electric Vehicles (BEVs), largely due to the influence of the Model Y. Strong BEV penetration can be seen across many other vehicle segments. For example, 58% of all luxury sedans sold in Europe last year were electric with the Porsche Taycan leading the charge with 19.965 examples sold, more than double the Mercedes-Benz S-Class in second position with 9.992 sales. In addition, 47% of midsize crossovers sold were electric with the Volkswagen ID.4 leading the way. Vehicles from the VW Group topped 12 of the 21 different segments, coming out on top in the compact, midsize, coupe/convertible, small SUV & crossover, compact SUV & crossover, midsize/large SUV & crossover, compact vans, midsize vans, compact premium, large premium, luxury sedan, and premium coupe segments. +++

+++ Last year, during his trip to China, where he met with a series of government officials, TESLA boss Elon Musk praised the country’s manufacturing industry and the workers at his company’s Shanghai plant for achieving top productivity levels globally. Now, reports indicate that the company is working to relocate the suppliers supporting its Shanghai factory closer to the United States by establishing operations in Mexico. However, the company may start facing resistance from the American government, the UAW, and a trade group representing Canada’s auto parts manufacturers, all of which are looking for ways to prevent Chinese companies from establishing themselves too comfortably in Mexico. Despite earlier concerns over Chinese automakers’ access to the U.S. market, Musk has reportedly invited suppliers from across the Pacific to Mexico in order to duplicate the supply chain Tesla’s Shanghai plant currently uses, unnamed sources told. This move is part of a larger initiative to produce more cost-effective EVs at a facility in Nuevo Leon, Mexico, which would subsequently serve Tesla’s plant in Austin, Texas. However, Tesla isn’t the sole automaker benefiting from parts sourced from Chinese-owned facilities in Mexico, as this segment of the industry saw a 15 percent growth in value in 2023. Experts argue that it’s logical for American automakers to leverage China’s highly efficient and cost-effective supply chain. Nevertheless, a separate report from last week suggests that the U.S. is looking to control the flow of products coming from China through Mexico. The White House is reportedly looking at ways to modify the existing tariffs against imports of Chinese-made vehicles, and is also looking at how it can limit the amount of data being gathered by Chinese vehicles, as the country’s automakers look to establish themselves in Mexico, too. As a result of this resistance, companies based in China are racing to establish themselves as suppliers in Mexico, and to set up shell companies in America’s southern neighbor. In response, the U.S. Treasury Secretary Janet Yellen went to Mexico in December to work on an agreement to strengthen Mexico’s screening of foreign investment. While economists believe that the U.S. should not close itself off completely to foreign trade with China, the Automotive Parts Manufacturers’ Association in Canada fears that a flood of Chinese suppliers could displace investment in North American companies. +++

+++ It’s been just 3 years since TOYOTA introduced the second generation of their popular GT/GR 86 sports coupe in 2021, alongside its Subaru BRZ counterpart. However, the rumor mill is already abuzz with speculation about a third generation of the series. Some sources even suggest an (admittedly) optimistic 2025 release date and a surprising new powertrain: a 3-cylinder turbocharged engine paired with a hybrid system. Here’s an analysis of the rumors and their potential implications for both Toyota and Subaru: For more than a year, reports about this specific scenario and platform and powertrain combination have been in the air. I initially covered these reports in October of 2022, but since then, 2 different narratives have emerged. One indicates that the next GR 86 will debut in 2028, featuring a 1.4-liter 4 cilinder turbocharged hybrid engine. Another suggests an earlier arrival in 2025, equipped with a 1.6-liter 3 cilinder turbocharged hybrid powertrain. It now seems that the latter scenario is more probable. According to a new report, the engine is expected to be similar to the one used in the GR Yaris and GR Corolla, but with a power output of “over 300 horsepower”. Additionally, it will incorporate some form of hybridization akin to that found in the Land Cruiser 250 and the upcoming Lexus GX. This configuration implies that it will maintain its front-engine/rear-wheel-drive layout, while still offering both a manual gearbox and an automatic transmission option. Keep in mind that this report comes from BestCar in Japan and doesn’t cite any specific sources, so you might want to take it with a grain of salt. What’s not up for debate though is just how persistent the rumors are. They resurfaced again late last year and certainly seem plausible given just how potent the engine in question is. Of course, developing a low-volume sports car isn’t exactly the best thing for margins at most automakers. That’s why Toyota and Subaru worked together to develop the GR 86 / BRZ in the first place. If Toyota indeed opts for its own engine in the next-generation GR 86, it could signal the termination of the partnership between the 2 in regards to the sports car series, as noted in the report. That, in turn, could spell the end of the BRZ, unless Subaru decides to go it alone in developing a successor for the compact sports coupe, which is unlikely but not entirely out of the question. +++