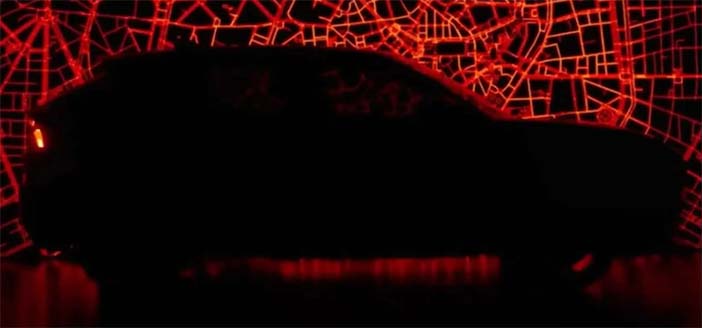

+++ “The outline of the future”. That’s how ALFA ROMEO defines it in the Instagram post where the Italian manufacturer shows the profile of the Milano. As its name suggests, the B-SUV will be unveiled on 10 April in Milan, Italy. It’s one of the most eagerly awaited new Italian models of the year. Over the last few months, we’ve already had a few glimpses of it through spy shots and an official video. With the Milano, Alfa Romeo returns to the B-segment after a 6-year absence. It’s a comeback in the form of an SUV and the Milano, which is expected to be around 4 meters long, is positioned below the Tonale. In the image, you can clearly see the profile, but also some details of the rear light units, which are illuminated. The rounded lines are described as “of the future”, as the Milano will be the forerunner of Alfa Romeo’s next new models. It is the Biscione’s first electric car and, although it is related to the Jeep Avenger and the Fiat 600e, it represents a turning point in the electrification of the range. In the background of the teaser is the city of Milan, from which the B-SUV takes its name, which has been used in the past for the Alfa Romeo 75 in North America. The official presentation of the Milano is now very close, but the teaser gives us the opportunity to remind ourselves of everything we already know. For example, looking at the spy shots, we saw that the classic Trilobo Alfa Romeo could be placed on top of the bonnet and that the led headlamp units are very similar to those on the Tonale and Stelvio. As for the interior, the sketches suggest typical Alfa Romeo styling, with instrumentation inherited (perhaps) from the Tonale. The electric motor should be the same as that used on the Jeep Avenger and the Fiat 600e (54 kWh battery pack and with a declared range of around 400 km, WLTP). Later versions could come with the 100 hp 1.2-litre 3-cylinder turbo petrol engine, available in both internal combustion and mild hybrid versions. But for full confirmation, we’ll have to wait a little longer. +++

+++ Boosted by strong electric vehicle sales, Chinese carmakers will be in the spotlight at the BANGKOK INTERNATIONAL MOTOR SHOW this week, underscoring the growing challenge to Japanese auto giants that have long dominated Thailand’s vehicle market. Chinese automakers such as Geely’s Zeekr and state-owned Xpeng Motors are slated to unveil their latest EVs to Thai customers as they debut at the Bangkok motor show, a weeklong expo that opens to public. At a media preview, the EV newcomers showcased their cars and technology at slick booths shoulder to shoulder with those from market leaders like Toyota that are household names in Southeast Asia’s second-largest economy. Hangzhou-headquartered Zeekr will launch 2 models in Thailand in June and open 10 showrooms in the country this year, as part of a wider expansion in Southeast Asia, vice president and head of emerging market Mars Chen said. Chen said Zeekr planned to position itself in the premium segment: “In the premium segment, there’s a lot of room for a new player like us”. Zeekr will compete with Chinese companies like BYD and Great Wall Motor that currently have the biggest share of Thailand’s EV market. Guangzhou-based Xpeng, which is showcasing a flying drone car at its booth, plans to open 5 showrooms in Thailand this year to offer higher-end EVs, said Elsa Zhang, senior manager for its overseas business. Chinese automakers have committed to invest more than $1.44 billion in production facilities in Southeast Asia’s largest auto manufacturing hub. Thailand is looking convert about 30% of its annual vehicle production into EVs by 2030. The expansion by Chinese EV makers in Thailand comes against the backdrop of intensifying competition at home where car makers are racing to cut prices. In 2023, Thais bought 73.500 battery EVs, or about 9% of domestic car sales, and that is expected to double by the end of 2024, according a Federation of Thai Industries (FTI) forecast. Local EV production capacity is expected to reach 100,000 cars by the end of 2024 as new facilities, mainly from Chinese car makers, come online, said FTI’s automotive industry spokesperson, Surapong Paisitpattanapong. Last year, Thailand produced 164 battery EVs. “EV sales are rising while ICE vehicles sales are falling,” Surapong said, referring to internal combustion engine vehicles and attributing the change to the cheaper EV models. “With that ICE car price, you can get a top EV model from several brands. Higher gasoline prices are also helping EVs”. But market leaders like Toyota, Isuzu and Honda are also working to maintain their grip. Major Japanese auto manufacturers are set to invest 150 billion baht ($4.34 billion) in Thailand over 5 years. Isuzu plans to use Thailand as a production base for an electric version of its D-Max pickup truck, with an aim to start exports in 2025, a Thai government spokesperson said last week. +++

+++ Chinese battery and automotive giant BYD achieved a record profit in 2023, annual results showed, despite fierce competition in the country as demand for electric vehicles grows. The Shenzhen-based company is now moving quickly overseas (including into countries in Southeast Asia but also further afield in Latin America and Europe) as a price war continues to be waged in China, the world’s largest automotive market. BYD overtook Elon Musk’s Tesla in the 4th quarter of 2023 to become the world’s top seller of EVs. The firm recorded a net profit of 30 billion yuan ($4.16 billion) last year, according to a filing to the Shenzhen Stock Exchange, up 80.7 percent year-on-year from 16.6 billion yuan in 2022, reaching an all-time high. The figure is in line with a forecast issued by the firm in late January of 29-31 billion yuan. Originally specialising in the design and manufacture of batteries, the company began diversifying into the automotive sector in 2003. In April 2022, BYD announced it had ceased the production of cars powered solely by gasoline, instead focusing exclusively on hybrid and electric models. BYD’s biggest advantage it now holds over competitors is scale, Tu Le, founder and managing director of Sino Auto Insights, said. The firm’s high production volume allows them to “aggressively price their vehicles and keep pressure on struggling EV startups and Original Equipment Manufacturers (OEMs), including Tesla”, said Le. BYD last year became the first automaker to pass the milestone of 5 million hybrid and all-electric vehicles sold, cumulatively. China is now the world’s largest producer of greenhouse gases, but officials plan for domestic car sales to be made up mainly of electric and hybrid models by 2035. The country’s EV market has grown rapidly in recent years, initially propelled by purchasing subsidies that were discontinued in late 2022. Now dozens of domestic automakers are engaged in a stiff battle of price cuts, fighting to get ahead in a crowded market as broader headwinds weigh on China’s economy. In a note attached to the earnings report, CEO Wang Chuanfu acknowledged the year had not been all smooth sailing. “At the beginning of the year, the recovery of automobile consumption was relatively lagging behind, affected by the switch in promotional policies and market price fluctuations”, he wrote. XPeng, one of BYD’s competitors in China, last week reported a net loss of 10.4 billion yuan ($1.4 billion) in 2023. As BYD continues to perform well in the competitive Chinese market, it is now expanding abroad. Earlier this year, BYD said that its future EV factory in Hungary would begin production in three years, making it the first Chinese firm to manufacture passenger cars in Europe. One of the company’s 8 bespoke cargo ships arrived in Germany in February, delivering around 3.000 cars in a bold bid to take on the European automaking powerhouse in its own market. It is still unclear, however, if the firm will be able to achieve high sales on the continent. The European Union launched an investigation last year into Chinese state subsidies, which it said had given companies from the country an “unfair” leg up in the local market. BYD is also making major inroads in emerging markets across Latin America and Southeast Asia. “It’s all part of their strategy to be the first mover into these markets before Tesla and their Chinese competitors enter”, Le said. “This will give them a head start on building awareness, educating the consumer about their products and ultimately building trust in those markets it needs to attract buyers”. Expanding into so many foreign markets won’t be easy, particularly in Europe and North America, Le said. “But right now they are clearly the best positioned to take advantage of this global shift towards clean energy vehicles”, he said, adding that he has “no doubt” BYD founder Wang understands the challenges ahead. In addition to being a leading EV manufacturer, BYD also supplies batteries to major global automakers including Tesla, BMW, Mercedes and Audi. +++

+++ FISKER is teetering on the brink of bankruptcy after rescue talks with a major automaker collapsed, but while a slowdown in the EV market has been cited as a factor, a new report reveals that the startup has had plenty of other problems closer to home, managing to temporarily lose millions of dollars of customer money. You might recall that one of the most eyebrow-raising details of Consumer Reports‘ (CR) recent less-than-flattering review of the Ocean was that Fisker never got around to cashing CR’s check, claiming that it couldn’t find it. An investigation discovered that wasn’t an isolated case and that Fisker struggled to keep track of numerous customer payments, resulting in the launch of an internal audit in December. Although the firm was eventually able to locate most payments (some of which were the full price) and get customers whose payments methods had expired to make new ones, Sources close to the matter say that some other cars were delivered without Fisker taking any money, as Consumer Reports’ was. “Checks were not cashed in a timely manner or just lost altogether”, one of the people told, whose sources blamed poor internal processes for the chaos. “We were often scrambling to find checks, credit card receipts and any wired funds a few months after a vehicle was sold”. PWC (Price Waterhouse Coopers) discovered that same level of disorganization permeated other areas of the business, finding when it was putting together Fisker’s annual financial report that the company couldn’t provide the right details about its EV sales. Fisker still hasn’t released its 2023 report. This isn’t the first time we’ve heard stories about the administrative disarray going on inside Fisker. The company itself admitted last November that it had problems with its financial reporting due to a shortage of employees with the skills to “analyze, record and disclose accounting matters timely and accurately”. At the same time as this was going on, some owners were getting an idea that all was not running smoothly behind the scenes. Fisker has had trouble making timely payments to state DMVs when setting up new customers, resulting in many spending months driving around on temporary license plates that even had to be renewed because they were expiring before Fisker worked though its backlog of registration niggles. +++

+++ The HYUNDAI MOTOR GROUP plans to invest 68 trillion won ($51 billion) over 3 years in South Korea to boost production of its electric vehicles and grow its mobility business. The company’s global chief operating officer Jose Munoz revealed during the New York Auto Show that Hyundai will invest 35.5 trillion won ($26.4 billion) to new research and development infrastructure, as well as new assembly lines for its EVs. It will also allocate 31.1 trillion won ($23.1 billion) to the research and development of electric vehicles. This includes software-defined vehicles and battery technology. A further 1.6 trillion won ($1.19 billion) will serve as a strategic investment into mobility and software. “We are doubling down on electrification,” Munoz said. “We’re very committed to the United States market”. Hyundai has previously committed to invest $12.6 billion into new EV and battery manufacturing facilities in Georgia. This represents its largest investment outside of South Korea. The group’s investments will allow it to invest 80.000 new employees. Of these, approximately 44.000 will be dedicated to its electrification, software-defined vehicles and carbon neutrality efforts. A new headquarters in Seoul’s Gangnam district will also be built. This new HQ will include two 50-story buildings and four small high-rises. It will support 9.200 jobs and cost approximately 4.6 trillion won ($3.3 billion). These investments show that Hyundai is not overly concerned with the current slowdown in demand for electric vehicles. In January, Hyundai North America’s senior vice president of product planning and mobility strategy, Olabisi Boyle, said the company is “exceptionally positioned” to be a leader in the “electric future”. +++

+++ LAMBORGHINI is widely recognized for its brash, sharp-looking, and ultra-attention-grabbing supercars, but they’ve opted for a more subdued approach in their logo makeover. Making its debut today, the new iconic shield featuring the raging bull has undergone simplification as part of a fresh corporate identity for the Sant’Agata brand. Embracing the minimalist trend of our era, the new Lamborghini logo abolishes the 3D appearance of its predecessor. With its absence of reflections, simplified graphics, and slightly broader typeface, it offers a more understated and flat aesthetic, complemented by the new color scheme. Black and white serve as the primary colors, with accents in yellow and gold. The new logo is already being featured across Lamborghini’s digital platforms and is slated for use on upcoming models. Speculation suggests it could make its debut on the successor to the Huracan, expected in the coming months with a plug-in hybrid V8. Eventually, the revised emblem will also grace existing models like the Revuelto V12 flagship, aiming to maintain consistency across the lineup. Additionally, the Urus SUV is set for a facelift, bolstering its plug-in hybrid offerings, so it’s expected to feature the new emblem as well. Besides the revised typeface, another significant change is that the raging bull will now stand alone on Lamborghini’s digital channels, separated from the shield for the first time. Additionally, there will be “a new set of icons” developed in collaboration with Lamborghini Centro Stile. This marks Lamborghini’s first logo and corporate identity redesign in over two decades, coinciding with a period of transformation for the automaker. The company aims to better embody its values of “brave, unexpected, and authentic” through the new visuals. This update is part of the “Direzione Cor Tauri” transformation project, which prioritizes sustainability and decarbonization. Beginning this year, Lamborghini’s entire lineup will undergo electrification, with the first fully electric model (previewed by the Lazandor 2+2 GT crossover concept) expected to debut in 2028. +++

+++ MITSUBISHI is considering bringing back the Pajero, its once flagship SUV model, in Japan by 2027. Its production for the domestic market has been stopped since 2019 due to declining sales. Originally introduced in 1982, the Pajero became the face of the SUV boom and as an exemplar of strong off-road vehicles, winning the desert-terrain Dakar Rally 12 times. At its peak, production numbers exceeded 160.000 units annually, but had dropped below 50.000 units by the time it was discontinued. The domestic factory where the Pajero was manufactured has already been shut down. In its revival, Mitsubishi plans to develop a new Pajero model based on the Triton, its mainstay pickup truck, and will be built in and imported from Thailand. The automaker aims to leverage its 4-wheel drive technology with the Pajero’s comeback to differentiate itself from competitors. +++

+++ NISSAN will expand its electric vehicle lineup, develop more powerful batteries and cut production costs, while speeding up the whole process, in what the Japanese automaker’s chief called The Arc pathway to higher sales by 2030. “The auto industry is now being forced to reshape its values so we can say continuous change is the new normal”, chief executive Makoto Uchida (photo) told reporters, in outlining a sprawling but ambitious business plan. “Nissan must change. We cannot succeed if we continue along the same path”. Costs will come down for electric models so they’ll be about the same as gasoline-engine models by fiscal 2030, while global sales will grow by a million vehicles during that period, he added. Last year, Nissan sold nearly 3.4 million vehicles around the world, up about 5% from the previous year. The company is planning 30 new models over the next 3 years, 16 of them EVs. Nissan plans to launch 34 EV models from fiscal 2024 through fiscal 2030, so that EVs will account for 40% of its global offerings by fiscal 2026, and 60% by the end of the decade. To slash costs, Nissan says it will start working with suppliers from the development stage, upgrade production methods to incorporate robotics and artificial intelligence, and have models sharing components; not just platforms but also parts. It also promised innovation in autonomous vehicles to make driving safer. Nissan, based in the port city of Yokohama, southwest of Tokyo, will leverage its partnerships around the world, including those with Mitsubishi, Dongfeng Nissan in China and in the alliance it has with Renault. Earlier this month, Nissan announced it was in talks on forming a partnership with Honda in electrification and artificial intelligence. Such tie-ups between rivals are relatively unusual but are needed to keep up with surging demand for more sustainable transport as concerns grow over carbon emissions and sustainability, analysts say. Nissan, Japan’s No. 2 automaker, was an early EV adapter, coming out with the Leaf in late 2010. In recent years, Japanese automakers have fallen behind Tesla of the U.S. and Chinese manufacturers like BYD. Automakers, including Nissan, have taken a hit from shortages of computer chips and other parts due to disruptions related to the pandemic. Nissan’s offerings of new EVs, plug-ins and hybrids will increase across all global markets, including the U.S., Europe, Japan, the rest of Asia, Australia and Africa, Uchida said. “The Arc plan shows our path to the future. It illustrates our continuous progression and ability to navigate changing market conditions. This plan will enable us to go further and faster in driving value and competitiveness”, he said, referring to Nissan’s goals. +++